Unit Corporation (ticker: UNT) is a diversified energy company engaged through its subsidiaries in the exploration for and production of oil and natural gas, the acquisition of producing oil and natural gas properties, the contract drilling of onshore oil and natural gas wells, and the gathering and processing of natural gas. The company celebrated its 50th Anniversary in 2013.

Recent Financial Results

Unit Corp. announced net income of $56.9 million ($1.17 per share, up 11% quarter-over-quarter) in its Q1’14 earnings release on May 8, 2014. Total revenues were $388 million and are 8% higher from the previous quarter. Unit’s average production during Q1’14 was 46.5 MBOEPD (45% liquids) – a decrease of 4% from the previous quarter due to the winter weather and mechanical problems on nine wells that have since been repaired. Unit’s liquids makeup has increased 155% since UNT began its liquids-based approach in 2009.

In a conference call with analysts and investors, Brad Guidry, Executive Vice President of Exploration at Unit Corporation, said, “Even though the first quarter did get off to a slow start due to the previously discussed issues, our drilling and completion program is accelerating during the second quarter and third quarters, which should lead to strong growth in the second half of 2014 and on into 2015.”

UNT’s New SOHOT Play is Sizzlin’

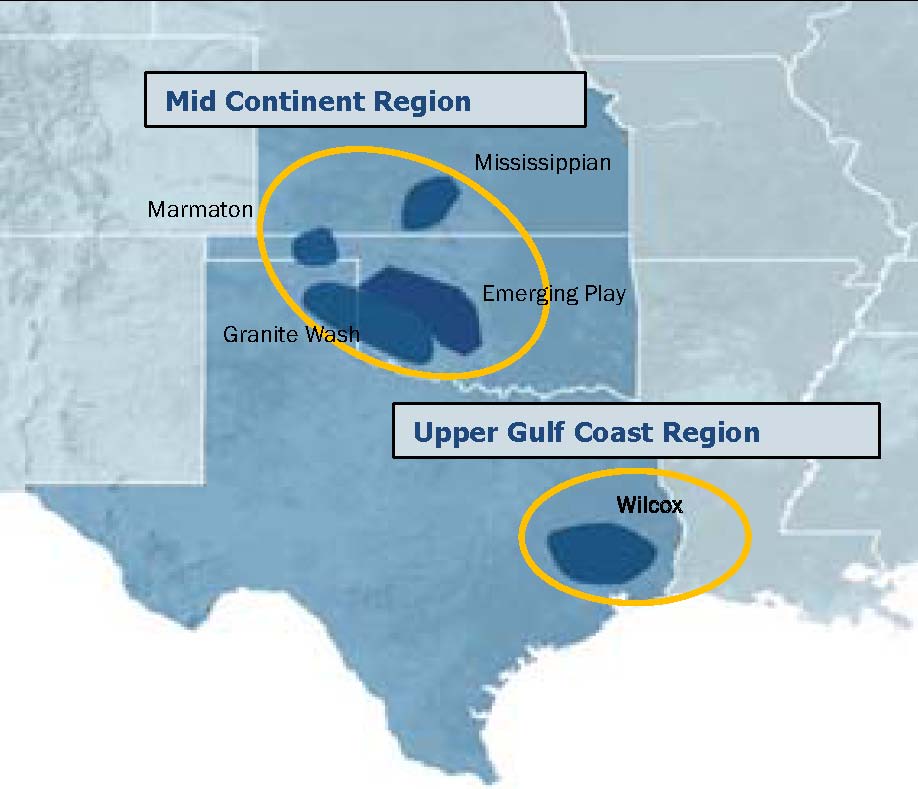

Source: UNT March 2014 Presentation

Unit identified the SOHOT as a new core asset. The region holds four to six potentially stacked pay sands with the Marchand and Medrano formations being its primary focus. The Marchand is roughly 11,000 feet of true vertical depth and consists of 70 feet of pay. Well costs are an estimated $7 million with estimated ultimate recoveries of 300 to 500 MBOE. One well flowed at a 30-day rate of 1,100 BOEPD (90% oil) and Unit is participating as a non-operator with three other Marchand wells producing at similar rates.

“There is no question the well looks very strong,” said Guidry in the conference call. “We’re very comfortable in the range we’re looking at. Certainly, we’re hopeful we’ll be more towards the top end of the range, but with only 30 days in there, it’s just too early to predict.”

The Medrano sand is shallower (9,800 feet TVD) and is gas-based with an average thickness of 150 feet. Well costs are estimated at $4.2 to $5.0 million apiece with EURs of 3.0 to 4.5 Bcfe. UNT’s pilot well produced a 30-day rate of 4.6 MMcfe/d.

Unit Corp. holds 50,560 gross acres (12,810 net) in its new core play and has identified 175 to 200 gross drilling locations. Two rigs will be added to the play in June and will increase the rig count to three. The company will drill six Marchand wells and seven Medrano wells in the remainder of 2014 under its current program. Capital expenditures have been increased to $82 million (49% higher than initially planned).

Production will Play Catch-up with Operational Re-Focus

The company plans on increasing focus in the Granite Wash and SOHOT (Southern Oklahoma Hoxbar Oil Trend) while dialing back its intensity in the Mississippian play. Due to the play switch and reduced production from winter, Unit has reduced its 2014 production guidance to 13% to 15% from 15% to 18%. Forecasted production, assuming the 16.7 MMBOE produced in fiscal 2013, would place 2014 production at 18.9 to 19.4 MMBOE. The company produced 4.3 MMBOE in Q1’14.

UNT’s 2014 capital budget remains intact at $718 million as expenditures are required to move rigs to its new areas. Larry Pinkston, President and Chief Executive Officer of Unit Corporation, said, “We continue to maintain a conservative financial profile, which provides ample flexibility as we continue to grow our three business segments.”

Drilling Segment

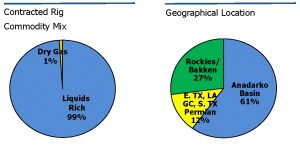

Source: UNT March 2014 Presentation

The company completed its first BOSS rig in the quarter and anticipates building three more prior to Q3’14. All four are contracted out to third party operators and management expects a fifth to be constructed late in the fiscal year. Unit has 118 rigs in its fleet and 73 under contract, with 30 of those under long term agreements. Utilization rates were at 57%, the highest since Q3’12. Management said five more rigs are scheduled to begin operations shortly and will bring the utilization rate for rigs above 1,000 horsepower to 87.5%. Four 3,000 horsepower rigs were sold in the quarter and nine have been sold in the last 12 months.

Midstream Division

UNT recorded $12.2 million in operating profit from its midstream segment and sold a record amount of liquids per day. UNT maximized its propane recovery by recovering all liquids to take advantage of the supply shortage. The company says limited capital investment is required going forward as 46 new wells were tied to sales in the quarter (up from 31 in Q4’13).

“Operating profit for the quarter benefitted from strong NGLs pricing, particularly propane, and we are now operating in full ethane recovery mode at all of our processing facilities,” said Pinkston in the call. “Our goal is to position this segment for sustainable growth with less exposure to commodity price volatility.”

Financial Structure

Unit holds $645.8 million in long term debt and has no borrowings under its credit facility. Unit’s debt to market cap ratio is 22% – a favorable number compared to its peers. In EnerCom’s 88-company E&P database, the median debt to market cap ratio is 40%. Unit has the fifth lowest ratio when compared to 25 other U.S. mid-cap operators. Its operating expenses, on a trailing twelve month basis, are $2.21 compared to a median of $3.11 from its mid cap competitors.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.