Acquired properties outperforming expectations

SM Energy (ticker: SM) announced third quarter results today, showing a net loss of $89.1 million, or ($0.80) per share.

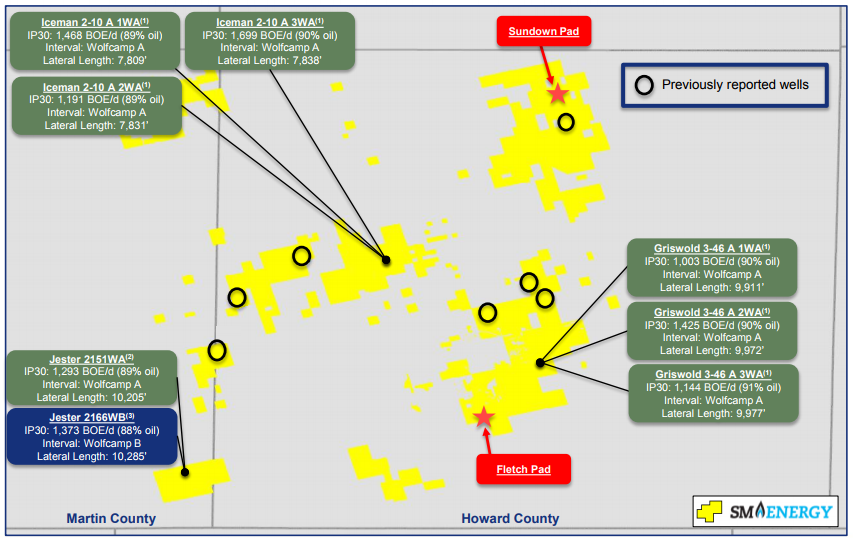

Q3 was a big quarter for SM’s Permian properties, with production taking off. Permian production totaled 3 MMBOE this quarter, a 31% increase from Q2 and a 118% increase from Q4 2016. SM is currently operating seven horizontal rigs in the basin, and completed 23 wells during the quarter.

SM Energy reports the acreage it acquired last year continues to outperform, with current wells “significantly outperforming acquisition assumptions.” At the three-well Griswold pad, for example, wells averaged a 30-day rate of 1,191 BOEPD.

SM President and CEO Jay Ottoson commented on the progress in the Permian, saying “The third quarter of 2017 marked a significant turning point in our transformation with a large increase in Permian production. In particular, our Howard County area wells in the Midland Basin, with high oil percentages and associated high margins, are generating outstanding returns, and continued delineation of our acreage in that area is yielding encouraging results.”

Eagle Ford JV will test new technology

SM Energy also announced the formation of a new joint venture agreement for developing the company’s North Eagle Ford acreage. The venture will drill 16 wells and complete 23, and allow SM to test new technology and gather data. SM did not disclose which company it had partnered with in this venture. It did, however, note that completions from the JV are significantly exceeding the North Eagle Ford type curve, now that Hurricane Harvey-related curtailments have ceased.

“We are also announcing today the signing of a joint venture agreement in a portion of our Eagle Ford North area that will result in a further increase in our capital efficiency,” Ottoson said. “This partnership, which is similar to our existing Powder River Basin joint venture, will allow us to test new technologies and completion designs at varied well spacing on a portion of our acreage that does not currently generate substantial cash flow, potentially enhancing the asset value while reducing our required capital outlay for acreage holding.”

Q&A from today’s Q3 earnings call

Q: You said that the JV agreement details are confidential, but just as I guess in general terms there, it sounds like somebody’s coming in and are they funding essentially all the drilling and completion of these wells in order to earn some interest in the properties?

SM: It’s a arrangement very similar to the one we have in the Powder River Basin which we found to be just exceptionally at improving things in a number of ways we hadn’t anticipated. So very similar arrangement, but it is with a different party. Just want to make sure that everybody was clear on that. But we think they’ll bring technology and they’ll bring services and they’ll bring funding for the joint venture area.

Q: Can you say how much capital you’re saving by going with the JV route?

SM: That’s probably one of those areas that we really can’t get into. When you do this, Mike, a lot of what they’re doing is providing services, so it’s a little hard to get to an exact capital. When we guide in the next couple years, we’re going to put that. We’ll get in our guidance and you’ll see it. But it will end up being a reduction in our outspend. So, and that’s an important aspect of it for us.

Q: You’ve made the comment as well on the potential for about $400,000 of savings on locally sourced sand within the Permian. Could you explain in a little bit more detail on the testing that you’ve seen there and then how is that ramped into 2018? Is that early in the year? Does that kind of come in throughout the year? And then just general on what you guys see as the general service cost outlook as things stand today especially on the Permian.

SM: There’s several things there you put in there. So first of all, on the transcript I’ve gone over really on the tech-spec side of things. Local sand works for almost all the intervals we have in Howard County and Sweetie Peck. So we’re real optimistic there. In terms of local sand capacity, there’s about two mines currently operating with about 6 million tons per annum of capacity. There’s underway are three more mines with more, 10 million more tons. So we do see a big ramp up and there’s quite a few more projected after that. We are engaged heavily with sand suppliers, so when we talk about that 400,000 plus, we got a really informed view about what sand will likely cost us in the future. And we’re feeling quite good that as these local sand mines ramp up, we’ll be able to use an increasing percentage of local sand in our completions and that’ll achieve those savings through 2018.

Q: And then more broadly on the service cost outlook in general right now?

SM: So on the service cost, it’s pretty level. We projected a 10% increase in completions cost and some areas were a little bit higher and some actually dropped and then we had some efficiency. So in aggregate, everything kind of came together at what we projected for the year. So we’re pleased about that. We do see some additional room for efficiency gains that will offset whatever escalations we see. But the market’s really kind of hit a nice stable place right here right now, and we’ll see if that continues as we go into 2018.