SM Energy Divestment of $792 Million Non-Core Assets Will Drive 30% Debt Reduction

Out of the Williston

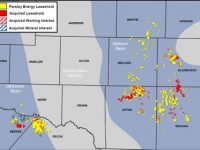

Midland- and Eagle Ford-focused SM Energy Company (ticker: SM) sold its remaining assets in the Williston Basin and third-party operated assets in Upton County, Texas. The combined sale generated $292.3 million, but the buyers have not …