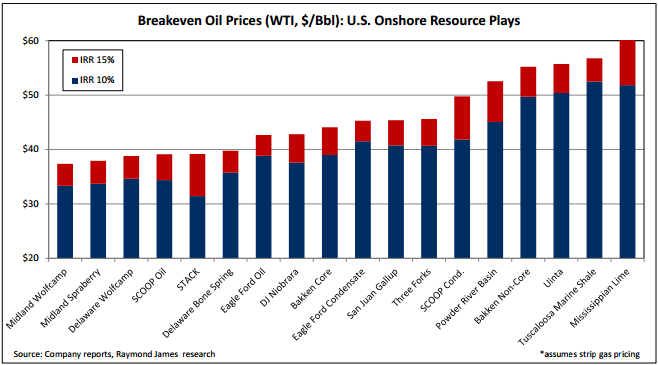

About one-third of U.S. plays remain economic below $40 per barrel WTI

As oil and gas producers around the globe continue to struggle with lower commodity prices, a select few basins remain economical at today’s prices. Six basins out of the 18 covered by Raymond James, or one-third of basins in their coverage, produce IRRs of 15% at sub-$40 WTI, the group said in a note.

Those basins are: the Midland Wolfcamp, Midland Spraberry, Delaware Wolfcamp, SCOOP Oil, STACK, and the Delaware Bone Spring Basins. Raymond James’ calculations are based off incremental well costs, reflecting the view of most U.S. companies that expenses such as leasehold acquisition, interest expense, seismic, and corporate G&A are “sunk” costs that will not impact the decision to drill and complete the next well.

Half of U.S. plays show pre-tax IRRs of at least 15% at $45 per barrel WTI, while 75% of plays show these types of returns at $50 oil.

“That means the U.S. onshore industry’s ‘threshold of pain’ increases meaningfully as prices fall from $50 to $35,” Raymond James said in its note. “The Permian Basin currently offers the lowest breakeven pricing ($37-40) across both the Delaware and Midland sub-basins. After the Permian, the SCOOP/STACK plays, Eagle Ford’s oil window, the DJ Basin’s Niobrara, and the Eagle Ford’s condensate window are still attractive below $40/bbl.

“At the high end of the spectrum, with breakevens in the $55-60 range, are Bakken non-core acreage, Uinta, the early-stage Tuscaloosa Marine Shale, and the Mississippian Lime.”

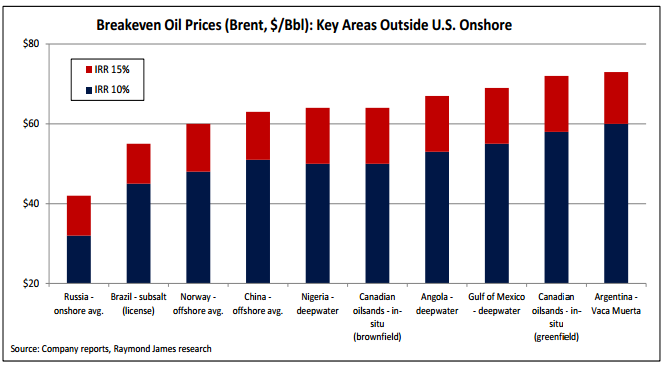

Breakevens abroad: apples v. oranges

On its face, it appears the breakevens for U.S. plays are marginally lower than breakevens in other parts of the world. Most international projects are unable to generate 15% IRRs below $50 per barrel Brent crude, much less at $40, where the international benchmark has hovered recently.

Trying to compare U.S. breakevens to international ones is like comparing apples and oranges, says Raymond James.

“As opposed to the incremental well breakeven analysis done for the U.S. plays, these international plays are typically incremental project based breakevens that would include substantially more of (if not all) of [sic] the full-cycle costs,” the note said.

Even with that being said, many international projects look like they will continue to generate economic returns if oil remains in the $40-$50 range. At or below $60 Brent prices, 30% of international projects covered by Raymond James would show 15% IRRs. Even assuming a $10 per barrel premium on Brent to WTI, roughly three-quarters of U.S. production would show 15% IRRs or better at the same price, though again, this is comparing marginal well costs to full-cycle costs on international projects.

Persian Gulf oilfield breakevens: +/- $30-ish, maybe

While The Persian Gulf is not included in the above chart due to the opacity of oil operations there, Raymond James believes that the lowest cost production still comes from this region. Despite the “absence of reliable data on economics … we can ‘guesstimate’ that Saudi/Kuwait/Qatar/UAE could profitably develop oilfields even in a $30 [per barrel] Brent environment, but it’s hard to know for sure.”