In this Midland/Delaware Basin infrastructure roundup, the following E&Ps are covered:

- Halcón Resources Company (ticker: HK)

- Approach Resources Company (ticker: AREX)

- Apache Company (ticker: APA)

- Callon Petroleum Company (ticker: CPE)

Waterworks

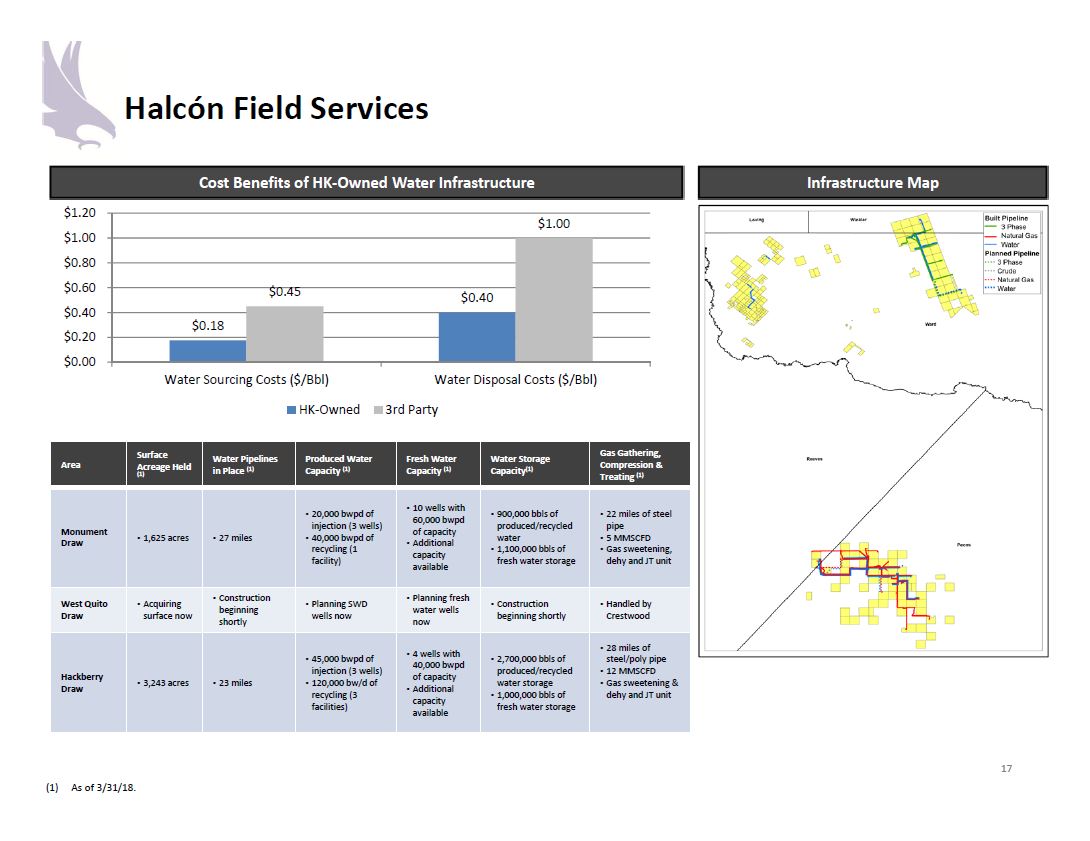

Halcón plans water saving costs

Halcon reported a LOE and workover expense at $6.3 million for the quarter, or $6.36 per Boe. This amount included approximately $700,000 of third-party water disposal charges in the Hackberry Draw. These charges were the result of producing excess water at a peak rate for a number of weeks, as few wells were flowing back after fracking.

CFO Mark J. Mize said the company is transitioning from treating recycled water via a third-party contractor to in-house processing – potentially saving ~$0.5 million per quarter in savings going forward.

No question about it, water infrastructure pays off for Approach

“Our produced water infrastructure and recycling facility reduces D&C and LOE costs, and is key to our impressive cost structure,” Approach CEO Ross Craft said. “We restarted our recycle facility earlier this year, with all-in cost of recycling produced water somewhere around $0.50. We’re making some modifications to our facility, which should reduce the all-in cost by close to 50%.”

“There’s no question about the benefits of using recycled produced water – lower LOE, lower D&C cost and better wells,” Approach CEO Craft said.

