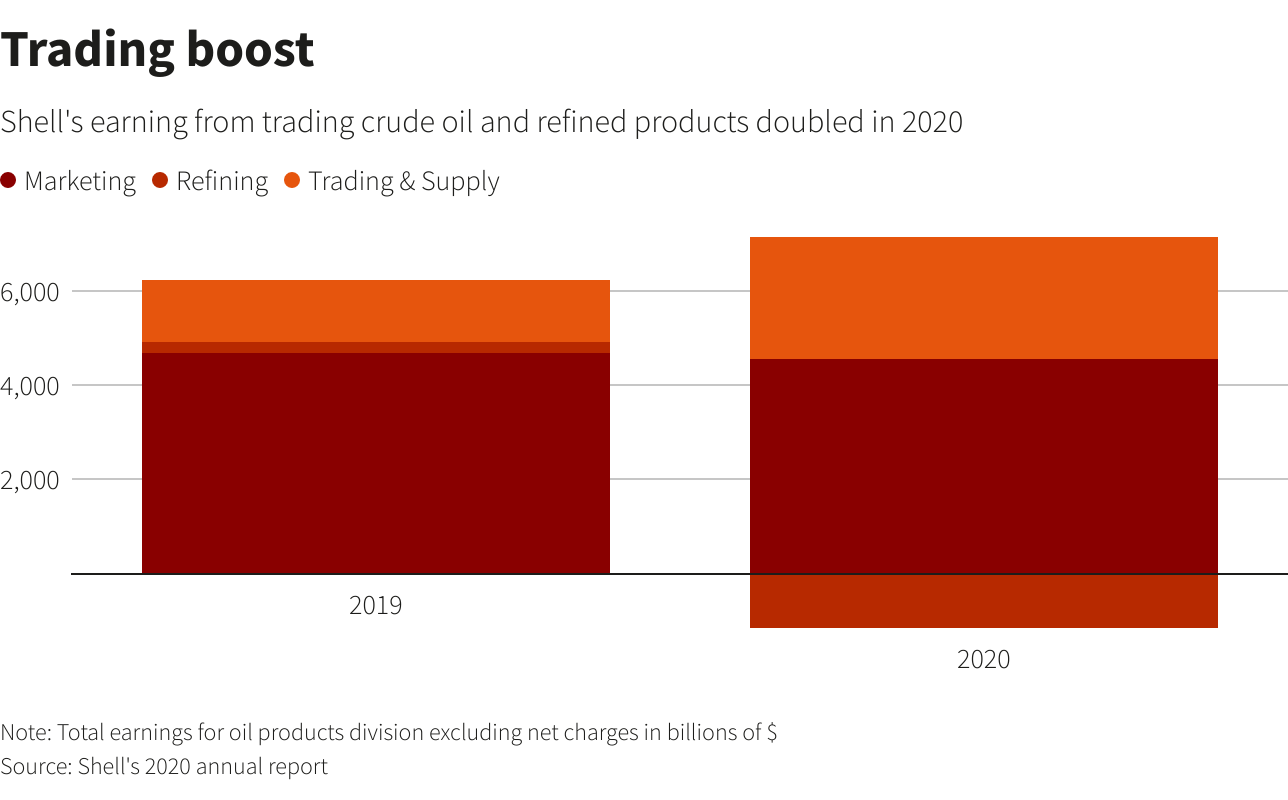

LONDON – Royal Dutch Shell’s 2020 earnings from trading crude oil and refined products doubled from the previous year to $2.6 billion, helping to offset a sharp drop in fuel demand due to the coronavirus pandemic.

Source: Reuters

Shell’s oil trading operations, known internally as Trading & Supply, accounted for 43% of the Oil Products division’s total earnings of $5.995 billion in 2020. Trading earnings totalled $1.3 billion in 2019, Shell’s annual report, which was released on Thursday, said.

The unusually high contribution from trading helped Shell to weather one of the toughest years in the industry’s history, when energy consumption collapsed during the pandemic.

Graphic: Trading boost –

Shell, the world’s largest energy trader, experienced a 28% drop in oil sales last year to 4.71 million barrels per day on average, the annual report said.

Its 2020 profit dropped to its lowest in at least two decades.

Shell’s oil trading figures do not include natural gas, liquefied natural gas, power and renewables. Shell is the world’s largest liquefied natural gas trader.

Rival BP’s trading arm made nearly $4 billion in 2020 on oil and gas trading, a copy of an internal BP presentation seen by Reuters showed, almost equalling the company’s 2019 record trading profit.

Companies can make large profits even during times of lower demand for commodities by storing products such as oil on shore or at sea. Shell’s vast refining, trading and retail operations also allow it to take advantage of short-lived changes in supply and demand around the world.

The strong trading results for BP and Shell show that there is real value creation which will transfer over into renewable power as the companies shift away from oil and gas, Bernstein analyst Oswald Clint said in a note.