Vanguard closes on LRR Energy for $541 million

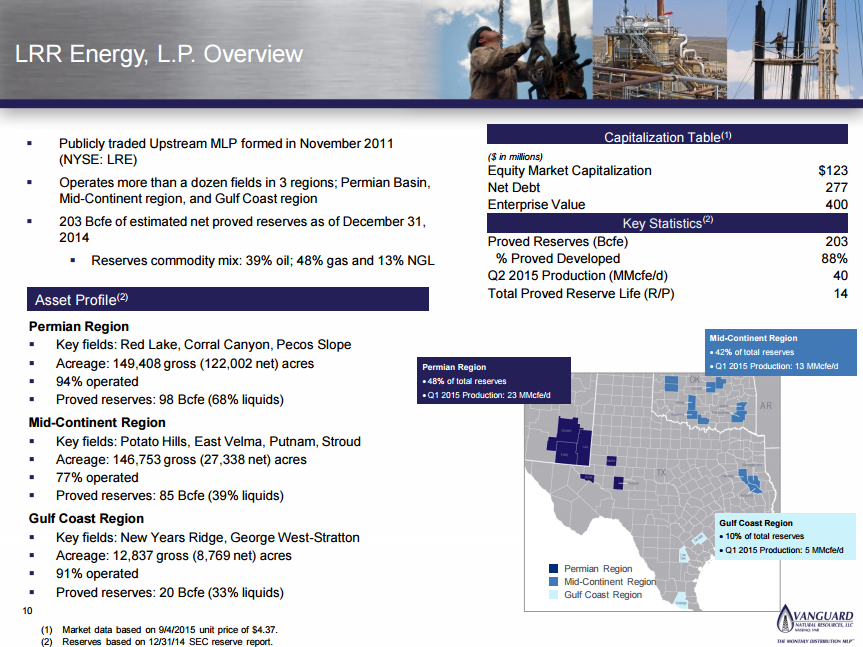

Vanguard Natural Resources (ticker: VNR) announced today the closing of the previously announced deal to acquire LRR Energy. According to the company’s press release, a subsidiary of Vanguard merged into LRR Energy and, at the same time, Vanguard acquired LRE GP, the general partner of LRR Energy (collectively LRE) for total consideration of approximately 15.45 million Vanguard common units and the assumption of $290 million in debt. As a result of the transaction, LRE is not a wholly owned subsidiary of Vanguard.

When the deal was first announced on April 20, Vanguard offered a total consideration of $251 million in VNR common units. The consideration to LRE unitholders was valued at $8.93 per LRR Energy common unit based on Vanguard’s closing price on April 20, a 19% premium to LRE’s ten day volume weighted average price. Total consideration, including debt which was announced as $290 million in the October 5 press release, amounts to $541 million.

