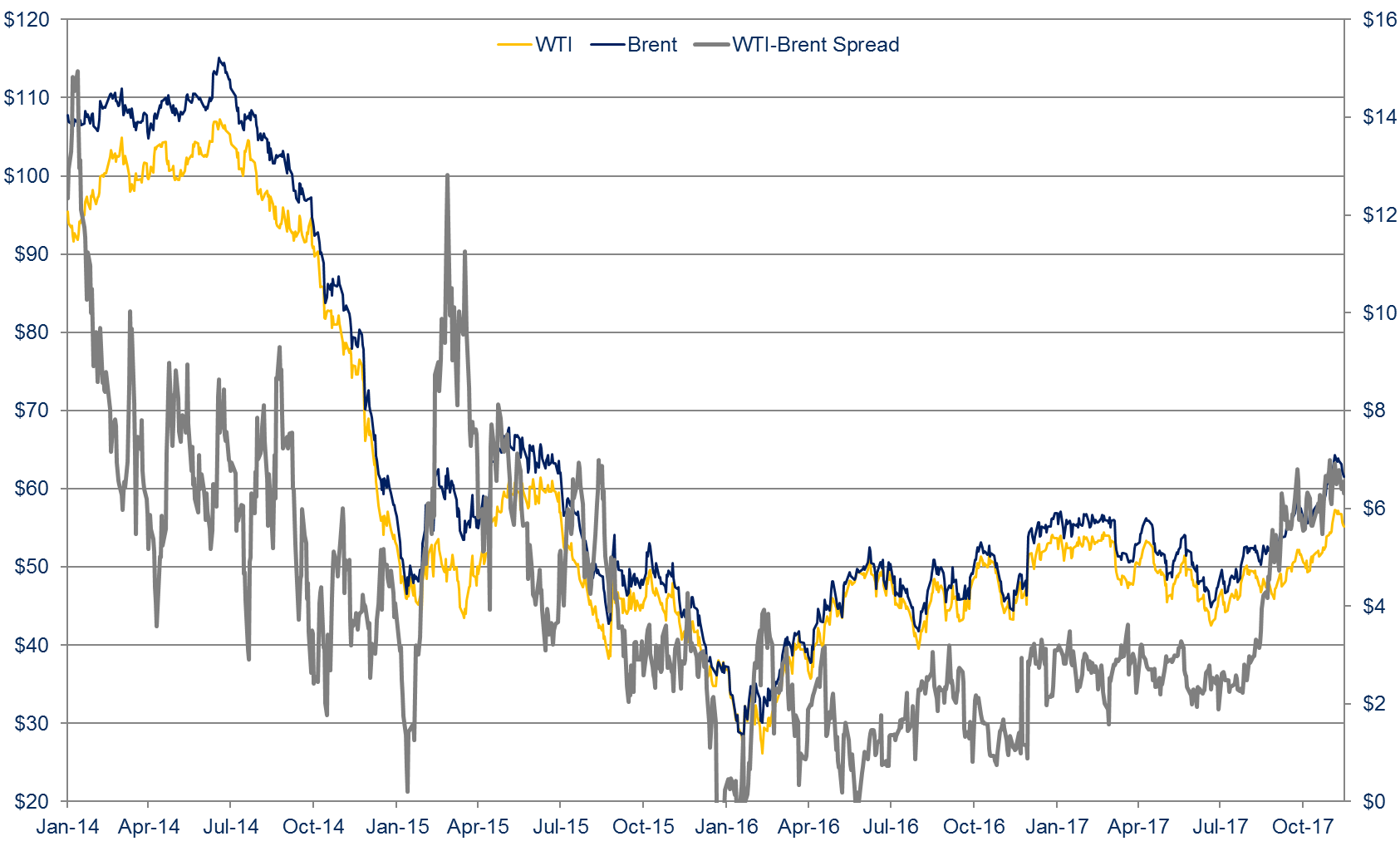

Spread has doubled since July

The spread between WTI and Brent prices has been rising in recent months, in a trend that is not likely to reverse soon.

WTI is currently trading at $55.21/bbl while Brent is at $61.50/bbl, a spread of $6.29/bbl. This spread is lower than the $6.99 reached at the end of October, but is still significantly higher than the average of $2.17 between October 2015 and July 2017.

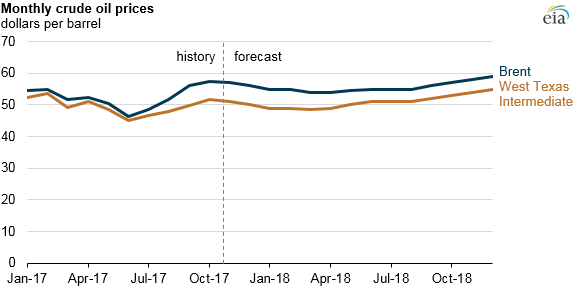

According to the EIA’s Short-Term Energy Outlook, this spread will continue in 2018. The STEO predicts the spread will remain at $6/bbl through the first quarter of 2018, and will hold at $4 for the rest of the year.

Transportation constraints drive Cushing inventories higher

According to the EIA, much of the spread is due to transportation constraints in U.S. operations. The explosion of activity in the Permian has created a similarly large need for transportation infrastructure, moving oil from western Texas to the Gulf Coast markets. However, transportation supply has not kept up with demand, and pipeline constraints are currently a factor.

Additional transportation infrastructure is also needed in Cushing. The EIA estimates that moving crude from Cushing to the coast costs about $3.50/bbl, but current transportation constraints have pushed this value higher.

These constraints have pushed Cushing inventory higher in recent months. Total U.S. crude inventories have declined by about 25 MMBBL since the end of July, but have risen by 8.8 MMBBL in Cushing. Cushing inventories are currently 51% above the five-year average, while overall inventories are 15% above the average.

Ports cannot handle large crude carriers

The export ban has been lifted, so oil can now be transported abroad. While this expands the market for U.S. crude significantly, there are still difficulties with the process. Ports in the U.S. generally cannot handle the largest crude carrying ships. These ships are much more economic for transporting crude over long distances, though, and are generally used internationally. To get around this, U.S. crude is often loaded on smaller vessels, then transferred to larger vessels in deeper waters in the Gulf.

While this is more economic than hauling oil all the way to Europe or Asia using smaller ships, it is far from ideal. While several ports, like Corpus Christi and the Louisiana Offshore Oil Port, are working to expand to handle Very Large Crude Carriers, these efforts will likely not make a meaningful change in the markets in the next year. Instead, transportation constraints will keep oil prices lower than the international benchmark.