Shell (ticker: RDS.A) released its annual LNG Outlook today with robust LNG demand and natural gas usage predictions.

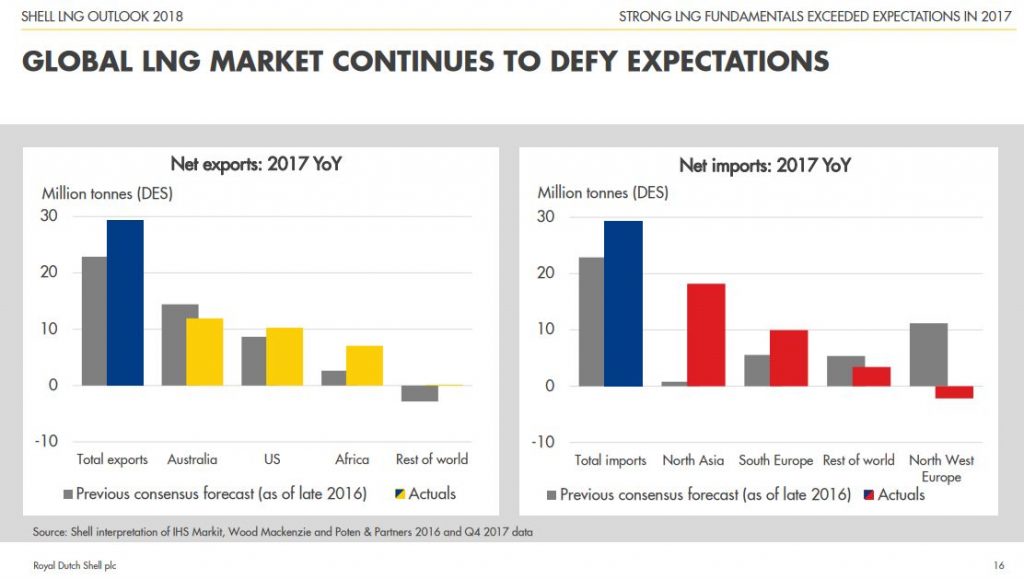

The global liquefied natural gas (LNG) market showed demand growing by 29 million tonnes to 293 million tonnes in 2017, according to Shell’s annual LNG Outlook.

