Voluntary effort to restructure debt

Vanguard Natural Resources (ticker: VNR) filed for chapter 11 bankruptcy relief on February 2nd in a voluntary move to restructure its debt.

The restructuring concerns several debt issues due 2019, 2020, and 2023. The restructuring, if completed, is expected to reduce the company’s debt by $708 million. The reorganization will include a fully committed $19.25 million equity investment by the holders of 2023 debt, and a $255.75 million rights offering that is fully backstopped by the consenting holders of the 2019 and 2020 debt.

Vanguard business operations will continue through restructuring period

Vanguard has filed several motions which will allow the company to maintain its operations during the restructuring process. This will ensure that wages and royalties are paid, and drilling and production operations are still funded.

Vanguard has obtained $50 million debtor-in-possession financing underwritten by Citibank, JPMorgan Securities, and Wells Fargo. This financing, combined with cash from operations, will fund business operations during the chapter 11 process.

In the company’s release Scott W. Smith, President and CEO commented: “The depressed commodity price cycle which has persisted over the past two years, combined with a tightened regulatory environment for senior debt providers, has resulted in a situation where, despite reducing our total debt by over $500 million in 2016, we find ourselves unable to meet the obligations of our current credit facility. With a successful restructuring of our balance sheet, Vanguard will be better positioned to weather this new lower for longer commodity price environment, while also improving our long-term financial security and better position us for long-term success.”

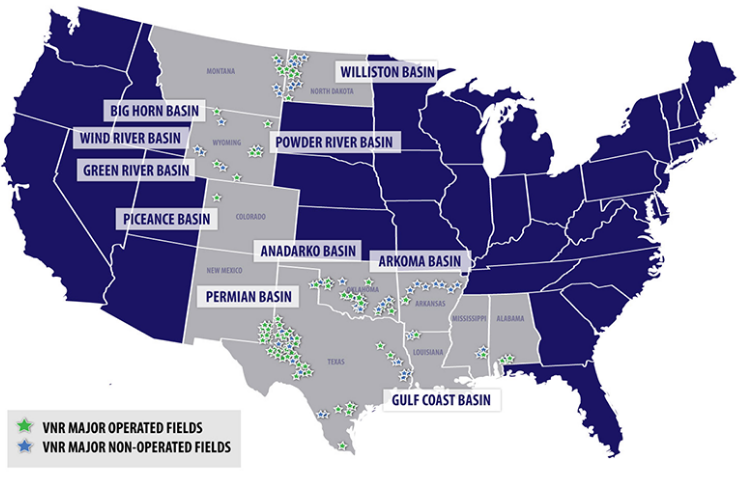

In one of several previous moves to pay down debt, Vanguard agreed in March to sell its assets in the SCOOP/STACK area in Oklahoma. This sale raised $280 million for reducing borrowing under the company’s reserve-based credit facility.