Last week, a Saudi crown prince dropped a bombshell in an under-the-radar interview that was published in The Economist. He said that the kingdom was looking into spinning off Aramco, or some portion of it, to raise cash.

Comments regarding a potential initial public offering (IPO) from the world’s largest oil company were received with shock and laughter from the global markets.

Shock, coming from the amount of cash an IPO would generate and a fundamental shift from Saudi values. “They’re having to sell part of their business to keep doing what they’re doing,” said Harold Hamm, Chief Executive Officer of Continental Resources and a steadfast critic of Saudi policy, in an interview with CNBC. “It’s obviously not working for them… I think it goes against their culture to borrow money.”

The very idea that an IPO coming from the smoke and mirrors associated with a globally renowned producer (who publishes only select information) is reminiscent of some of the laughable Chinese reverse mergers of the past decade. The crown prince himself acknowledged that an IPO would increase transparency.

Regardless of the widely covered opinions about the news, there is no denying Aramco’s prominence and sheer size on a worldwide scale. But Aramco is owned and run by its government, and has faced little in the way of competition until the U.S. shale revolution achieved cruising speed during the past decade.

Upstream Aramco Not Off Limits: Chairman

Even the lowest valuations believe Aramco is worth $1 trillion (Aramco advisors believe the value could be ten times higher than that). However, dozens of commentary pieces are sharply advising against any kind of Western investment, believing this could be another version of Petrobras. Others question the motives behind any offering, saying it would be easier to simply issue bonds rather than giving up equity in the country’s crown jewel.

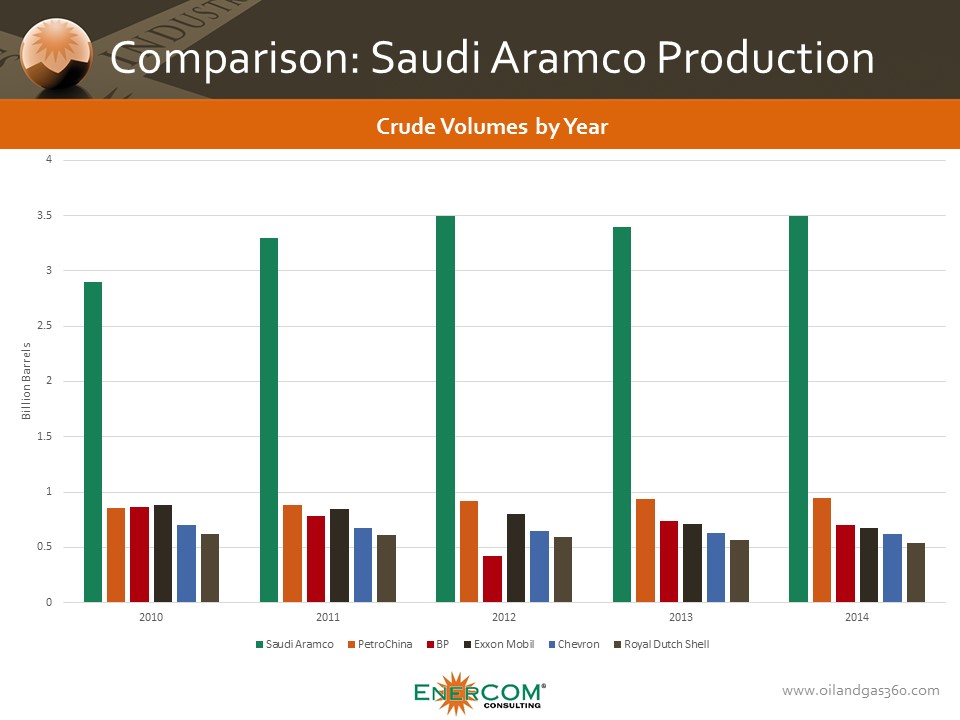

Analysts are torn on the market value of Aramco, but, as evidenced by Oil & Gas 360®’s Chart of the Week, when you look at the company’s oil production, it dwarfs that of the “other” major producers and its listed reserves are more than 12 times greater than those of Exxon Mobil Corp. (ticker: XOM), its closest Western oil company competitor in terms of size.

Apparently, communication and consensus among Aramco officials is also proving to be a difficult task for the world’s largest producing company.

Sources of Reuters say Aramco’s foreign partners were unaware of its IPO plans until the crown prince’s interview in The Economist. Other sources allege that only the downstream portion will be offered, although Aramco’s chairman says it has not ruled out listing its upstream operations.

Even though the kingdom posted record deficits in 2015 and expects a repeated shortfall in 2016, the OPEC leader still has more than $600 billion in foreign reserves as a cushion, and even with oil dipping close to $30 per barrel, Saudi Aramco’s owner is not backing off its “market share over commodity price” strategy.

However, that commodity price is just 30% of its former value, and Saudi relies on oil revenues for 80% of its budget. Forthcoming social issues, including rising tensions with its longtime rival Iran and the costs of funding an insurgency in Yemen, may have the OPEC leader weighing all strategic options after initiating the self-inflicted commodity crash in late 2014.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.