Bids for Divide County acreage didn’t add up

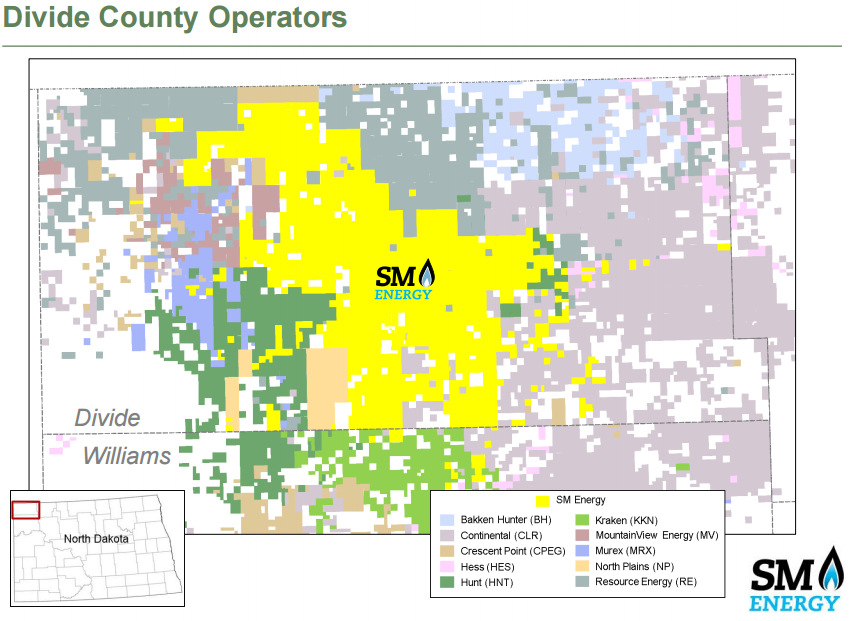

SM Energy (ticker: SM) announced today that it has postponed indefinitely the sale of its Divide County North Dakota assets.

SM expressed its desire to sell its Divide County assets in January, and expected to close the transaction around mid-year.

Goal was to reduce leverage

According to analysts at Wells Fargo, expected valuations were around $400 million. However, the bids the company received were too low and would not allow SM to meaningfully reduce its leverage. With this in mind, SM has decided to retain its 123,570 net acres in North Dakota.

SM’s Divide County assets are producing about 10.7 MBOEPD. SM did not drill or complete any wells in the area in Q1, but reports 17 net DUCs (drilled uncompleted wells) in inventory.

SM wans to focus on Midland, Eagle Ford

SM Energy has already completed a series of divestitures, as it focuses on its Midland basin and Eagle Ford properties. In December the company sold its Williston basin assets outside of Divide County to Oasis Petroleum (ticker: OAS) for $765.8 million. In January the company sold its non-operated Eagle Ford assets for $800 million to an affiliate of KKR (ticker: KKR).

SM used the Williston basin sale to fund its acquisition of acreage in the Midland basin, and has now accumulated 88,000 net acres in the area. The company plans to use the proceeds from its Eagle Ford sale to fund its projected 2017-2018 spending, which will exceed cash flows. The Divide County sale would have been used to reduce debt, as the company’s 3-year objective is net debt to EBITDAX of 2.0x. SM’s net debt to total 2016 EBITDA was 5.6x, for reference.

No sale increases immediate net debt to EBITDAX, but reduces outspending

The failure of the sale means that net debt to EBITDAX will not decrease as quickly, but the funds from this asset will decrease projected outspending over time.

Wells Fargo reports that without a Divide County sale net debt to EBITDAX will climb to 4.4x in Q1 2018 before beginning to decrease. The lack of a sale increased KLR’s net debt to EBITDA projection from 3.4x to 3.8x. Stifel now projects year-end 2017/2018/2019 net debt to EBITDA of 3.4x/2.6x/1.9x vs 3.1x/2.7x/2.0x.

SM President and CEO Jay Ottoson commented on the sale, saying, “We have successfully pre-funded the expected outspend for our capital program for 2017 and 2018 with the completed sale of our third party operated Eagle Ford assets, and we do not need to sell our Divide County assets.

“We have concluded that current market uncertainty around forward oil prices is not conducive to realizing a sales price that meets our deleveraging objective. We remain committed to our long-term financial strategy, which is best served by retaining the cash flow generated by the Divide County assets.”