Synergies to generate $400 million/year in savings

Total S.A. (ticker: TOT) announced the acquisition of Maersk Oil, a subsidiary of the Maersk Group, today in a deal valued at $7.45 billion. The transaction will make Total the second largest operator in the northwest Europe offshore region, with over 500 MBOEPD of production in the area.

Adds 160 MBOEPD of production in 2018, 200 MBOEPD by 2020’s

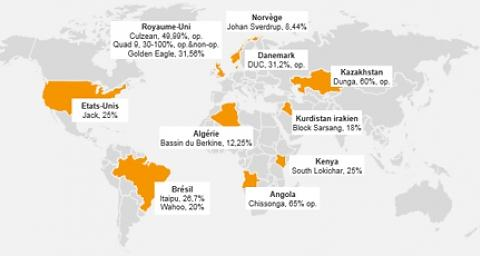

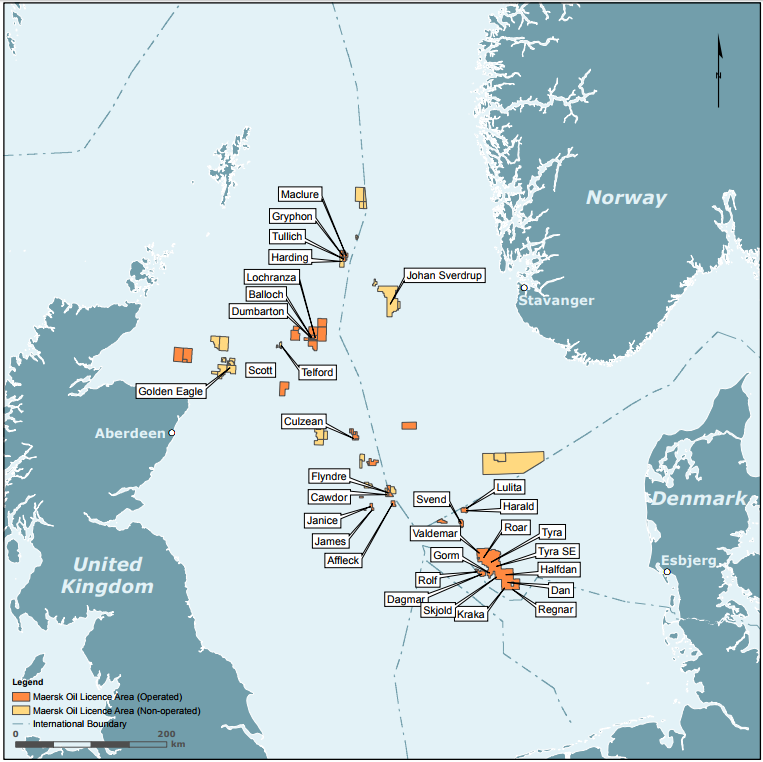

Maersk Oil owns about 1 billion BOE of 2P reserves, more than 80% of which is in the North Sea. Overall, Maersk Oil holds 92 gross licenses, or nearly 12.7 million gross acres. Total will add about 160 MBOEPD of primarily liquids production in 2018, which will grow to more than 200 MBOEPD in the early 2020’s.

Total reports that both companies primarily focus have significant operations in the North Sea, meaning this transaction can yield synergies of more than $400 million per year. For example, the UK Culzean gas field operated by Maersk Oil is very close to the Elgin-Franklin hub operated by Total. In addition, this transaction gives Total a stake in the massive Johan Sverdrup field, which is estimated to have 2.8 billion barrels of oil in place and peak production of 660 MBOPD.

$4.95 billion in equity, $2.5 billion in assumed debt

In the transaction Total will pay Maersk $4.95 billion in Total shares, and Total will also assume $2.5 billion of Maersk Oil’s debt. Maersk will receive 97.5 million of shares, 3.75% of the enlarged share capital of Total. In addition, Total has offered the possibility of a seat on its board of directors to the main shareholder of Maersk. Total expects the purchase to close in Q1 2018, with an effective date of July 1, 2017.

This transaction is consistent with Maersk Group’s recently unveiled strategy to focus on its transport and logistics business, instead of its energy operations.

Total Chairman and CEO Patrick Pouyanne commented on the purchase, saying “This transaction delivers an exceptional opportunity for Total to acquire, via an equity transaction, a company with high quality assets which are an excellent fit with many of Total’s core regions. The combination of Maersk Oil’s North Western Europe businesses with our existing portfolio will position Total as the second operator in the North Sea with strong production profiles in UK, Norway and Denmark, thus increasing exposure to conventional assets in OECD countries. Internationally, in the US Gulf of Mexico, Algeria, East Africa, Kazakhstan and Angola there is an excellent fit between Total and Maersk Oil’s businesses allowing for value accretion through commercial, operating and financial synergies.”