Shell starts third phase offshore Nigeria in Bonga field

Royal Dutch Shell (ticker: RDSA) said today that it is starting the third phase of its Bonga field production offshore Nigeria. The third phase of the project will have a peak production of 50,000 barrels of oil equivalent, Shell said in an email. The floating production and storage facility serving Bonga’s third phase has a capacity of more than 200 MBOPD and 150 million standard cubic feet of natural gas per day.

The project uses a floating production, storage and offloading (FPSO) facility to produce from the Bonga North West field, which sits at a depth of more than 1,000 meters (3,300 feet). According to Shell, the Bonga FPSO is the largest of its kind in the world at 300 meters long. The FPSO receives production from wells on the seabed, then process them on board before offloading to a single point mooring buoy anchored nearby.

Partners in the program include Shell Nigeria Exploration and Production Company (SNEPCo), which holds a 55% interest in the project, Esso Exploration & Production Nigeria Ltd. with a 20% interest, Total (ticker: TOT) E&P Nigeria Ltd. with a 12.5% interest, and Nigerian Agip Exploration Ltd. with a 12.5% interest. The venture also has a production sharing contract with the Nigerian National Petroleum Corporation.

The move to offshore Africa drilling

The news that Shell decided to continue with the third phase of its Bonga project comes after deciding to leave the Alaskan Arctic last week. Shell and other producers have been forced to put off more capital intensive projects in the current price environment.

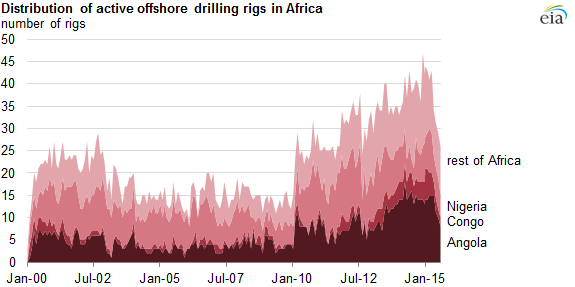

Despite the low price for oil, an increasing number of offshore rigs have been moved to Africa. Most of the recent growth in active offshore rigs outside of the United States has occurred in Africa. Angola and Nigeria account for much of the growth in the region after 2010. Angola has more than 10 offshore oil projects expected to come online within the next five years. Nigeria’s offshore activities have been focusing on the deepwater and ultra-deepwater; at least three deepwater projects are in development and are projected to come online in the next five years.

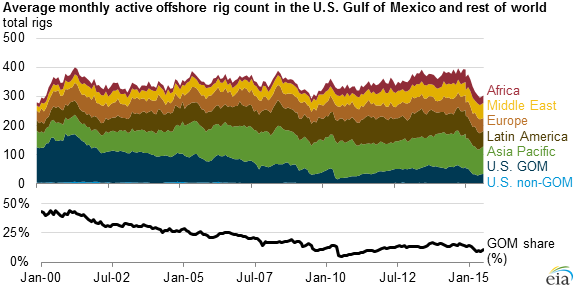

Worldwide, the number of offshore rigs has declined by 19% from since the decline in crude oil prices, falling to 304 in August 2015, down from 377 in August 2014. Lower oil prices were felt even more acutely in the Gulf of Mexico (GOM), with rig counts dropping by 46% over the same time period.

Technological advances have made the Gulf of Mexico a less attractive area to drill in, with a focus on deepwater (water depths greater than 1,000 feet) drilling pulling rigs out of the shallow waters of the GOM. Natural gas production from offshore has also become increasingly unattractive as production from the shale-driven onshore operations in the U.S. help keep downward pressure on natural gas prices.

