Unconventional drilling and varied completion techniques are receiving plenty of attention from E&Ps in the ever-growing shale market. Shale play hot spots have emerged in turn with drilling advancements, and the majority of producers mention what they learn from their peers. Strategic Oil & Gas (ticker: SOG.TO), however, went a truly unconventional direction. The company is exploiting an asteroid crater in the northern section of Alberta.

An Introduction to Strategic Oil & Gas

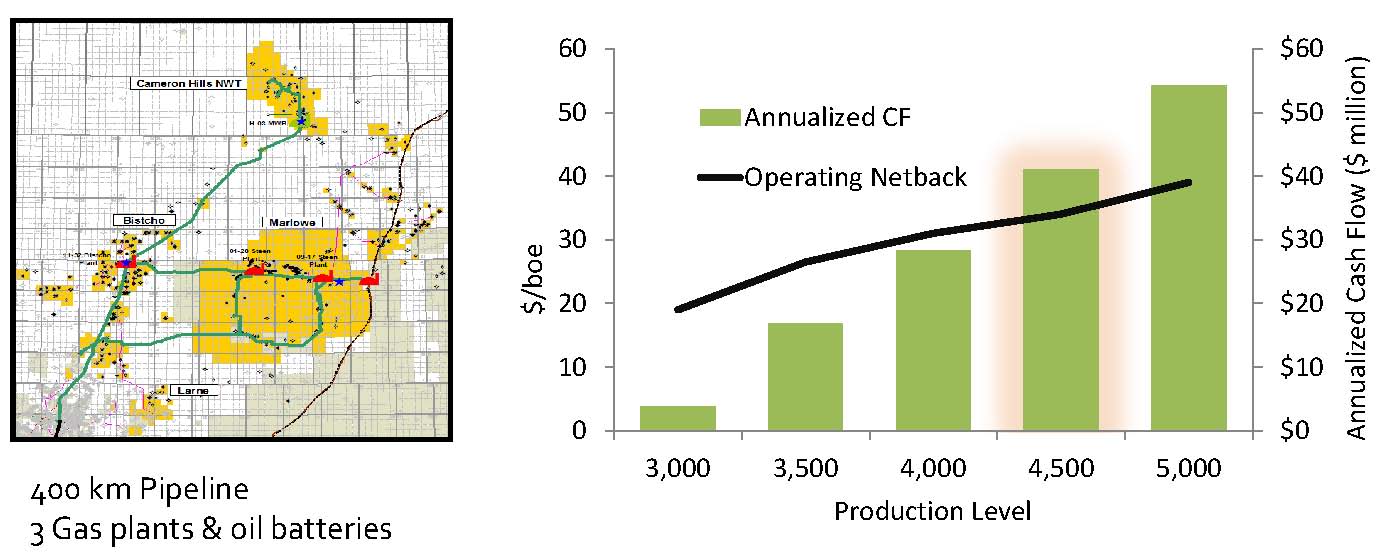

Strategic Oil & Gas is based in Calgary, Alberta, and holds roughly 500,000 acres in the northern part of the province. About 70% of its property (350,000 acres) is in the Marlowe, where the company has mapped more than 3 billion barrels of oil in place.

“How did we come to 3 billion barrels of oil in place?” asked Gurpreet Sawhney, President and Chief Executive Officer of Strategic Oil & Gas, at EnerCom’s the Oil & Gas Conference® 19 last month. He explains: “What lies below our acreage is a massive structure that was created 100 million years ago by the impact of an asteroid. The impact created a massive doughnut of about 15 miles in diameter from the crest. What Strategic is chasing is the rim of the crater, where we have discovered six layers of carbonates which are about 800 feet thick.”

Click here for a webcast of Strategic’s presentation at TOGC® 19.

Source: SOG August 2014 Presentation

Sawhney says SOG discovered the resource about four years ago – the same time many of its peers were heading to the south to chase the Bakken and Cardium plays. Strategic was producing roughly 300 BOEPD from Marlowe at the time and saw an opportunity to expand. A total of $600 million has been spent on infrastructure in the last two years, including three gas plants and four oil batteries.

