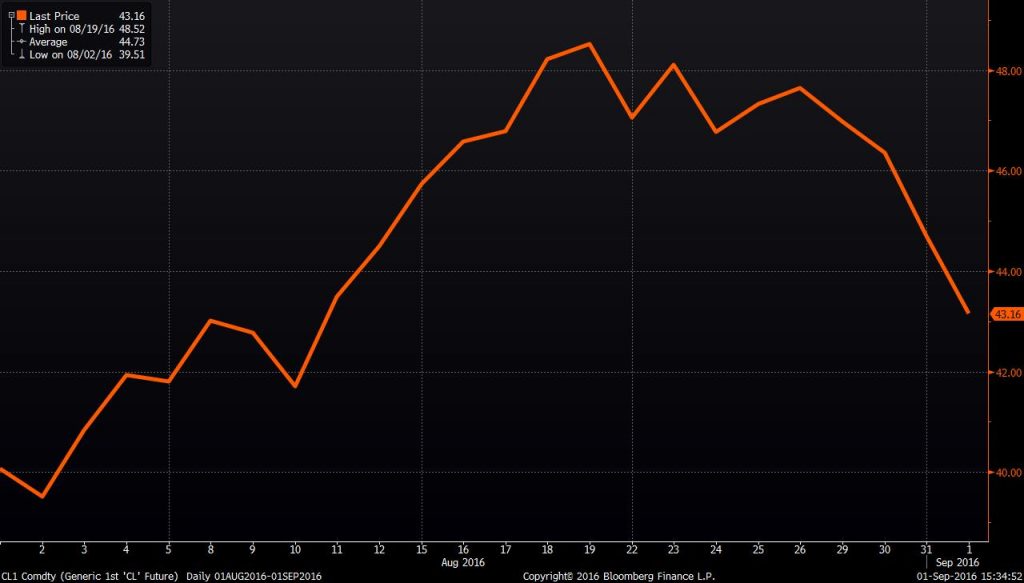

Oil prices fall as crude storage climbs

Oil fell more than 3% Thursday despite hopes that OPEC might freeze production. Investors were more concerned with this week’s crude oil stockpile build than talk from OPEC after the EIA announced a 2.3 MMBO build in storage for the week ended August 26.

Both Brent and WTI crude oil prices climbed more than $2 from August 15 to August 19 as talks of a new OPEC production freeze gave markets hope that the group might take action to help stabilize prices. Speculation has lost its bullish steam, however, even as Saudi Foreign Minister Adel Al-Jubeir said Thursday that OPEC and non-OPEC oil producers were moving toward a common position on output.

“Talk is cheap,” Harry Tchilinguirian, global head of commodity markets strategy at BNP Paribas, told the Reuters Global Oil Forum. “Reality will set in, and the market will realize that the agendas of various OPEC producers are not aligned.”

$45.44 oil for 2016

A Reuters poll of 34 analysts and economists forecast Brent would average $45.44 per barrel in 2016, slightly lower than last month’s forecast of $45.51. The change was the first downward revision in the forecast in six months, and came from continued concerns that output is not slowing down fast enough for demand to absorb.

“Basically it’s a retest of that breakout,” Andreas Wunder at Alphatrade Asset Management in Austin, Texas, said, noting the move lower appeared as forceful as the one higher.

Drillers’ efficiencies could cap prices

Even as prices decline this week, the greater stability in the value of oil is allowing U.S. operators to get back to work, Wunderlich Director of Equity Research and Chief Market Strategist Art Hogan told Oil & Gas 360®.

“As stability comes back, production starts to come back online, and we start to see some increased capex. That’s happening because of [price] stability, but it’s also happening because North America is becoming much more productive,” he said.

The improved efficiency of U.S. drillers could cap the future rise of oil prices, however. With each step up in price, more oil plays become economic to produce, thus meeting or exceeding demand, and keeping prices from rising sharply.

“Supply sets a ceiling on price,” said CIBC Capital Markets Managing Director and Chief Economist Avery Shenfeld. “When we get a recovery in price, we might see increasing U.S. supply that matches demand growth,” but this will keep downward pressure on the price of crude oil.

“It’s about finding what price we need to incentive the growth in supply that a growing global economy actually needs,” said Shenfeld.