Assets: South of $5 Trillion; Liabilities: North of $21 Trillion

In February of each year, the Government Accountability Office puts out an updated snapshot of the books, written in plain language. Since Congress is working and this is an election year, it’s prudent to revisit the basic assets and liabilities graph published in the latest Financial Report of the United States Government – Fiscal Year 2015, quoted below, from the publication:

What We Own and What We Owe

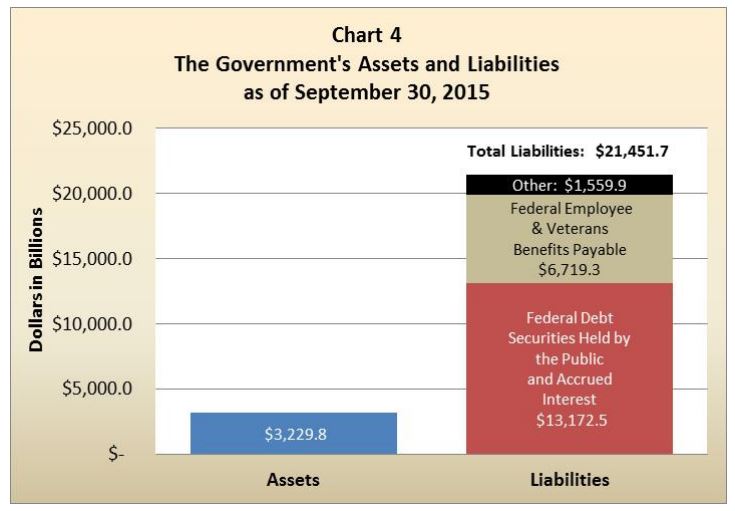

The chart summarizes what the Government owns in assets and what it owes in liabilities.

As of September 30, 2015:

- The Government held about $3.2 trillion in assets (mostly $1.2 trillion in net loans receivable (primarily student loans) and $893.9 billion in net property, plant, and equipment). Beyond these assets, other significant Government resources not reported on the balance sheet include stewardship assets, natural resources, and the Government’s power to tax and set monetary policy.

- Total liabilities ($21.5 trillion) consist mostly of: (1) $13.2 trillion in federal debt securities held by the public and accrued interest and (2) $6.7 trillion in federal employee and veteran benefits payable. The “public” consists of individuals, corporations, state and local governments, Federal Reserve Banks, foreign governments, and other entities outside the federal government.

- The Government also reports about $5.1 trillion of intragovernmental debt outstanding, which arises when one part of the Government borrows from another. For example, Government funds (e.g., Social Security and Medicare trust funds) typically must invest excess annual receipts in Treasury-issued federal debt securities, creating trust fund assets and Treasury liabilities. These amounts are included in the financial statements of investing agencies and Treasury, respectively, but offset each other when consolidated into the government-wide financial statements. Thus, they are not reflected in Chart 4. Debt held by the public plus intragovernmental debt equals gross federal debt, which, with some adjustments, is subject to a statutory debt ceiling (“debt limit”).

- When delays in raising the debt limit occur, as they did during both fiscal years 2014 and 2015, Treasury implements “extraordinary measures,” on a temporary basis, to enable the Government to protect the full faith and credit of the United States by continuing to pay the Nation’s bills. o Increasing or suspending the debt limit does not increase spending or authorize new spending; rather, it permits the Government to continue to honor pre-existing commitments. Congress suspended the debt limit during FY 2014 and FY 2015: from October 17, 2013 through February 7, 2014; and again from February 15, 2014 through March 15, 2015. In November 2015, the debt limit was again suspended through March 15, 2017. The debt limit was last raised to $18.1 trillion in March 2015.

As budget deficits continue to occur, the Government will have to continue to borrow from the public. Instances where the debt held by the public increases faster than the economy for extended periods can pose challenges to the sustainability of current fiscal policy.