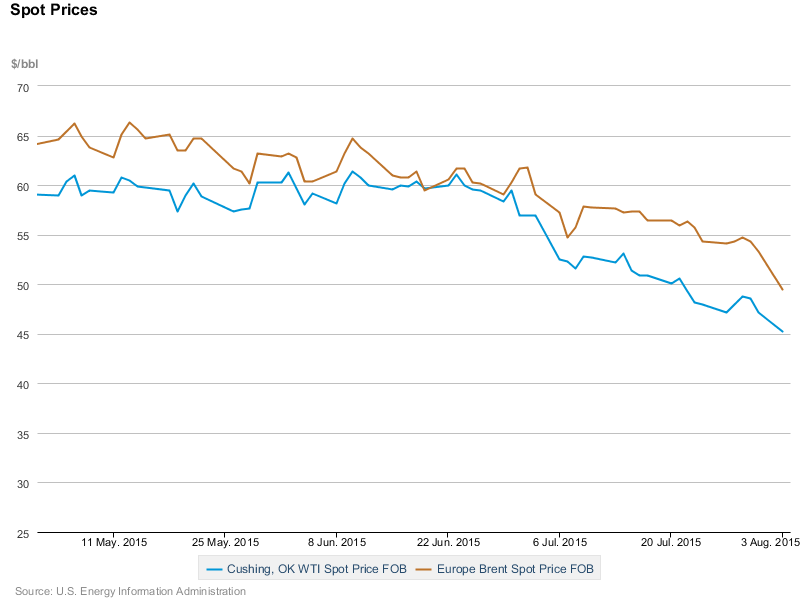

Brent Crude Follows U.S. Oil Toward Bear Market

From The Wall Street Journal

Oil prices are on track for their longest losing streak in more than three decades as concerns about oversupply have rapidly returned to the market.

The recent fall has wiped out all of oil’s gains …