TORONTO, Sept. 14, 2016 /CNW/ - Canadian economic growth will snap back after a second-quarter contraction and will get further lift in 2017 from rising energy prices, low interest rates, and federal stimulus, according to the latest RBC Economics Outlook report.

The RBC forecast calls for real Gross Domestic Product (GDP) growth of 3.7 per cent (annualized) in the third quarter of 2016 as rebuilding takes place in Alberta, followed by a slower 1.9 per cent gain in the fourth quarter.

"The Alberta wildfires and sharp pullback in oil sands production in May took the Canadian economy on a brief detour into negative growth," said Craig Wright, senior vice-president and chief economist at RBC. "Yet the recovery should spur a similarly sharp rebound in growth in the latter half of this year and we anticipate that momentum will carry over into next year," Wright said.

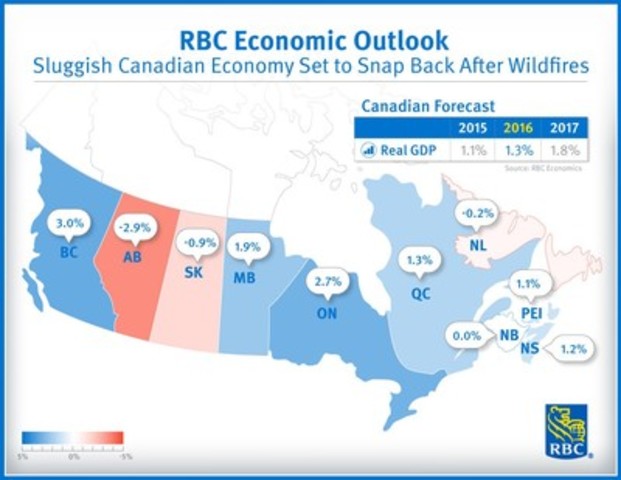

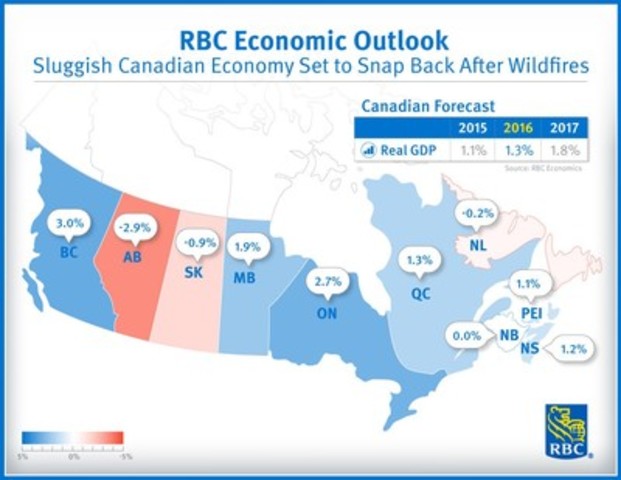

Canadian GDP growth is expected to accelerate to 1.8 per cent in 2017 from 1.3 per cent in 2016.

With core inflation likely to hover around the Bank of Canada's 2 per cent target, there is little reason for the central bank to take any action on interest rates. RBC expects the Canadian central bank to hold its overnight rate steady through the remainder of 2016 and 2017 as well.

Limited upside for Canadian dollar despite projected oil price

RBC projects that oil prices will gradually rise to $50/barrel in 2016 and push higher toward $60/barrel in 2017.

However, the Canadian dollar is expected to see minimal benefit from higher oil prices: a U.S. Federal Reserve interest rate hike is likely in the first half of 2017, which would bolster the U.S. dollar, while the Bank of Canada is expected to hold steady on rates.

Provincial outlooks becoming more balanced in 2017

RBC expects the economies of Alberta, Saskatchewan, and Newfoundland and Labrador to contract further this year as the oil-producing provinces continue to struggle with low revenues and private sector restraint. Some of the recent weakness in Alberta from the wildfires in Fort McMurray should start to reverse in the second half of 2016.

All other provinces except New Brunswick are expected to continue to expand in 2016, albeit at varying paces.

"Momentum appeared to slow this spring in several oil-consuming provinces, including Ontario, Quebec and Manitoba, and we lowered our 2016 growth forecasts for eight provinces," said Wright. "Our 2017 outlook shows more balanced growth across the country, with Alberta and Saskatchewan returning to positive growth and economic activity moderating in British Columbia."

Outside of Canada

U.K. economic outlook downgraded

In the wake of the Brexit vote, RBC expects the U.K. economy will barely muster any growth in 2017 – a massive downgrade from the previous projection for a 2.1 per cent rise – and growth in its largest European trading partners is also forecasted to slow down.

Brexit repercussions should exert little pressure on Canada and the United States due to their proportionately smaller trade flows with the U.K.

U.S. consumers on a roll

U.S. real GDP growth averaged a meagre 1 per cent in the first half of 2016, largely due to weakness in business fixed investment and inventories, while consumer spending ramped up. Strong labour markets, accelerating wage growth and low financing rates should keep U.S. consumers spending.

Uncertainty about the U.S. presidential race in the near term may produce periods of volatility for the U.S. dollar, yet RBC maintains that the U.S. currency will post modest gains against the Euro, Canadian dollar and sterling as markets look for a U.S. Federal Reserve policy rate increase in the first half of 2017.

A complete copy of the RBC Economic and Financial Market Outlook is available online as of 7 a.m. ET. A separate RBC Economics Provincial Outlook assesses the provinces according to economic growth, employment growth, unemployment rates, retail sales, housing starts and consumer price indices.

A summary of each province's economic outlook can be found in this fact sheet.

About RBC

Royal Bank of Canada is Canada's largest bank, and one of the largest banks in the world, based on market capitalization. We are one of North America's leading diversified financial services companies, and provide personal and commercial banking, wealth management, insurance, investor services and capital markets products and services on a global basis. We have over 80,000 full- and part-time employees who serve more than 16 million personal, business, public sector and institutional clients through offices in Canada, the U.S. and 36 other countries. For more information, please visit rbc.com.

RBC helps communities prosper, supporting a broad range of community initiatives through donations, community investments, sponsorships and employee volunteer activities. In 2015, we contributed more than $121 million to causes around the world.

SOURCE RBC

Image with caption: "RBC Economic Outlook - Sluggish Canadian economy set to snap back after wildfires (CNW Group/RBC)". Image available at: http://photos.newswire.ca/images/download/20160914_C4910_PHOTO_EN_772061.jpg

Craig Wright, Senior Vice-President and Chief Economist, RBC Economics Research, 416-974-7457, craig.wright@rbc.com; Dawn Desjardins, Deputy Chief Economist, RBC Economics Research, 416-974-6919, dawn.desjardins@rbc.com; Catherine Hudon, RBC Communications, 416-974-5506, catherine.hudon@rbc.comCopyright CNW Group 2016