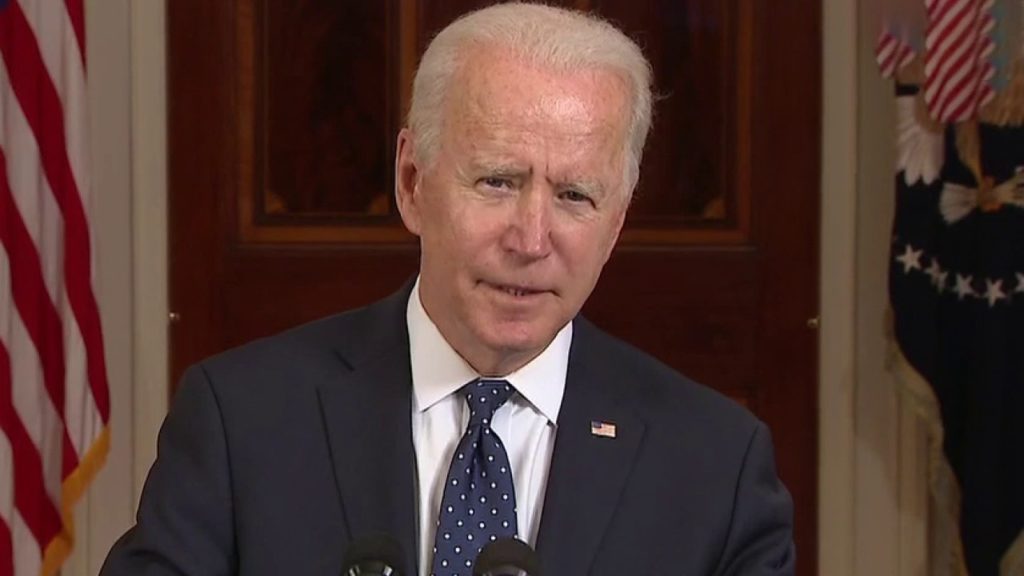

Wall Street strategists are growing increasingly concerned that President Biden’s proposed tax hikes could put an end to the stock market’s record-setting run.

Source: Fox Business

The benchmark S&P 500 has rallied 10% this year through Thursday, booking 23 record-high closes in 76 trading sessions, according to Dow Jones Market Data. The index has soared 85% off its March 2020 low.

“This market is priced for perfection,” said Greg Valliere, chief U.S. strategist at Toronto-based AGF Investments, which has nearly $39.5 billion in assets. “At the very least, we’re looking at headline risk for Wall Street.”

Biden, as part of his $1 trillion American Families Plan, is preparing a capital gains tax hike proposal that would double the rate for wealthy individuals to 39.6%, according to a source familiar with the matter. The rate would increase to 43.4% when including a tax on net investment income.

Wealthy individuals in blue states like California and New York would see their effective tax rates near 60%.

Analysts at Goldman Sachs led by Alec Phillips expect a “more modest increase” to around 28% that would likely not apply to gains realized before May and go into effect Jan. 1, 2022.

They also say it’s possible the increase may not pass through Congress as Democrats have “razor-thin majorities in the House and the Senate.”

A capital gains tax hike proposal would be the latest in a number of tax increases planned by Biden and may not be the last as his administration seeks to “vilify the rich and big corporations,” Valliere said.

He sees the potential for an estate tax hike, in addition to the corporate tax hike, action on foreign income shelter and personal income tax increases that are already being considered to help pay for Biden’s sprawling economic agenda that will cost trillions.

The bevy of tax hikes coming from the Biden administration is cause for a “reassessment of what this means for the ‘E’ [earnings] and the inflated ‘multiple’” of the S&P 500, said David Rosenberg, chief economist and strategist at Toronto-based Rosenberg Research.

He estimates the barrage of tax hikes could cause the S&P 500 to fall 16% from current levels to 3,460.

While Valliere declined to provide a target as to how far markets might fall due to the tax hikes, he worries they will be “very unsettling.”