Vanguard to acquire Eagle Rock later this week

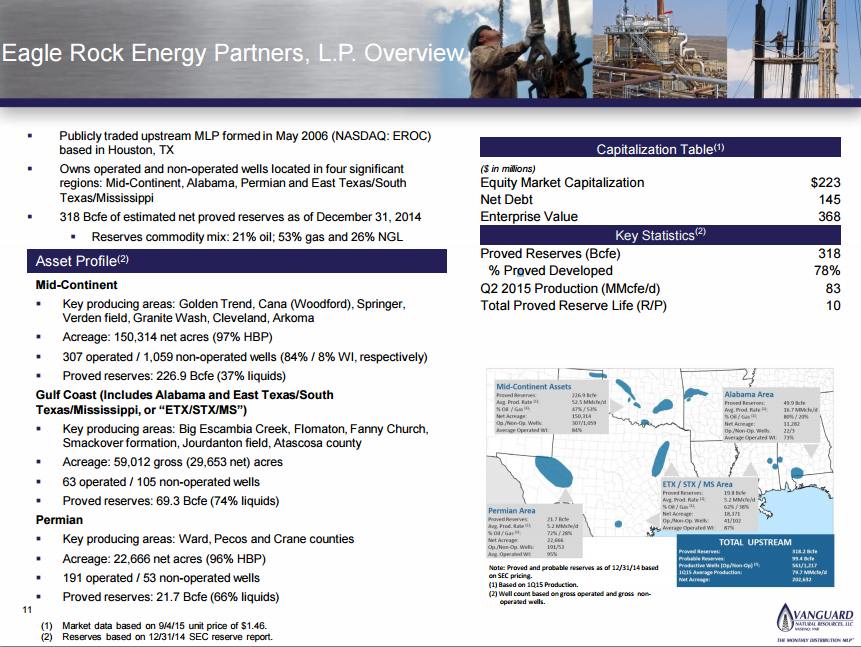

In addition to the acquisition of LRE, Vanguard announced today that it plans to close on its acquisition of Eagle Rock Energy (ticker: EROC) on October 8 as well. A press release from the companies announced that the unitholders of both companies had approved the transaction the same day that Vanguard closed on LRE.

The companies announced in May that Eagle Rock would merge with Vanguard for total consideration of $474 million in Vanguard common units and the assumption of Eagle Rock’s net debt of $140 million. The transaction will be a tax-free unit-for-unit transaction with an exchange ratio of 0.185 Vanguard common units per Eagle Rock common unit. The consideration to be received by Eagle Rock’s unitholders is valued at $3.05 per Eagle Rock common unit based on Vanguard’s closing price as of May 21, 2015, representing a 24% premium to Eagle Rock’s closing price on May 21, 2015.

Mergers strengthen Vanguard’s position

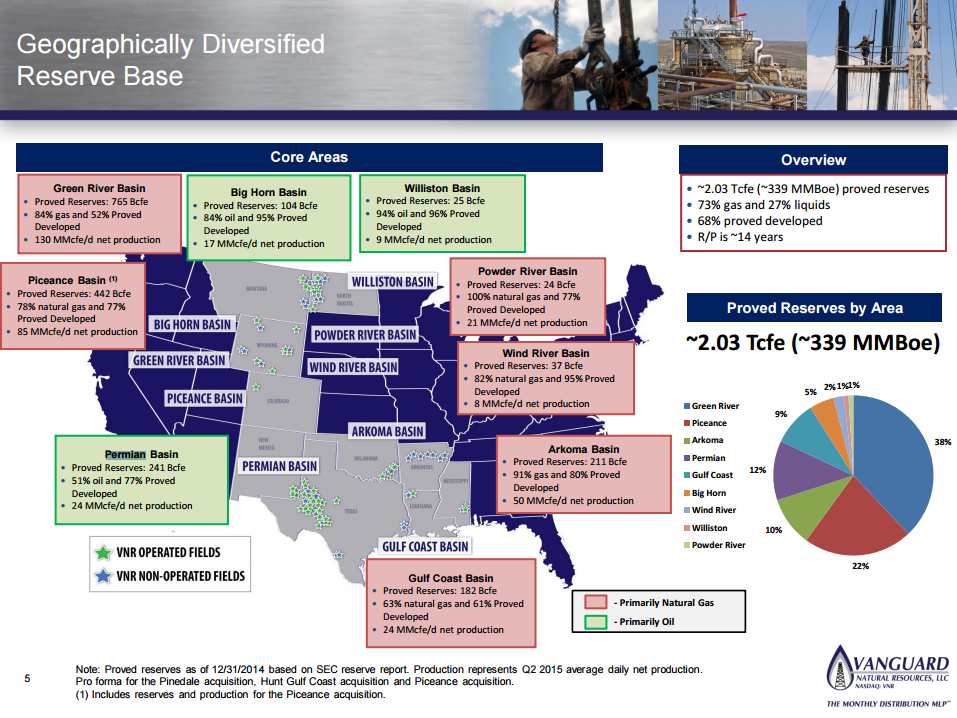

The news of Vanguard’s two acquisitions this week were seen in a largely positive light by analysts covering the MLP. The LRE acquisition adds to Vanguard’s Permian and Arkoma Basin positions where the company previously had 241 Bcfe and 211 Bcfe of proved reserves previously. The assets are long-life, and low-decline making them a good fit for Vanguard’s upstream MLP structure.

EROC’s assets were not viewed as being as good a fit for an upstream MLP, but were still strong. “While we are not as excited about the high decline production profile of EROC’s SCOOP/STACK acreage (25%+) in an upstream MLP, the transaction does provide VNR with its third area for organic growth potential,” said a note from Wunderlich Securities. The note went on to mention that SCOOP generates some of the highest rate of return wells in the country.

