$30 million capital budget will be focused on six Muskeg wells

Calgary-based Strategic Oil & Gas (ticker: SOG) announced its capital budget for the first half of 2017 Friday. The company plans to spend $30 million in the first six months of the year, Strategic said in its press release.

The majority of the budget will go toward six Muskeg wells at Marlowe, and includes building road and pipeline to tie-in the company’s 14-35 Muskeg well, which the company reported produced at a test rate of 1,060 BOEPD in Q1’16. The company said its anticipated production exiting the first half of next year is 4 MBOEPD.

Targeting $40 million placement

To provide funding for the first six months of next year, and to add financial flexibility, Strategic has also undertaken a non-brokered private placement of up to 333 million common shares at a price of $0.12 per share for gross proceeds of up to $40.0 million. Strategic said a significant portion of the private placement will be acquired by insiders of the company.

Muskeg wells exceeding type curves

Along with the announcement of the company’s 1H 2017 budget, Strategic also released the results of its 14-12 Muskeg well, the company’s third successful Muskeg well. The 14-12 was producing at an average rate of 810 BOEPD (59% oil) over a four day period, according to SOG.

On November 1, the company announced results from the Muskeg well 2-13 which tested 1,057 BOEPD (54% oil) over 7 days. Both new wells have been tied in, equipped with artificial lift and are producing to company-owned pipelines and facilities.

During the fourth quarter, Strategic drilled four Muskeg wells on a pad with average lateral length of 1,900 meters (6,234 feet) and 20 completion stages. The first two wells are tied in and producing “significantly above the company’s type curve,” SOG said in its release.

The third Muskeg well 2-27 is equipped, tied in and producing 85 BOEPD while still cleaning up. The completion program for the fourth well on the pad has been delayed due to operational issues, the company said.

Marlowe

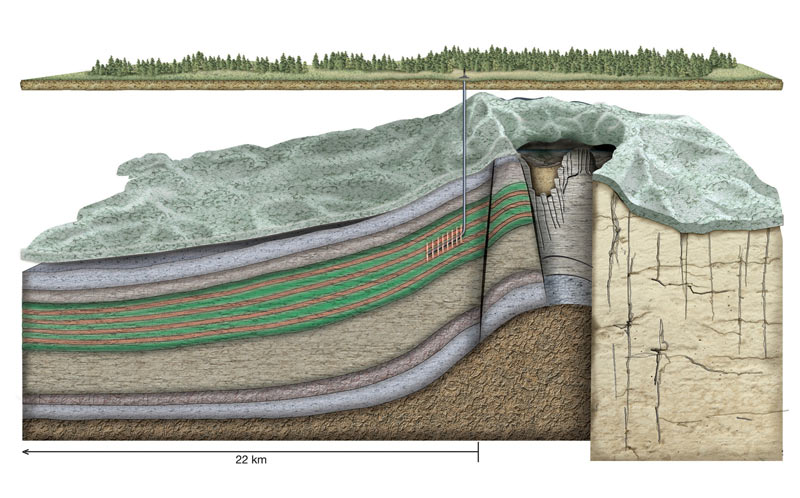

The Marlowe area assets are located in northwestern Alberta, approximately 60 mile north of the town of High Level, Alberta. Strategic Oil & Gas is operator with a 100% working interest in 344,096 gross/net acres. In 2013, Strategic purchased 44,600 net acres of land in Marlowe, shot 19.97 km2 of 3D seismic, 177 km of 2D seismic, upgraded the production facility and built all weather road access to all major producing wells.

Strategic calls Marlowe “an asset like no other”:

- 3 billion barrels of light OOIP in stacked zones

- 100% working interest & infrastructure with replacement value $500+ million

- Muskeg & Keg River are key focus for growth

Like many other oil and gas operators in North America, Strategic said it is also realizing cost savings relative to budget from reductions in drilling days and economies of scale related to pad development.

In its press release, the company estimated it was able to reduce operating and G&A costs 15% in 2016 compared to 2015 levels. The company’s internal projections put operating costs at $14.3 million for 2016 compared to $19.8 million the year before.