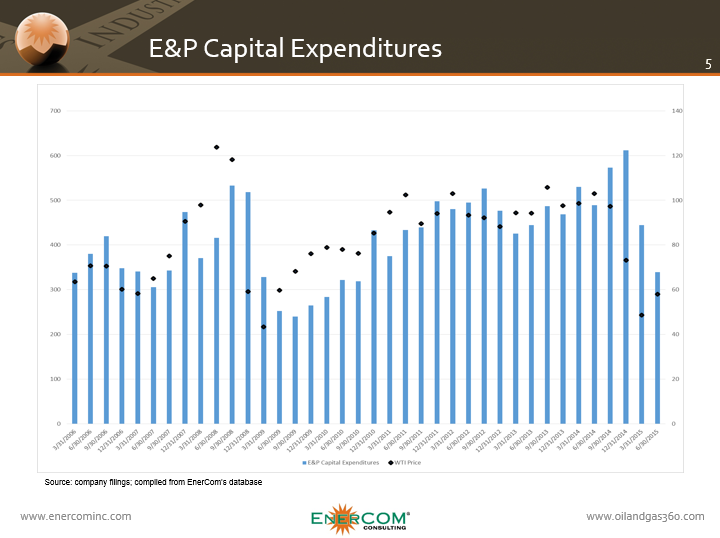

Antero Resources Lowers Capex and Provides Guidance for 2016

Antero Resources announced on February 17, 2016, the company’s capital budget and guidance for the 2016 fiscal year. 2016 capital spending will be reduced to $1.4 billion from $1.8 billion, a reduction of 23%. The new capital plan includes an …