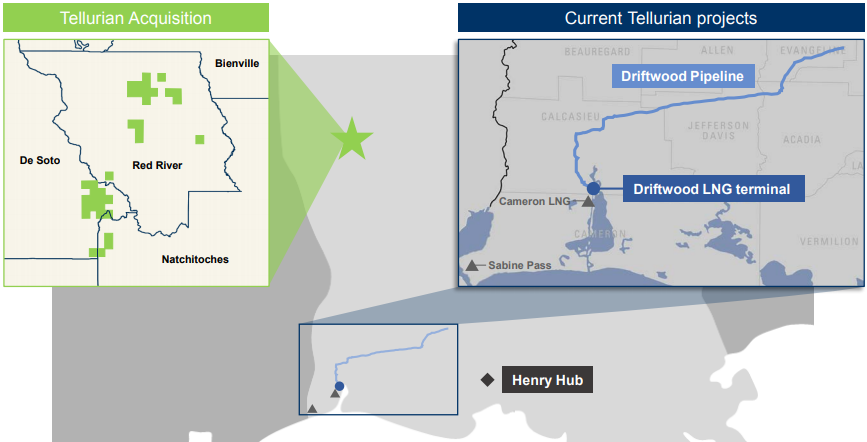

Tellurian Inc. (ticker: TELL) has closed a previously announced agreement with Rockcliff Energy Operating LLC to purchase natural gas producing assets and undeveloped acreage in northern Louisiana for $85.1 million.

The assets include about 9,200 acres, 19 producing operated wells with production of 4 MMcf/d, and approximately 138 drilling locations. Tellurian estimates that the total acreage has about 1.3 TCf of total natural gas resource potential. The assets are 100% held by production and 92% operated, allowing Tellurian to control the pace of development.

Tellurian is still in the permitting and planning phases for its Gulf Coast Driftwood LNG export terminal. The newly acquired Haynesville assets will give Tellurian access to its own nearby gas supply, allowing it to compete with Henry Hub. Tellurian estimates that the full cycle cost of production and transportation to natural gas markets from its Haynesville properties will cost $2.25/MMBTU. Tellurian said it expects Henry Hub gas prices to be $3.10/MMBTU.

Oil & Gas360® previously estimated a production valuation of $1,250 per Mcfe/d, meaning that Tellurian paid approximately $8,707 per acre. For reference, Indigo purchased 22,500 acres from Buesa Energy for $10,000/acre and GeoSouthern purchased 112,000 acres from EnCana for $5,167/acre. The average adjusted acreage price out of seven recent Haynesvilles deals is approximately $7,786. The Tellurian-Rockcliff deal includes significant gathering facilities, which might justify the higher acreage price.

Tellurian President and CEO Meg Gentle said, “Acquisition of natural gas producing acreage in the core of the Haynesville provides the foundation for a growing portfolio of assets that we expect can produce LNG for a cost of $3.00 per MMBTU, FOB U.S. Gulf Coast, when Driftwood LNG begins operations in 2022.”