“Today,” Sawhney said at TOGC, “Strategic controls everything in the top 70 miles of Alberta, including the plants, the batteries and the roads.”

Setting the Table

SOG’s focus is its asteroid crater in the Marlowe, and the company has spent the last three years building up infrastructure while testing its properties. SOG began its additional testing in the Marlowe by re-entering old vertical wells, which revealed 20 to 50 BOEPD on six separate horizons in the play. The company discovered the eastern side of the crater was 2,800 deep and held high volumes of gas. The western side, on the other hand, was 4,000 feet deep and held greater volumes of oil.

Drilling began in 2013, and SOG completed two horizontals in the Northwest section of Marlowe targeting the Muskeg formation. The wells proved the Muskeg was oil-bearing and the company responded by drilling an additional ten wells to infill its acreage, which represented between 20% and 25% of its total acreage. Reserve auditors mapped out 250 MMBO of light oil resource in the infill area, equating to roughly 1 billion BOE in the Muskeg alone. An additional 400 risked locations have been added to the company’s portfolio, and Marlowe EURs are 250 MBOE.

Strategic has drilled four Muskeg wells during the third quarter and is now planning to drill six more Muskeg wells during Q4’14 after announcing an accelerated program on September 2, 2014. The estimated exit rate for 2014 is 4,600 BOEPD. The Company remarked that production rates continue to exceeding the Company’s type curve and field netbacks in Marlowe are currently over $40/BOE.

Source: SOG August 2014 Presentation

Delineation to Execution

“2013 was the year of delineation,” said Sawhney. “Now, 2014 is the year of exploitation, and we have been executing.”

Strategic implemented company goals for each quarter of 2014, and Q1’14 targeted the improvement of well performance. “2013 was a year where we fine-tuned our drilling and completion techniques,” said Sawhney, after the company experienced downtime of 20% to 30% on six horizontal wells. “Our key focus in Q1’14 was to improve IP rates. We increased both IP rates and uptime by 25%.”

Strategic followed up its improvement in Q2’14 by reducing well costs by 25%. Drilling time has been cut to 18 days from 30 days in comparison to when operations first began. Production in Q2’14 was 3,538 BOEPD and the company believes it can achieve a 2014 exit rate of 4,600 BOEPD (23% above current rates, and more than 15 times above 2010 rates). The Marlowe is expected to account for 76% of volume.

Source: SOG August 2014 Presentation

Strategic’s Future

Strategic’s next step is to leverage its infrastructure. The pipeline additions eliminated the need for trucking, resulting in a 45% netback increase on a quarter-over-quarter basis. The company expects total operating cost savings of 50%, or $19 per barrel, by year end 2014. Netback is forecasted to increase by 60% in the same period.

The Company plans to continue executing a continuous one rig drilling program through the end of 2015, drilling up to 23 wells in 2015 and achieving production growth of approximately 25%. The company outlined that the capital requirements for this accelerated program will require approximately $50 million to $75 million over and above cash flow from operations for the remainder of 2014 and 2015.

The outspend of cash flow will be funded from equity, potential increases in credit facilities and sales of non-core assets. The company also announced a US$10 million loan from Bay Resource Partners Funds as a short-term interest-bearing bridge loan to enable continuation of the capital program as financing options are evaluated.

The company has identified a break-even point of 2,500 BOEPD, with 3,000 BOEPD generating $5 million in cash flow. From that point on, the cost of each incremental barrel is $5. Sawhney expects cash flow to reach $50 million once the company expands to 5,000 BOEPD from 3,000 BOEPD. For this reason, it is important for SOG to continue bringing on economic wells and accelerate production growth in the Marlowe to realize the benefits from its investment in infrastructure. Resource estimates are placed by SOG’s team at 30 MMBO per section – growth of 56% in the last three years.

“The last two times I’ve presented at EnerCom’s The Oil & Gas Conference®, I’ve said SOG will create value but we still had to buy the infrastructure and prove up the play,” said Sawhney in his closing remarks. “The value is now, because we have achieved those tasks and plan to grow production by 30% to 50% over the next 12 months.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.