Tight oil, gas will dominate production over next 30 years

The EIA released its Annual Energy Outlook today, examining the long-term prospects for oil, gas and other energy sources in the U.S. The Annual Energy Outlook makes predictions through 2050, unlike the Short Term Energy Outlook which only covers the next two years.

The EIA predicts total energy consumption in the U.S. will likely grow modestly in the next thirty years, but low economic growth could reverse this trend. Slow growth would mean efficiency efforts advance more rapidly than demand, and consumption would fall slightly. While high, low, and base case economic growth are relatively close, with annual GDP growth of 2.6%, 1.5% and 2.0%, respectively, the cumulative effects of different growth rates can lead to a significant difference in energy demand in 2050.

Electric power, industrial demand will grow significantly

The EIA expects that natural gas and renewables will continue to grow significantly, continuing recent trends. The elimination of the Clean Power Plan means coal is not expected to decline, but should remain relatively flat in the next thirty years. Electric power generation and industrial usage are the largest-growing consumers of energy, as the EIA expects petrochemicals and other industrial demand will grow significantly in the coming years.

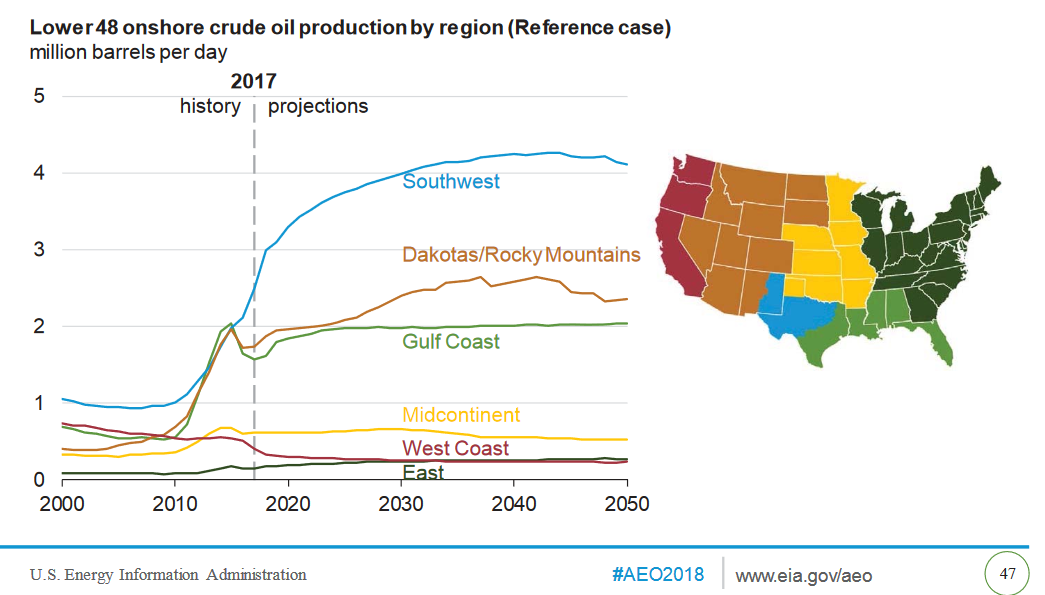

Oil output expected to peak at approximately 11.5 MMBOPD

The EIA expects that U.S. shale will continue to grow in almost every case, with only a sustained low oil price or low available oil and limited technology advancement slowing the shale renaissance. Either way, tight oil will account for the majority of U.S. oil production. U.S. oil output is expected to peak at around 11.5 MMBOPD, as the move to less productive areas caps further growth potential.

The Permian will remain king, with eastern New Mexico and western Texas oil output rising to more than 4 MMBOPD. The EIA predicts the Dakotas and Rockies will exceed the Gulf Coast, as the productivity in the Eagle Ford declines with limited prime drilling locations remaining.

LNG growth will make U.S. net energy exporter

In most cases, the continued expansion of shale production will make the U.S. a net exporter of energy in about five years.

This will primarily be driven by the massive expansion of U.S. LNG projects, as five projects are currently under construction and numerous others are proposed. This would depend greatly on oil price and available gas, though. A low oil price would make developing LNG significantly less attractive, as LNG prices are often tied to oil prices.

Marcellus gas will fuel LNG exports

The gas to fuel LNG projects will be plentiful, though, as the EIA predicts the Marcellus will grow significantly in coming years. The eastern portion of the U.S. already supplies nearly half of the country’s gas and will continue to expand. Further improvements in technology have a massive effect on productivity, as plays like the Marcellus and Haynesville have extensive undrilled acreage. Other sources of gas will be further squeezed out of the market, as the Marcellus continues to asset its dominance.

Electricity fuel mix depends on gas availability, price

The electricity mix in the U.S. is heavily dependent on oil and gas supply assumptions. The EIA’s base case predicts natural gas and renewables will continue to grow significantly, dominating power in the U.S. Other sources, like coal and nuclear power will remain essentially flat. If the shale revolution dries up, on the other hand, oil and gas prices will rise, making natural gas power less economically attractive. In this case, renewables will grow rapidly, becoming by far the largest source of electricity in the U.S. This scenario would also benefit coal, as rising gas prices makes coal plants more economically attractive.

Plentiful shale gas would have the opposite effect, leading to a massive expansion in natural gas power. This would not significantly blunt the growth of renewables, but would instead further replace coal power.