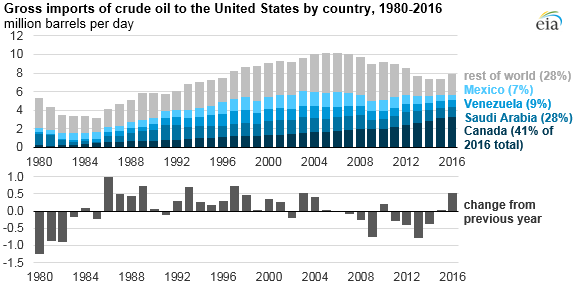

Imports still 22% below peak in 2005

U.S. imports of crude oil increased to 7.9 MMBOPD in 2016, according to a note released today by the EIA. Total crude oil imports increased by 514 MBOEPD last year, continuing the growth seen in 2015.

U.S. oil production decreased in 2016, as low oil prices discouraged activity. Despite the increase in 2016, gross imports of crude oil are still 22% below their peak of 10.1 MMBOPD in 2005.

The U.S. shale boom has displaced a large amount of these imports. Back in 2005, the U.S. was the world’s largest net importer of refined products and crude oil. U.S. exports of petroleum products have grown fivefold since then, making the United States the largest net exporter of refined products in the world.

Net imports of crude oil also increased last year, but saw smaller growth due to the growth in crude exports in 2016. Exports of crude oil grew by 12% last year, and were delivered to more destinations than ever before.

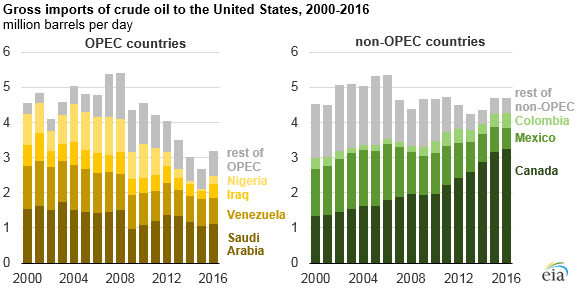

Whose oil is the U.S. importing?

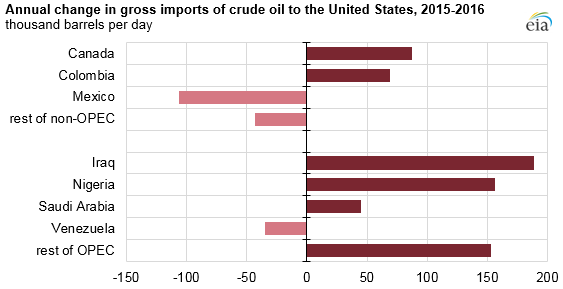

Canada remained the primary source of crude oil imports, providing more crude to U.S. refineries than all of OPEC combined. Imports from Canada have increased for the last seven years, as Canadian production from oil sands and other projects continue to accelerate.

Crude oil Imports from Mexico declined in 2016, continuing a six year slide. Mexican crude oil production is in decline, and may become a prime destination for U.S. exports. Most imports from Mexico are heavy crude, which are being replaced with heavy crude from Canada.

OPEC-produced crude up slightly for 2016, but lower than any year since 1973

Imports from OPEC increased in 2016, supplying 40% of all imports. This is higher than OPEC’s share in 2014 and 2015, but is lower than any other year since 1973, the first year when the EIA recorded country-specific import data.

Imports from Iraq and Nigeria grew more than any other country in 2016. Iraqi imports grew from 229 MBOPD to 418 BOPD.

Nigerian imports, after falling to record lows in 2015, grew to 210 MBOPD. According to the EIA, this is because Nigerian crude is of similar quality to crude from the Bakken. As Bakken and other production decreased, refineries looked to imports of light crude for replacements.