The Colorado Supreme Court ruling against cities issuing frac bans must have caused sweet dreams for E&P operators all over the Wattenberg field in northern Colorado, where two municipalities had attempted to stop hydraulic fracturing. Before the ink could dry at the courthouse, new deals were announced.

Synergy Resources (ticker: SYRG) announced a deal with Noble Energy (ticker: NBL) this week in which Synergy will acquire certain Wattenberg assets from Noble for total consideration of $505 million cash. The assets come with a 46% working interest (72,000 gross/33,100 net acres).

Synergy highlighted the following aspects of its transaction with Noble:

- Approximately 72,000 gross (33,100 net) acres located in Weld County Colorado, primarily in and around the city of Greeley.

- The acquired lands are largely contiguous allowing for longer lateral lengths per well and the efficient development of infrastructure.

- Over 80% of the acquired lands are held by production from vertical wells, allowing for orderly horizontal development.

- Synergy has identified over 900 gross locations on the acquired lands, of which over 800 of those locations are suitable for mid (<7,500′), long (<10,000′) and extended (>10,000′) length laterals, using an initial assumption of horizontal development with 20-24 wells per drilling unit, creating multiyear drilling inventory.

- Drilling locations will target the Niobrara A, Niobrara B, Niobrara C and Codell zones which all produce in the acquired lands.

- For the first quarter of 2016 estimated net daily production of 800 BOE/d from non-operated properties and 1,600 BOE/d from operated properties.

Synergy said it intends to finance the acquisition with cash on hand and proceeds from financing transactions, including a private placement of $80 million in notes for which it has a commitment letter in place.

Looking Closer at the Deal

Based on the $505MM purchase price, the assets were acquired for $15,257 per acre or $210,417 per flowing BOEPD. Even though more than 80% of the acquired lands are held by production from legacy vertical drilling, this acquisition is primarily focused on building inventory of future horizontal drilling locations. Estimated new inventory includes 900 gross locations, of which over 800 of those locations are suitable for mid (<7,500′), long (<10,000′) and extended (>10,000′) length laterals. Allocating the purchase price across the 900 drilling locations, each gross well location is valued at $561,111.

Tapping the Equity Markets

Synergy plans to tap the equity markets for the third time this year with an anticipated issuance of 45,000,000 shares and intends to grant the underwriters an option for 30 days to purchase up to an additional 6,750,000 shares of the Company’s common stock. As of market close today, SYRG shares closed at $6.89.

The company’s first raise of the year was on January 21, 2016 where the company issued 16.1 million shares at $5.75 per share. The second was on April 14, 2016, less than a month ago, where the company issued 22.4 million shares at $7.70 per share.

Neither raise was tied to any acquisition and had use of proceeds targeting “general corporate purposes,” reduction of the minimal net debt carried at 12/31/15 ($11.5 million), continuing to develop its acreage position in the Wattenberg and potential future acquisitions.

Assuming no discount to today’s closing price for the newest issuance, a fully subscribed overallotment and the proceeds from a concurrent but separate divestiture, SYRG will have raised $648.6 million this year.

The vertical well transaction recently closed and the undeveloped acreage transaction is expected to close in the second quarter of 2016, Synergy said. Pro forma for the closing of these transactions, the Company will have an interest in approximately 47,200 net largely contiguous acres in the Company’s defined Wattenberg fairway area and approximately an additional 22,000 net acres of other Wattenberg acreage.

Deal is Transformational: Peterson

Lynn Peterson, Synergy’s chairman and CEO, characterized the Wattenberg transaction in a press release as “transformational.” Peterson said that Synergy does not expect to increase operational activity in 2016, but he expects the acquired properties to be part of an expanded 2017 operation program using up to three drilling rigs. “This was a unique opportunity to acquire a contiguous block of acreage in the heart of the Wattenberg Field that may never present itself again,” Peterson said.

Noble Energy’s View

Noble included the following data points in its press release:

- Combined with other asset sales, we have now announced transactions totaling more than $775 million in proceeds this year, which further enhances our flexibility to strengthen our investment-grade balance sheet and accelerate activity levels once justified by higher commodity prices

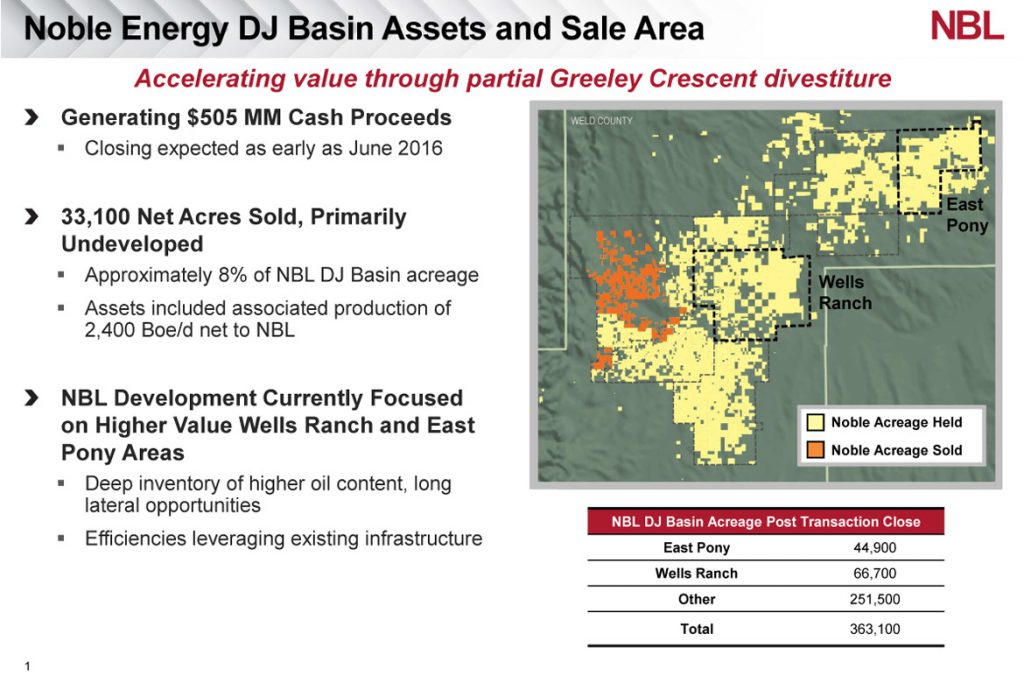

- The acreage and production sold represent approximately eight percent and two percent, respectively, of the company’s totals in the DJ Basin.

- The Greeley Crescent sale signifies Noble Energy’s continued portfolio management efforts and accelerates the value of these assets to the company. This transaction also highlights the strong value of undeveloped acreage throughout the DJ Basin. Our DJ Basin development activities are currently focused on Wells Ranch and East Pony, where we have a deep inventory of long lateral drilling opportunities in an oily part of the basin.

NBL also said, “The acreage included in the transaction remains dedicated to Noble Energy’s midstream business for oil and water gathering, as well as freshwater services.”

Synergy’s Divestiture of Adams County Assets for $27 Million

Synergy also announced in its press release that in two separate transactions, it has also entered into definitive purchase and sale agreements with two private entities to divest approximately 3,700 net undeveloped acres and 107 vertical wells primarily in Adams County, Colorado for total consideration of approximately $27 million cash, subject to customary purchase price adjustments. The divested assets had associated production of approximately 200 BOE/d.