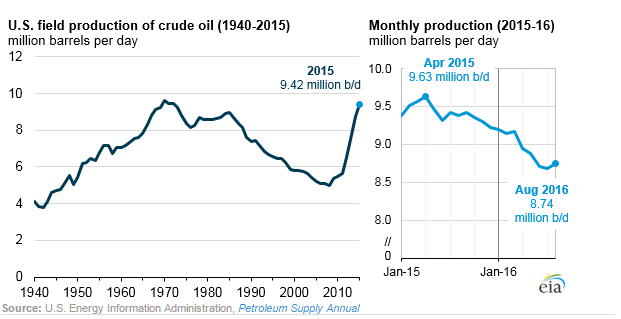

According to EIA’s recently released Petroleum Supply Annual, U.S. field production of crude oil increased in 2015 for the seventh consecutive year, reaching 9.42 million barrels per day in April of that year. This was the highest crude oil production level since 1972.

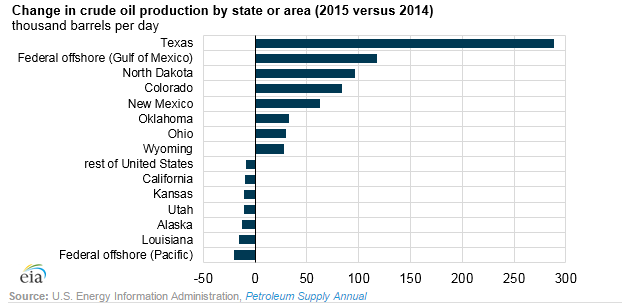

2015 production gains were highest in Texas, the Gulf of Mexico, and North Dakota, with these three regions accounting for 77% of the total U.S. increase.

Although annual production for 2015 grew, monthly U.S. crude oil production has declined since April 2015. Lower oil prices led to slower development activity, and production fell to 8.74 MMBOPD as of August 2016.

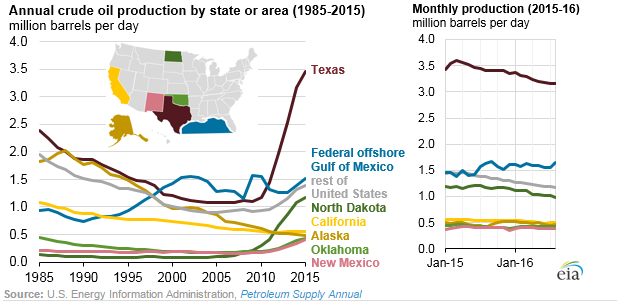

States or areas with the highest volumes of production also saw the largest gains in 2015. Texas is by far the largest crude oil-producing state, providing 3.46 MMBOPD in 2015, the highest level since at least 1981, EIA’s state-level production data began to be collected. Production in Texas grew by 289 MBOPD in 2015, the largest increase of any state.

The Federal Offshore region of the Gulf of Mexico was second in both absolute level and 2015 increase, growing by 118 MBOPDto reach 1.52 MMBOPD, the highest production in that area since 2010. The Federal Offshore is also the only region to see production increase since 2015 and is currently near record levels of 1.5+ MMBOPD seen in the early and late 2000s.

Production in North Dakota was third in both absolute level and 2015 increase, growing by 96 MBOPD to reach 1.18 MMBOPD, setting a new record for the state. Colorado was fourth in 2015 increase and eight in absolute level, with production increasing by 84 MBOPD.

California production has generally declined since 1985—when it was 1.08 MMBOPD—and averaged 0.55 MMBOPD in 2015, making it the fourth largest producer in the country. Alaska’s crude oil production, almost all of which is in the North Slope, fell for the thirteenth consecutive year, declining to 0.48 MMBOPD in 2015. The state is currently the fifth largest producer in the U.S.

New Mexico and Oklahoma were fifth and sixth in terms of growth and sixth and seventh in terms of absolute production, growing 63 MBOPD and 33 MBOPD, respectively, to produce 0.43 and 0.40 MMBOPD in 2015. New Mexico has benefited from increased production in the hot Delaware Basin while Oklahoma’s SCOOP and STACK plays in the Woodford Shale have drawn increased interest as well.