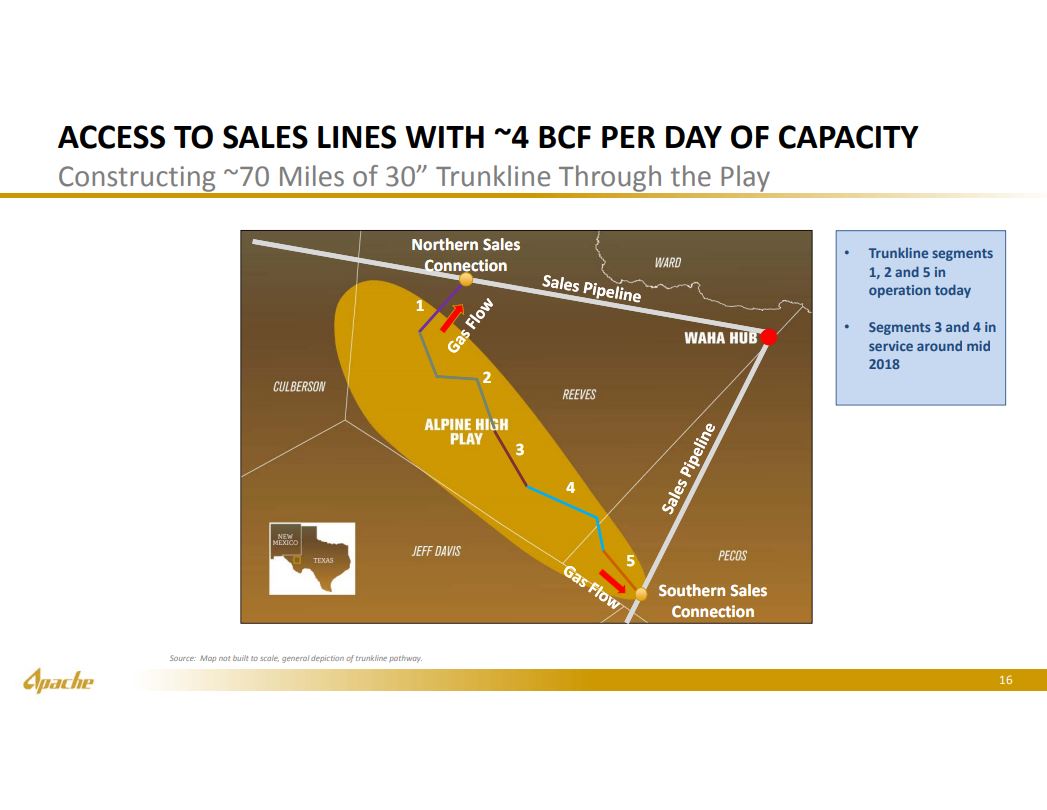

Apache’s Alpine High midstream venture

Apache said that its midstream build out at Alpine High is continuing, with additional infrastructure coming online as scheduled. According to the company’s April presentation, Apache has invested $700 million through yearend 2017. By the end of 2018, the company plans to have 830 MMcf/d of gross inlet processing capacity.

The company’s objectives this year include finalizing a joint venture, or partial monetization of the midstream enterprise, and reaching agreements for future oil and gas takeaway capacity.

Q: With respect to the monetization of the Alpine High midstream, are you still planning to keep a large equity stake?

Apache CEO John Christmann: We are deep in a process. It is going very well, and there’s a tremendous amount of interest.

I think the thing that we recognize is, is that this asset is unique, because of the column that we have. We’ve got 6,000 feet of pay. And really the value of this infrastructure is going to grow significantly over the next five, six, seven, eight years.

And so unlike other midstream assets, where you’re developing one or two zones, this has a built-in set of wells and capital that’s going to drive value.

So we will want to hang onto a large piece of the equity and keep that exposure, because ultimately it’s our upstream capital that’s going to be driving that.

So we’re very encouraged. I think we’re going to be able to maintain control. I think we’re going to be able to eliminate the future spend.

Q: About the midstream monetization… can you talk at all about the type of long term contracts or commitments that you need to make? And the longevity or magnitude of those to be successful with your monetization plans?

Christmann: Well, I think first and foremost is, it’s a very thoughtful process where there’s a lot of due diligence being done on us, and we’re doing a lot of due diligence on the potential partners.