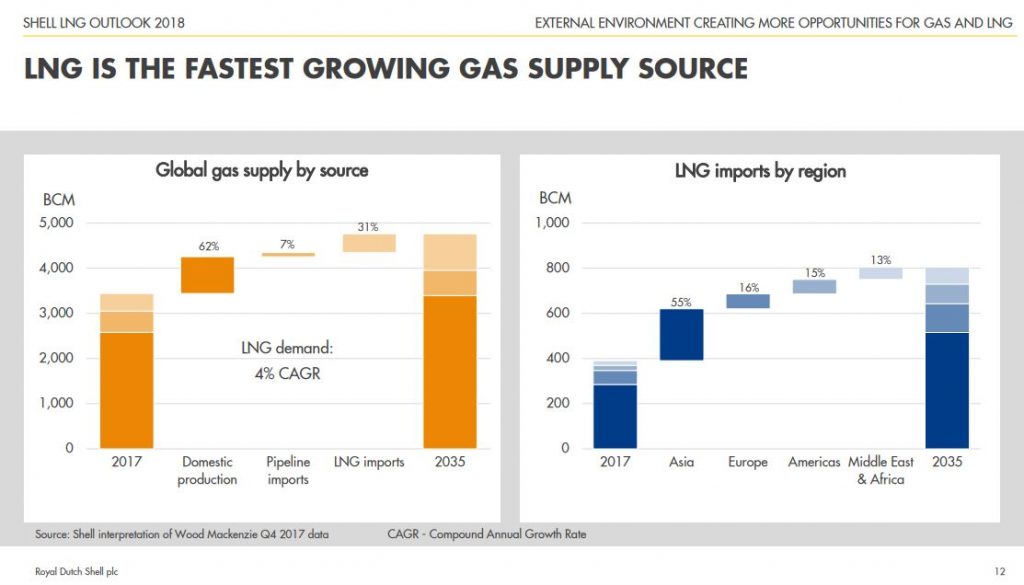

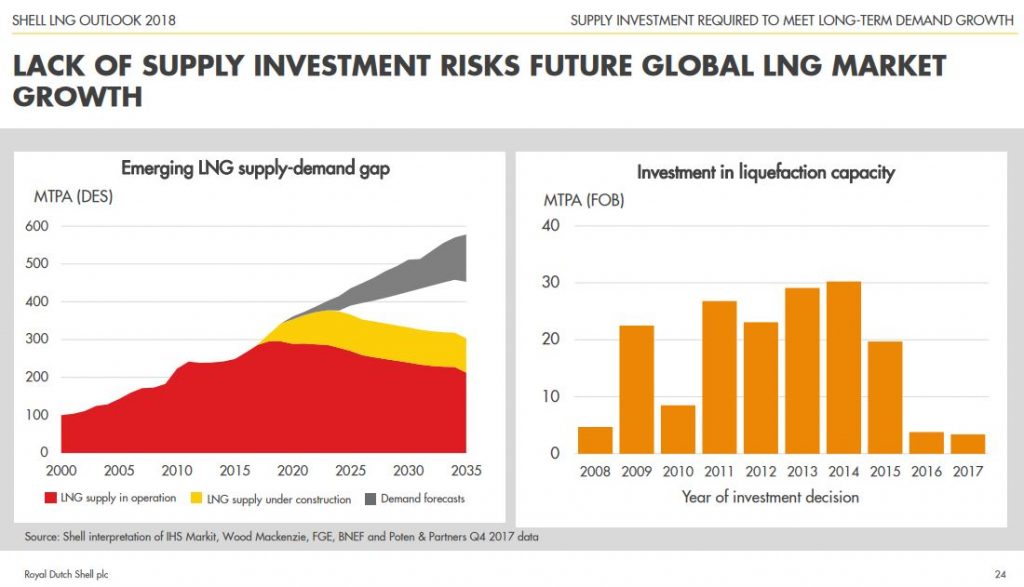

Shell said based on current demand projections, it sees a potential for a supply shortage developing in mid-2020s, unless new LNG production project commitments are made soon.