VAALCO drilling offshore Africa

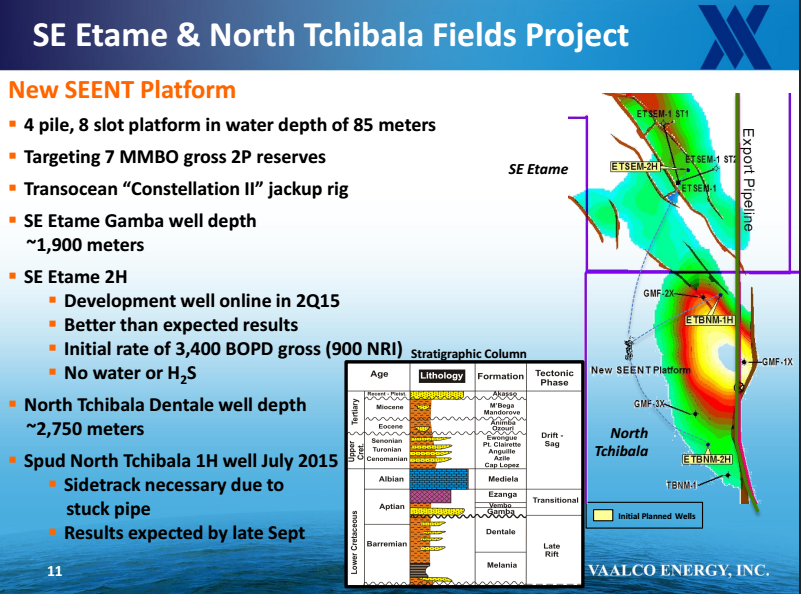

Another operator seeing success in Africa’s offshore market is Houston, Texas, based VAALCO Energy (ticker: EGY), which has offshore operations in Gabon, Angola and Equatorial Guinea. On September 16, VAALCO announced that brought its North Tchibala 1-H well online, offshore Gabon, West Africa. According to EGY, the well came online at a rate slightly in excess of 3,000 gross barrels of oil per day.

This is the second well drilled and placed on production at VAALCO’s new Southeast Etame/North Tchibala (SEENT) platform located in approximately 260 feet of water offshore Gabon. VAALCO is the operator of the Etame Marin permit area and owns a 28.1% working interest and a 24.4% net revenue interest. The Transocean Constellation II jackup rig is mobilizing over to the Avouma/South Tchibala platform to conduct workover operations to replace ESPs on three existing development wells, two of which are off production.

During his exclusive interview with Oil & Gas 360® at EnerCom’s The Oil & Gas Conference 20®, VAALCO CEO Steven Guidry, said that the EGY understands the area well, and was excited to see production. “It’s a reservoir that has been defined very well by four wells that were drilled by prior operators back in the 1980’s … but it has never been produced. We’re very excited to this opportunity.”

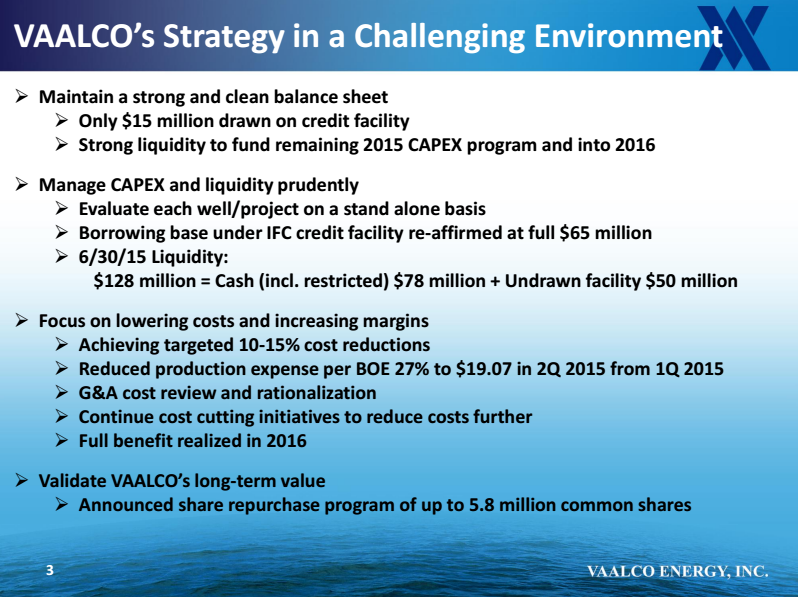

VAALCO boasts strong financial metrics as well in EnerCom’s® E&P Weekly scorecard. The company’s debt-to-market cap ratio is just 13%, compared to a group median of 95%. EGY’s net debt-to-trailing twelve month (TTM) EBITDA is also -4.7x, meaning they have more cash than debt, giving it a strong position even in today’s market. The group median for net debt-to-TTM EBITDA is 2.3x.

Download a tear-sheet and other financial information about VAALCO Energy here.