So you won’t see big volume commitments. You’d see acreage dedication. And quite frankly, you’ll see us controlling. So we’re open to what the structure looks like. We recognize that the infrastructure investment really should sit in a different structure, where there is a different true cost of capital. We also recognize that we want to maintain as much of that equity as we can, because of the value we’re going to create with our capital spend from the upstream side.

The parties we’re talking with, the potential structures vary. I’m very encouraged by where we are. We’re very deep into the process. There’s a tremendous amount of interest. And we’re very confident that we will do something very attractive in 2018.

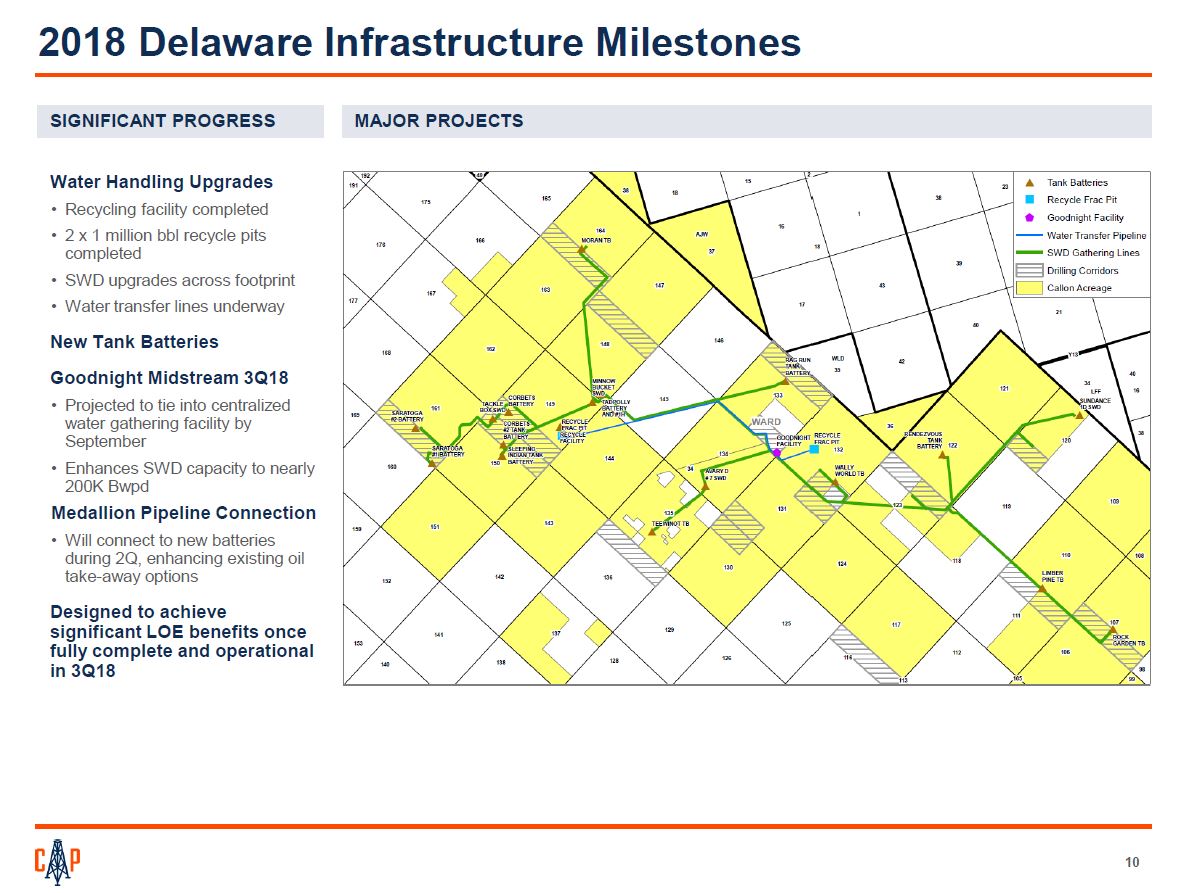

Callon sources more recycled produced water

In the Midland Basin, at Callon’s Monarch area, successful recycling efforts resulted in sourcing 40% of frac water needs from recycled produced water. The company has high expectations for use of recycled water at the company’s Spur operations.

According to the company’s May 2018 investor presentation, Callon’s water recycling facility has been completed, along with two, one million barrel recycle pits and salt water disposal (SWD) upgrades.

In the third quarter of 2018, Callon expects Goodnight Midstream to further enhance SWD capacity by 200,000 BPD of water.