Drilling continues to pick up in the U.S. as oil remains above $50 per barrel

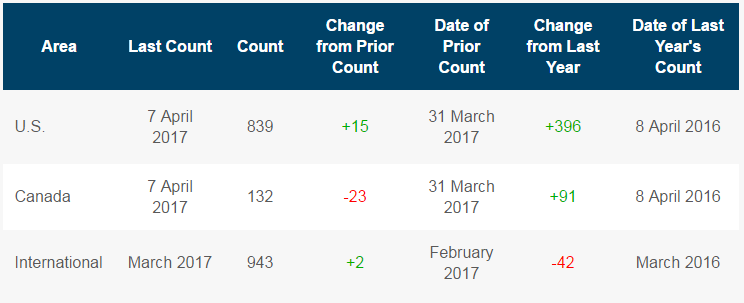

Baker Hughes Industries (ticker: BHI) released the North American rig count Friday showing yet another week of increased drilling activity in the United States. The total rig count reached 839 for the week ended April 7, 2017, up 15 from last week.

The majority of the rig count continues to drill for crude oil with 672 of the total rigs targeting liquids, according to BHI, up 10 from last week. The remaining five rigs added to the count this week were all drilling for natural gas bringing the total number targeting that commodity to 165.

Rig counts are rising steadily as oil prices remain near $50 per barrel. The total rig count is now 396 more than at this time last year, representing an increase of 89% year-over-year as U.S. operators take advantage of higher oil prices and lower breakeven costs.

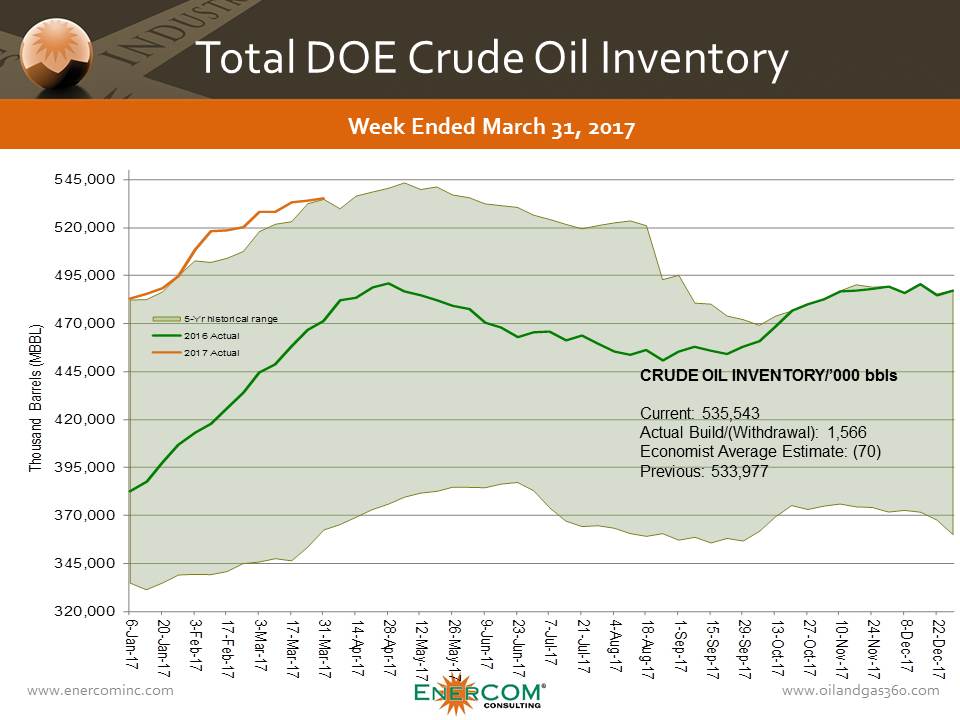

Higher prices were brought on in large part thanks to a decision by OPEC and non-OPEC producers to cap production, but the increased value of oil is spurring on more drilling in the U.S., giving some cause for concern that any cuts from OPEC may simply be replaced by U.S. operators. Crude oil inventories remained above the five-year historical average in the United States for the week ended March 31, 2017, but even that news combined with increased drilling did not stop WTI from making gains today.

WTI and international crude oil benchmark Brent both closed higher today. WTI gained more than 1%, finishing the day at $52.24, while Brent crude closed at $55.21, up $0.32 from the previous day’s close.

The majority of drilling activity continues to take place in the Permian Basin, which reported 12 additional rigs this week bringing its total to 331 rigs, roughly 39% of the total rig fleet. The count in the Permian is more than double where it was this time last year when just 142 rigs were drilling in the region.