The deal also offered VNR attractive hedges, Brian Brungardt of Stifel told Oil & Gas 360. “EROC is significantly less levered, this plus the LRE deal should improve the balance sheet.” This sentiment was echoed by a number of analysts who viewed the deal as an attractive way to improve Vanguard’s leverage. Kevin Smith with Raymond James expects Q4’15 debt/EBITDA to be reduced to roughly 4.4x, down notably from VNR’s Q1’15 ratio of 5.6x, while James Dobson of Wunderlich Securities was modeling a ratio of 4.0x for 2016. Hedges cover about 84%/88% of oil/gas production in 2015 and 50%/67% in 2016, according to Wunderlich.

The analysts also believed that the deal would not hurt Vanguard with its approaching debt redetermination. “Operations should remain relatively unchanged,” Brungardt told OAG360 when what the acquisitions might mean for the company’s borrowing base. Wunderlich believes Vanguard should have about $400 million in liquidity following the closing of the deals, “[leaving] VNR better positioned for an increase than a decrease.”

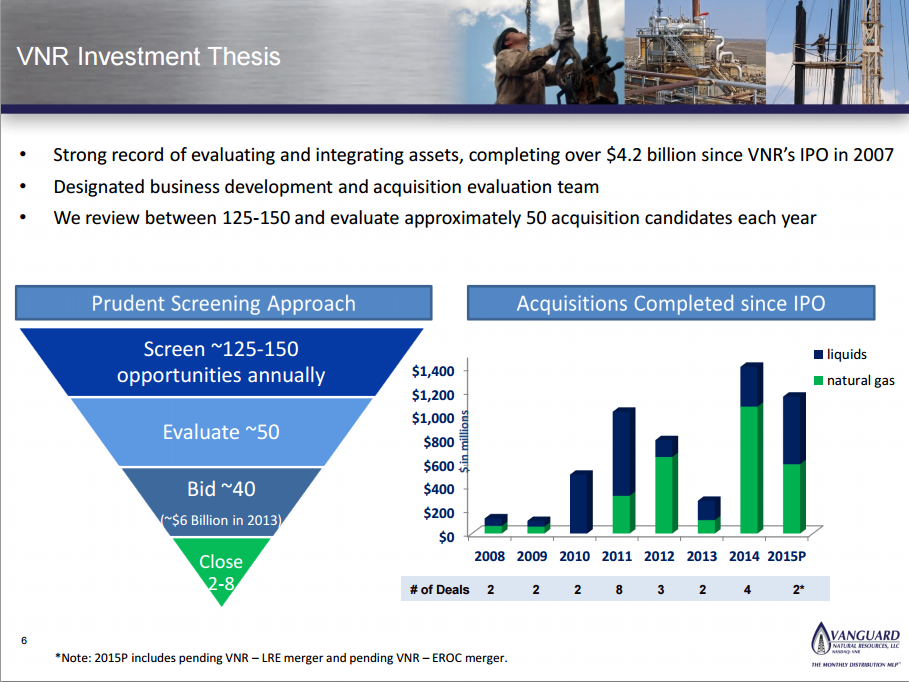

The rapid succession of acquisitions is part of Vanguard’s strategy to close on 2-8 deals per year, according to a company presentation. Brungardt mentioned that Vanguard management had done a good job of replacing reserves in the current price environment.

During the company’s Q2 conference call, management was asked about what could happen to the yield. Vanguard CEO Scott Smith responded that the company is “serious about maintaining distributions.”

Wunderlich anticipates an 11.8% yield for Vanguard, while Raymond James expects a 10.8% yield for its 2016 distribution forecast. Brungardt told OAG360 that he had modeled a 20% reduction in yield, but noted that the lower distribution should allow the company to exit the year cash flow-neutral.

The improved credit metrics from acquiring LRE and EROC, along with the increased reserves should allow Vanguard to resume distribution growth moving forward notes Dodson. Raymond James believes Vanguard will continue to have “One of the most secure distributions in the upstream MLP space.”

In EnerCom’s MLP Weekly, Vanguard Natural Resources has a slightly below average yield at 17.1%, compared to a group median of 21.8%, but also had a lower debt-to-market cap ratio of 266%, compared to a group median of 294%.