EIA: U.S. remains the largest hydrocarbon producer for the third straight year

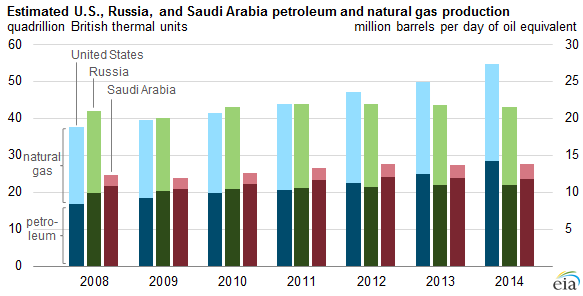

The United States remained the world’s top producer of petroleum and natural gas hydrocarbons in 2014, according to Energy Information Administration (EIA) estimates. U.S. petroleum production increased by 3 quadrillion Btu (1.6 MMBOPD) in 2014, while natural gas production increased by 5 quadrillion Btu (13.9 Bcf/d) over the past five years. Combined hydrocarbon output in the world’s second and third largest producers, Russia and Saudi Arabia, increased by 3 quadrillion Btu and 4 quadrillion Btu respectively in the same time period.

Since 2008, U.S. petroleum production has increased more than 11 quadrillion Btu, with dramatic growth in Texas and North Dakota. This trend continued last year despite oil prices falling by more than 50% since the second half of 2014. Total production increased to about 55 quadrillion Btu (about 27.5 MMBOPD) in 2014 from approximately 50 quadrillion Btu (25 MMBOPD) in 2013.

Russia reaches new record high

Production in Russia is split almost evenly between petroleum and natural gas, in energy content terms. Although Russian oil production continued increasing in 2014, natural gas production declined due to weak European economic growth and a warm 2013-2014 winter, says the report.

Crude oil production has continued to grow in Russia, largely thanks to state-owned giants Gazprom (ticker: OGZPY) and Rosneft (ticker: RNFTF). Russian production reached an average of 10.71 MMBOPD in March of this year, up 0.6% from February, setting a new record for post-Soviet levels of production. The previous monthly high was 10.67 MMBOPD, set in December 2014. Russia’s production record was set in 1988 when the country produced 11.41 MMBOPD while part of the Soviet Union.

Saudi Arabia raising prices in Asia

The world’s third largest producer, Saudi Arabia, differs from the U.S. and Russia in that the majority of its hydrocarbon production comes from petroleum. Saudi Arabia departed from precedents set in the past by deciding to maintain production despite global oversupply in 2014. As a result, the country’s total petroleum and natural gas hydrocarbon production was nearly unchanged from 2013, says the EIA.

Oil prices began to make a rally yesterday after U.S. benchmark crude West Texas Intermediate (WTI) fell below $50/bbl. This was due in part to increased confidence in healthy prices as state-owned Saudi Aramco increased its prices to Asian markets for the second straight month. The discount for Arab Light to Asia was cut by $0.30/bbl to $0.60/bbl less than the regional benchmark, while Arab Medium will sell at a $2.00 discount in May, according to the company.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.