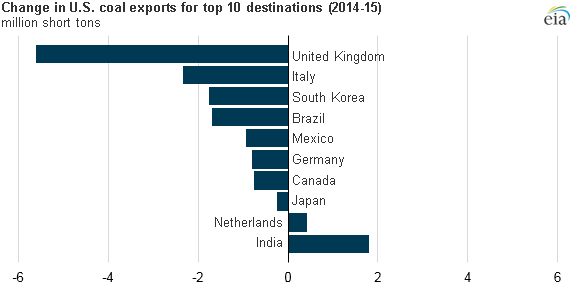

U.S. remains a net exporter of coal, exporting 74.0 MMst in 2015

Flows of coal in and out of the United States showed a net decline in 2015, with coal exports falling 23% while imports remained relatively unchanged. The U.S. remained a net exporter, however, with 74.0 million short tons (MMst) of net outflows on the year. 2015 marked the third consecutive year with declines in coal exports, exports 23 MMst lower than in 2014, and more than 50 MMst less than the record volume of exports in 2012, according to the EIA.

Lower mining costs, cheaper transportation costs, and favorable exchange rates (compared to the U.S. dollar) continue to increase the competitiveness of other coal-producing countries, such as Australia, Indonesia, Colombia, Russian and South Africa.

India saw the largest increase in coal exported from the U.S. in 2015. Coal exported from to India increased by nearly 2 MMst, bringing total U.S. market share to 9%, up 4% from 2014. Coal exports to Europe, a traditional destination for U.S. exports, fell by 14.6 MMst, or 28%.

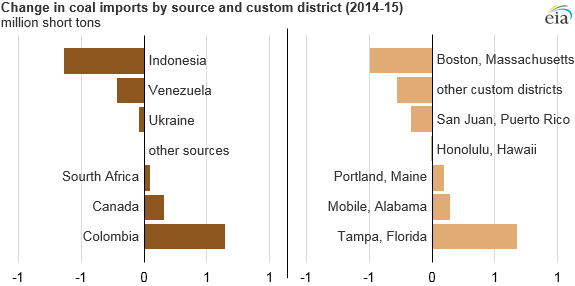

Coal imports hold steady at 11.3 MMst

Imports of coal into the U.S. remained unchanged from 2014 to 2015, even as exports rolled off. 85% of those imports were steam coal, which is primarily used to generate electricity. While the overall amount of coal imported last year did not change, the source of the did, as well as the port of entry, reports the EIA.

The biggest changes in the origin of U.S. imports involved imports from Colombia and Indonesia, which increased by 8% and decreased by 42%, respectively.

Tampa, Florida, overtook Mobile, Alabama, to become the largest recipient of coal imports in 2015. The closure of coal-fired electricity generators in New England led to a 41% (0.5 MMst) decrease in imports into the Boston, Massachusetts, customs district.

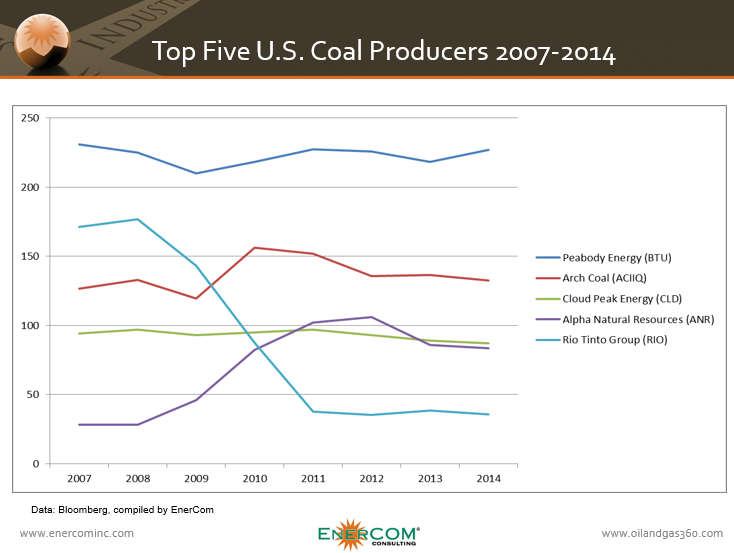

Coal production trending down

Overall coal production has been steadily trending downward since the shale revolution. The abundance of natural gas produced from hydraulic fracturing, along with more stringent environmental regulations, in the U.S. has increased the number of power plants using natural gas instead of coal.

The five largest coal producers in 2013, according to a report from the EIA, have all seen their production fall from peaks in the last seven years.

Coal miner bankruptcies are prolific

The largest coal producer in the U.S., Peabody Energy (ticker: BTU) has seen its production fall from a high of 231.1 MMst in 2007 to 227.2 MMst in 2014, according to information from Bloomberg. The largest decline among the group was seen by Rio Tinto (ticker: RIO), which saw production plummet from highs of 171.5 MMst in 2007 to just 35.9 MMst in 2014, moving it from second to fifth largest producer in the United States.

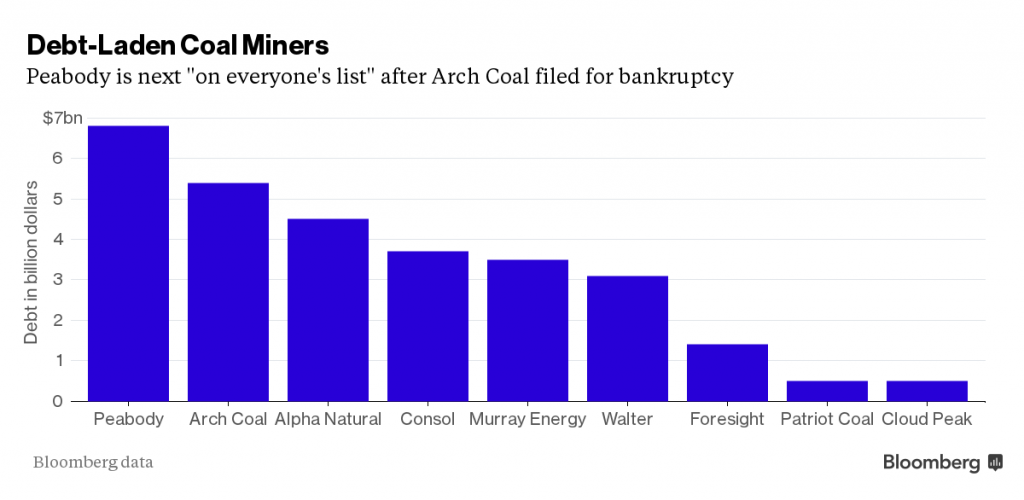

Patriot Coal Corp., Walter Energy Inc., Alpha Natural Resources Inc. and Arch Coal have all filed for bankruptcy in the past year, and according to Bloomberg, “investors are wondering if the biggest, Peabody Energy Corp., could be next.”