Shale production provides new opportunities

The shale boom has not gone unnoticed by refiners, as two companies are looking to Texas to join some of the biggest plays in the United States. MMEX Resources (ticker: MMEX) and Raven Petroleum both have recently announced their intentions to build refineries in Texas to take advantage of the shale oil production boom.

On March 7, MMEX Resources announced plans to build a 50,000 BOPD crude oil refinery in Pecos County. The facility will cost about $450 million, cover about 250 acres and take about 18 months to build. MMEX’s refinery would process crude from the Permian basin, as it is located in the heart of the Delaware. Rigs in the Permian have more than doubled since bottoming out at 134 in May, with Baker Hughes reporting 315 currently active rigs. Based on the most recent information available from the EIA, the EnerCom Effective Rig Count for the Permian stood at 1,018 in February.

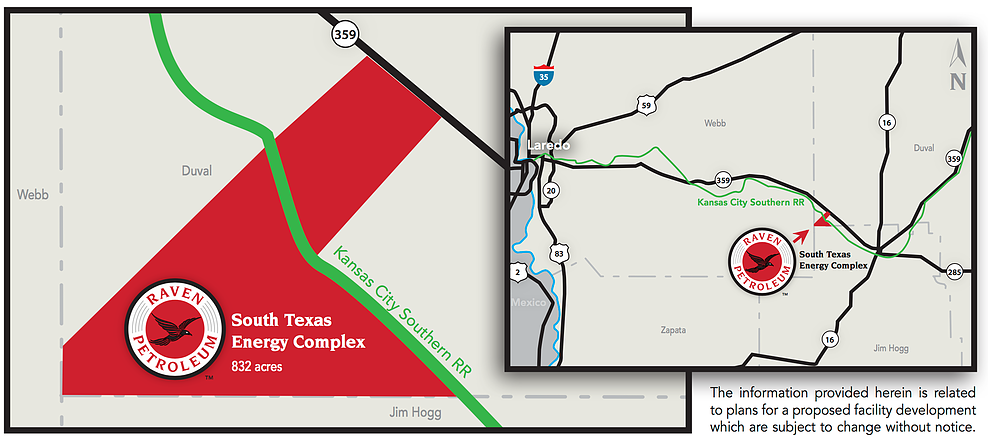

Raven Petroleum, a subsidiary of Raven Resources Group, has similar plans for the Eagle Ford. The company plans to build a 55,000 BOPD refinery in Duval County near Laredo. Crude from the Eagle Ford would supply this facility via the Kansas City Southern railway. According to Baker Hughes’ Rig Count, the Eagle Ford is the second-most active basin in the U.S. with 72 rigs.

Raven Petroleum claims its refinery is different from most in both design and purpose. Geothermal and natural gas will be used for power, while extensive CCS will limit emissions. Unlike many domestic refineries, Raven Petroleum’s has been built specifically to export produced products to Mexico.

Refineries targeting Mexico for exports

Mexico is in the process of deregulating its fuels market, most recently by phasing out mandated gasoline prices. Demand in Mexico is growing by 3% per year, outpacing growth in supply. Gasoline prices rose by 20% in Mexico in January as the government raised maximum rates. The Mexican supply imbalance has made it an attractive destination for refined products, a situation Raven is looking to take advantage of.

According to the EIA, only six refineries have been built in the last 20 years, out of a total of 139 active refineries in the country. Those six refineries represent about 182,000 BOPD of refining capacity, meaning the combined 105,000 BOPD of these new refineries will be significant.