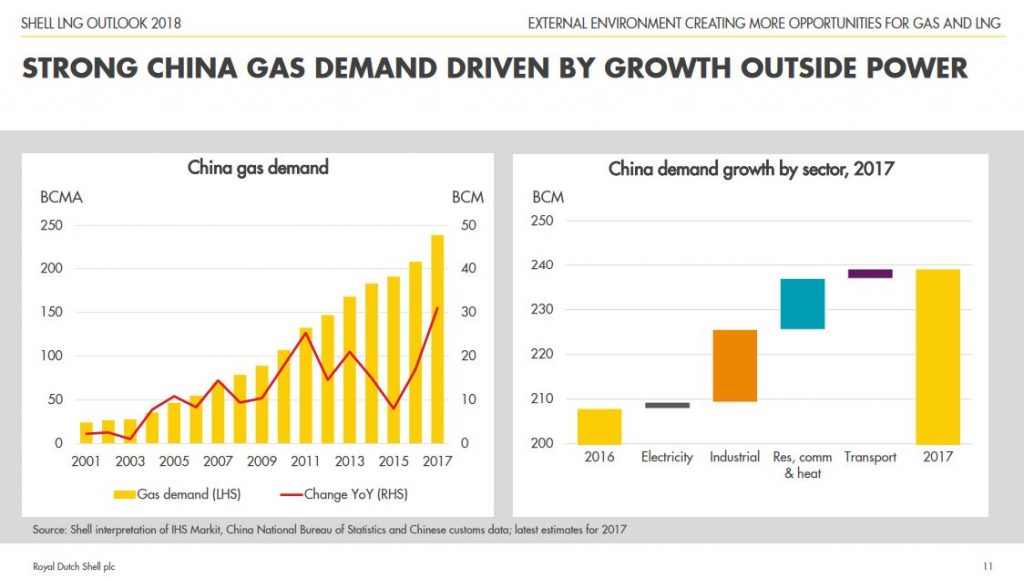

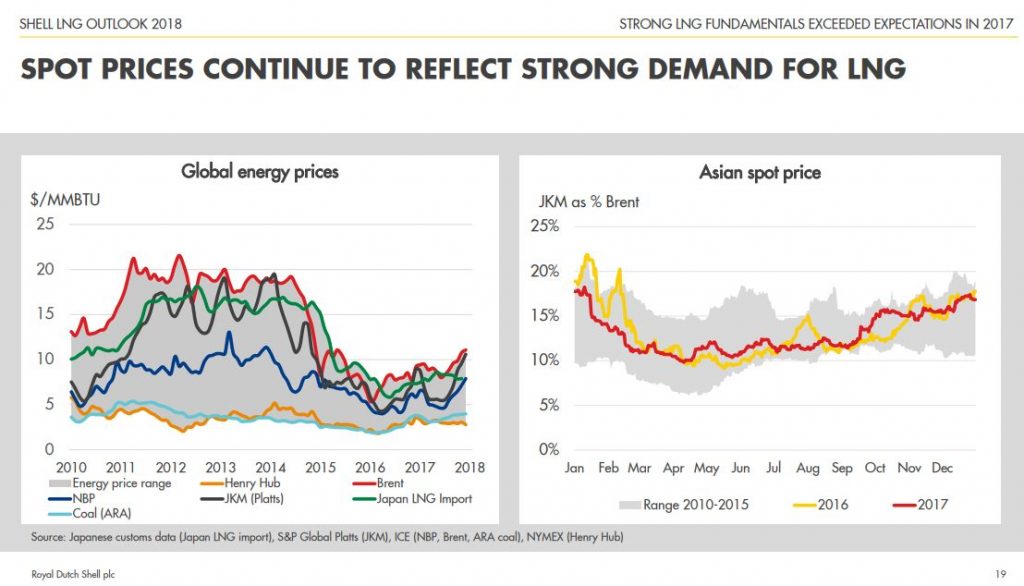

According to the Shell LNG Outlook, Japan remained the world’s largest LNG importer in 2017, while China moved into second place as Chinese imports surged past South Korea’s. Total demand for LNG in China reached 38 million tonnes, a result of continued economic growth and policies to reduce local air pollution through coal-to-gas switching.

Maarten Wetselaar, Integrated Gas and New Energies Director at Shell pointed out in a statement, “In Asia alone, demand rose by 17 million tonnes. That’s nearly as much as Indonesia, the world’s fifth-largest LNG exporter, produced in 2017.”

Since 2000, the number of countries importing LNG has quadrupled and the number of countries supplying it has almost doubled. LNG trade increased from 100 million tonnes in 2000, to nearly 300 million tonnes in 2017, enough gas to generate power for around 575 million homes, according to Shell.

Buyers want shorter and smaller contracts – hampers FIDs

In 2017, the number of LNG spot cargoes sold reached 1,100 for the first time, equivalent to three cargoes delivered every day. This growth mostly came from new supply from Australia and the USA.

The mismatch in requirements between buyers and suppliers is growing, Shell said.

Most suppliers still seek long-term LNG sales to secure financing. But LNG buyers increasingly want shorter, smaller and more flexible contracts so they can better compete in their own downstream power and gas markets.

This mismatch needs to be resolved to enable LNG project developers to make final investment decisions, the Holland-based oil major said.

Shell acquired BG chiefly for its LNG assets two years ago in a $70 billion deal. The company is also building a large petrochemical complex in Pennsylvania to be fed natural gas from the Marcellus and Utica plays.

Shell’s LNG Outlook for 2018 is available on the company website at www.shell.com/lngoutlook.