Goal is to debottleneck the existing pipeline infrastructure in Southwest Louisiana: TELL

Tellurian Inc. (ticker: TELL) expects to develop and expand its pipeline network by adding two pipelines to the previously announced Driftwood Pipeline (DWPL).

The two additional pipelines will expand supply alternatives for the growing natural gas demand in Southwest Louisiana. Projected in-service dates are mid-2021 for the DWPL and end-2022 for the two new pipelines.

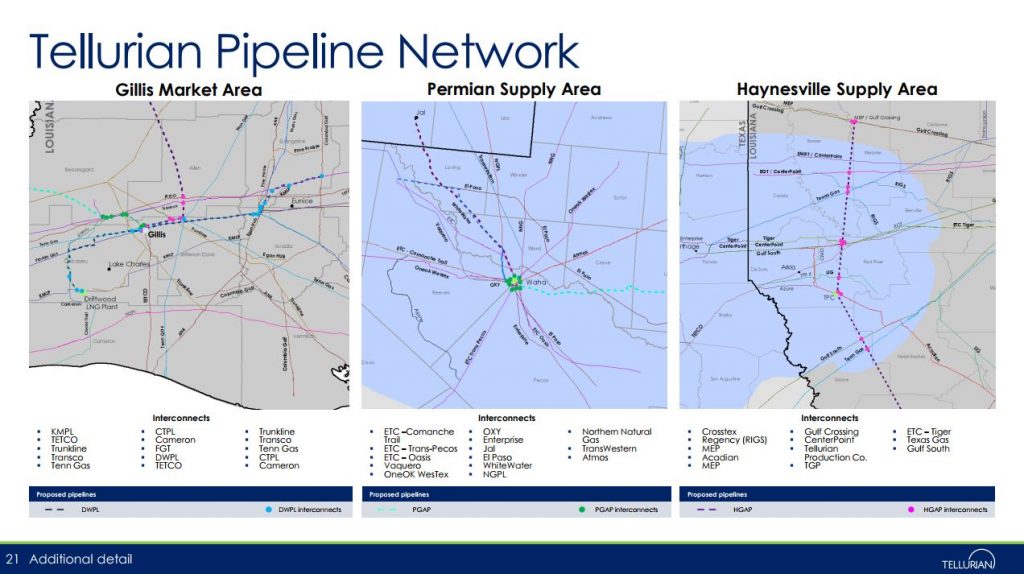

The newly proposed Permian Global Access Pipeline (PGAP) will be an approximately 625-mile, 42-inch diameter pipeline transporting 2 Bcf/d of natural gas per day. PGAP will originate at the Waha Hub in Pecos County, Texas, and will connect to the Permian and associated shale plays located around Midland, Texas. PGAP will terminate near Gillis, Louisiana, with proposed deliveries to the Creole Trail Pipeline, Cameron Interstate Pipeline, Trunkline Gas Company, Texas Eastern, Transco, Tennessee Gas Pipeline, Florida Gas Transmission, and DWPL, among others.

The other new pipeline is the Haynesville Global Access Pipeline (HGAP). It will be an approximately 200-mile, 42-inch diameter pipeline, it will also transport 2 Bcf/d with proposed deliveries to the same interstate pipelines near Gillis, Louisiana.

The previously announced DWPL is a 96 mile, 48-inch diameter natural gas pipeline transporting 4 Bcf/d from near Gillis, Louisiana and terminating at Driftwood LNG. DWPL is currently under permitting with the Federal Energy Regulatory Commission.

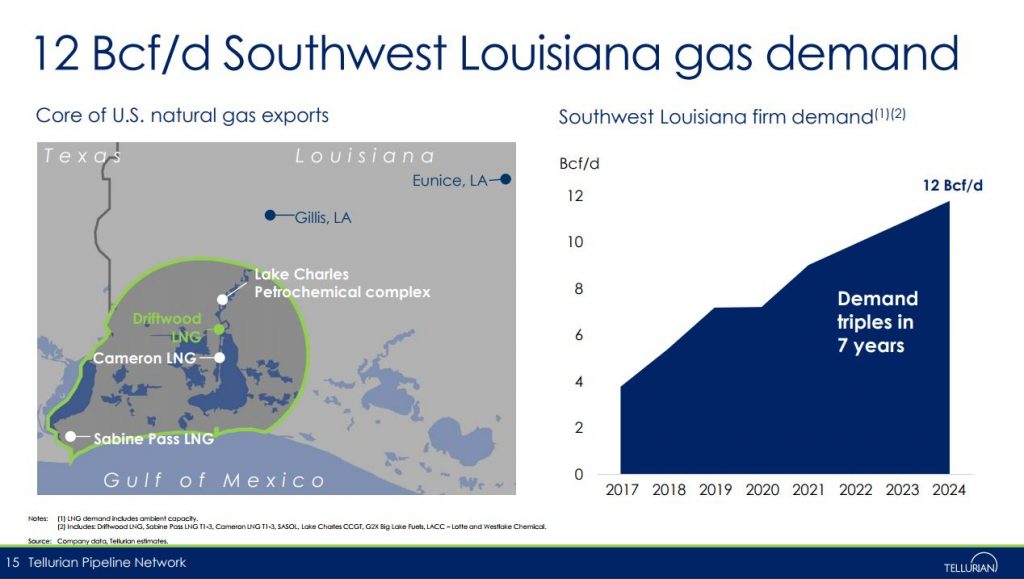

Tellurian President and CEO Meg Gentle said, “The Tellurian Pipeline Network would serve the approximately 8 Bcf/d of incremental natural gas demand expected by 2025 in Southwest Louisiana. When completed, PGAP and HGAP will deliver natural gas from multiple low-cost production basins and debottleneck the existing pipeline infrastructure in Southwest Louisiana. We intend to begin soliciting third party shipper interest in the first half of 2018, and would seek to commercialize PGAP and HGAP by year end 2018. The proposed Tellurian Pipeline Network represents approximately $7 billion of investment in infrastructure and 15,000 jobs in Texas and Louisiana.”

Gentle said that Tellurian has hired Joey Mahmoud to be president of Tellurian’s pipeline network. Gentle said Mahmoud was over $30 billion of energy-related infrastructure as EVP of Engineering and Construction at Energy Transfer (ticker: ETP).

Tellurian’s public offering of common stock closed

Tellurian closed its previously announced underwritten public offering of 10,000,000 shares of its common stock at a public offering price of $10.00 per share. Proceeds from the offering, after deducting underwriting discounts and commissions and estimated fees and expenses, were approximately $94,800,000.

Credit Suisse Securities (USA) LLC acted as sole book-running manager for the offering, and Tuohy Brothers Investment Research, Inc. acted as co-manager. The company has granted the underwriters a 30-day option to purchase up to 1,500,000 additional shares of common stock to cover over-allotments, if any.

The company intends to use the net proceeds from the offering for detailed engineering of an LNG terminal facility and an associated pipeline in Southwest Louisiana, general corporate purposes and working capital.