CIBC’s Katherine Spector: “In the very short-term, while there may be a few more dollars of downside in the crude price, increasingly lopsided futures market positioning suggests that an end is probably near.”

The world will need more oil from OPEC, but not as much as they are producing

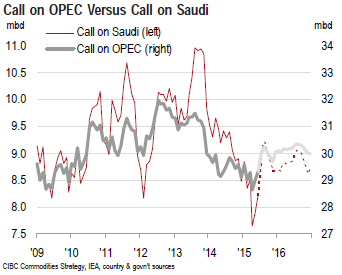

The most recent oil market outlook released by Canadian Imperial Bank of Commerce (CIBC) predicts an improved call on OPEC in the second half of 2015, but says that the organization is already producing more than it expects markets will absorb by the end of the year. The CIBC report expects that demand for OPEC’s oil will reach 30 MMBOPD by the end of the year, but the group continues to increase production. Most recently, OPEC reported production of 31.51 MMBOPD in July.

The calculation of OPEC’s continued over-production has led the Canadian bank to lower its crude oil price expectations from a previous report in March. For 2015 and 2016, respectively, CIBC pegs West Texas Intermediate at $54.00 and $62.50, Brent at $61.00 and $70.50, and Western Canadian Select at $36.00 and $46.50 in its most recent report. CIBC’s March report predicted WTI at $57.00 and $70.50, Brent at $69.50 and $82.50, and WCS at $42.00 and $60.50, for 2015 and 2016, respectively.

An end is probably near

Despite the downward revision, there is a light at the end of the tunnel. “In the very short-term, while there may be a few more dollars of downside in the crude price, increasingly lopsided futures market positioning suggests that an end is probably near,” said Katherine Spector, CIBC’s head of commodities strategy.

Supply drives price

Spector’s note points out that while a great deal of attention has been given to bullish demand indicators, such as weakness in the Chinese stock market, supply is what influences prices most. “Supply has been the main driver of price since the recession, both when prices were high in the years through 2014, and now when prices are low,” said Spector.

As the market adjusts to the new lower prices, CIBC suspects that that production from the U.S. and OPEC will continue to make up most of the market, while non-U.S. and non-OPEC producers are shut out of the market. “Meager performance” from both non-U.S. and non-OPEC producers when prices were above $100 per barrel leads Spector to believe that these groups will likely be the ones most widely affected by the low price environment.

Lower production from groups outside of the U.S. and OPEC is bound to make both groups’ production more relevant moving forward though, according to the note from CIBC, but Spector remains constructive on global crude prices. OPEC is producing nearer and nearer to its full capacity, says Spector. “OPEC spare capacity on a long-term historical basis underscores the difference between today’s market and the market of the early 1980’s,” she said.

Katherine Spector at TOGC 20®

Katherine Spector will be presenting at EnerCom’s The Oil & Gas Conference® in Denver, Colorado, next week. Spector will be joined by numerous other speakers and company presenters as the oil industry gathers to discuss what lies ahead in 2016. To register for The Oil & Gas Conference®, click here.