Bill Barrett Corporation: Lower Debt, Longer Laterals

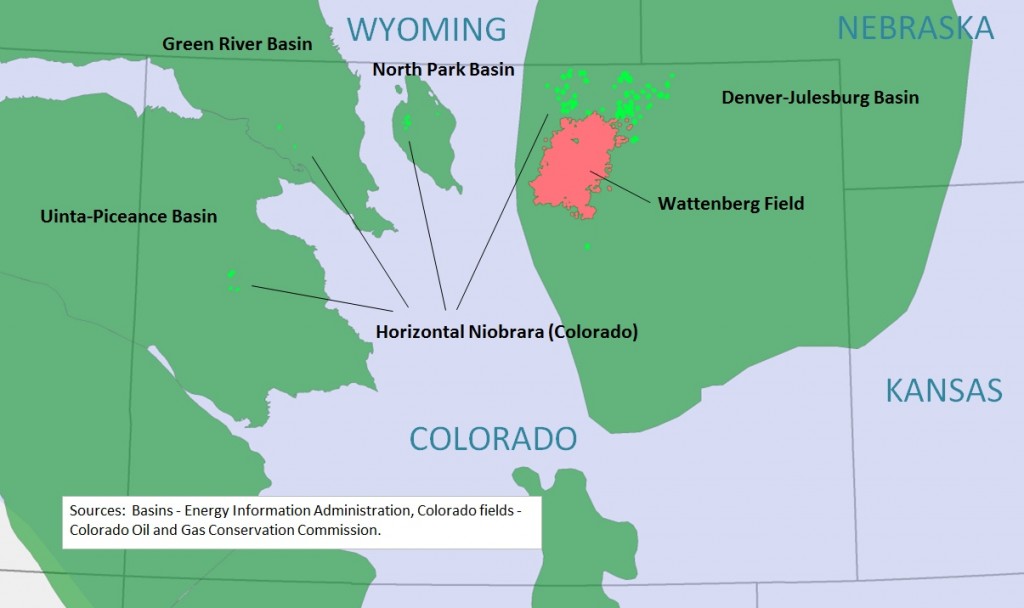

Bill Barrett Corporation (ticker: BBG) has built a core position in the Northeast Wattenberg field in Colorado’s Denver-Julesberg (DJ) Basin, where it holds 71,900 net acres. The company also has producing acreage within the Uinta Basin in Utah, numbering approximately …