Southwestern cites ‘advancing opportunities in Appalachia’, cost cutting

Southwestern Energy Company (ticker: SWN) sent out a press release announcing its intention to find “strategic alternatives” for its Fayetteville Shale E&P business and the related midstream gathering assets.

The company also said in the same announcement that it would make internal organizational changes to cut costs.

The company said it would use funds realized from selling Fayetteville along with cash from its internal cost reductions “to reduce debt, supplement Appalachia development capital, potentially return capital to shareholders, and for general corporate purposes.”

Southwestern CEO Bill Way focused remarks on his company’s Appalachia assets’ industry-leading returns, and its growing liquids component. Way said the Appalachian assets will soon be capable to self-fund future growth and that Southwestern is now in position “to further advance our opportunities in Appalachia.”

Way described Fayetteville as a “large-scale, low decline, cash flow generating asset with identified, low-risk future development opportunities and a world-class operating team. The future success of Southwestern Energy will always be underpinned by the legacy of our Fayetteville asset and our employees who will continue to build on that foundation.”

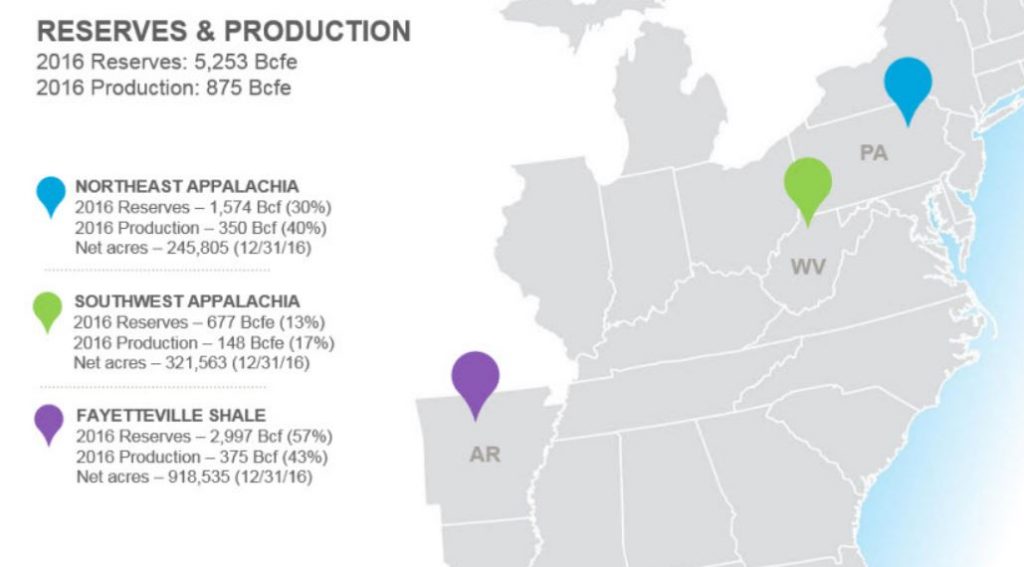

Fifty-seven percent of Southwestern’s 2016 reserves were associated with its Fayetteville assets—almost 3 Tcfe; and 43% of the company’s production was from Fayetteville. Southwestern controls almost 919,000 acres in the Fayetteville shale. Southwestern’s other assets are in the Marcellus and Utica.

Marcellus is the only gas basin breaking even: KLR

In November, John Gerdes of KLR analyzed breakevens in the major oil and gas plays in the U.S.

Breakevens are lowest in the wet southwestern portion of the Marcellus, which breaks even at $2.95/Mcf. However, this area needs $3.75/Mcf to generate a 10% unleveraged return. Other portions of the Marcellus have breakevens ranging from $3.10/Mcf to $3.25/Mcf, and need significantly higher to generate returns. The Haynesville needs $3.35/Mcf, while the Utica needs $3.50 and the Fayetteville needs $3.65.

Gas prices have ranged between $2.80/Mcf and $3.20/Mcf in recent months, meaning only the Marcellus was breaking even at the time of Gerdes’ report.