Next Best Bid Behind Vantage was $335 Million; Bids Exceed Rice Energy’s “Stalking Horse” Offer of $200 Million

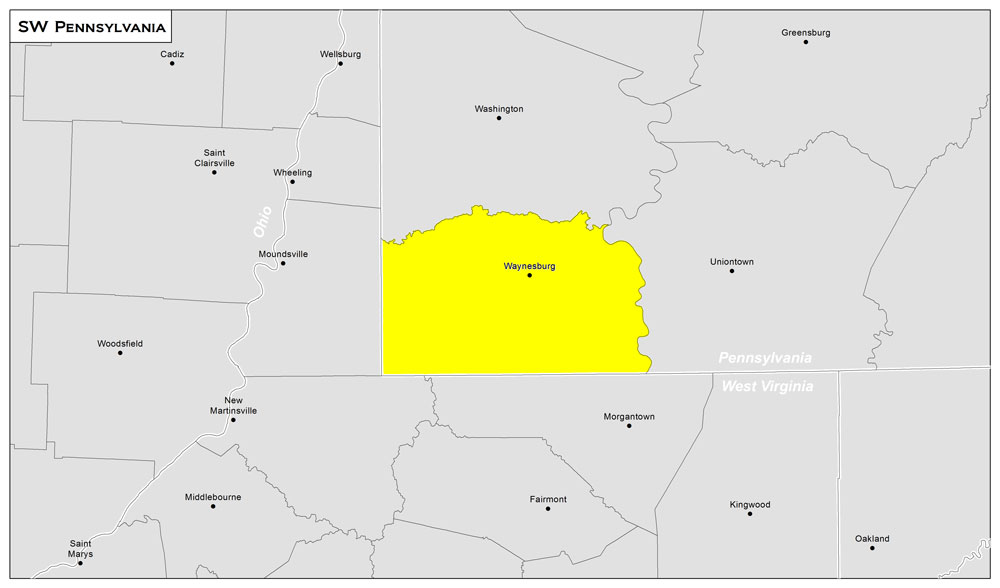

Bankrupt coal giant Alpha Natural Resources (ticker: ANRZQ) announced today that Colorado-based privately held gas producer Vantage Energy was the successful bidder for its subsidiary Pennsylvania Land Resources’ oil and natural gas assets (PLR assets) in Southwest Pennsylvania.

Vantage’s winning cash bid of $339.5 million “far exceeded the previously announced stalking horse bid of $200 million for those same assets,” Alpha said in a press release. The reference is to Appalachian gas producer Rice Energy’s (ticker: RICE) April 12, 2016, bid to acquire for the coal miner’s Marcellus and Utica assets in central Greene County, Pennsylvania for $200 million in cash.

Here is how Rice announced its intentions in a press release on April 12. The release from Rice was entitled “Rice Energy Enters into Stalking Horse Asset Purchase Agreement to Acquire 27,400 Net Undeveloped Marcellus Acres.”

“Through the chapter 11 proceeding, Alpha is conducting a sale of these assets pursuant to section 363 of the Bankruptcy Code. Rice Energy and Alpha intend for the proposed asset purchase agreement to constitute a “stalking horse bid” in accordance with the bidding procedures approved by the bankruptcy court; however, Rice Energy’s bid protections, such as certain break up fees and expense reimbursements, are subject to court approval. If Rice Energy’s “stalking horse bid” is approved by the bankruptcy court, Alpha may be required to hold an auction for these assets before we can consummate the acquisition. Consummation of the acquisition would be subject to Rice Energy’s being selected as the successful bidder in any such auction and bankruptcy court approval.”

Vantage’s higher bid to the tune of $339.5 million as part of the bankruptcy court’s asset auction process put an end to Rice’s $200 million offer.

How the Bidding Worked

On February 8, 2016, Alpha filed a motion with the bankruptcy court requesting approval of procedures to govern a marketing and sale process for Alpha’s core assets. On March 11, 2016, the court entered the Bidding Procedures Order approving the bidding and sales process.

Under the Bidding Procedures Order, interested potential purchasers were required to submit “Qualified Bids” for any of the Debtors’ assets by May 9, 2016.

On April 12, 2016, Rice Energy Inc. announced that its affiliate, Rice Drilling B, LLC, had entered into a stalking horse asset purchase agreement with Pennsylvania Land Resources to acquire the PLR Assets, subject to higher and better offers from competing, qualified bidders.

On May 16, 2016, the debtors conducted an auction among five qualified bidders for the sale of the PLR Assets. At the conclusion of the auction, the $339.5 million cash bid submitted by Vantage Energy Appalachia II, LLC was designated as the Successful Bid.

The debtors also designated a bid with a cash purchase price of $335 million as the Next Best Bid. U.S. Bankruptcy Court approval is required before the agreed-upon acquisition by Vantage Energy can close. A hearing on this matter is currently scheduled for May 26, 2016. Alpha was advised on this transaction by Jackson Kelly as corporate counsel, Jones Day as restructuring counsel, and Rothschild Inc. as Investment Banker.

“While we were not surprised with the interest the PLR Assets generated from operators in the region, the strategic sale of these assets will only help to maximize the value of the estate for the benefit of all stakeholders,” said Alpha’s Chairman and CEO Kevin Crutchfield in a press release. “We continue to forge ahead toward the final phase of our restructuring.”

Coal Companies Filing Bankruptcy

Alpha Natural Resources, which ranks among the largest coal producers in the U.S., fell into financial trouble as did many other coal producers. It was brought on by the rapidly escalating move from coal to natural gas for U.S. electricity generation, slowing demand in China and other regions, and tough requirements on burning coal by the EPA and the Clean Power Plan. Alpha filed a voluntary petition to reorganize under Chapter 11 in August 2015. Alpha and its affiliate mining operations in Virginia, West Virginia, Kentucky, Pennsylvania and Wyoming mine and ship metallurgical coal to the steel industry and thermal coal to electricity generators on five continents.

Some Background on Alpha’s Natural Gas Assets

In July 2015, Alpha announced that its wholly-owned subsidiary, Pennsylvania Services Corporation (PSC), had acquired the 50% interest in its natural gas exploration and production joint venture, Pennsylvania Land Resources Holding Company, LLC (PLR), owned by EDF Trading Resources, LLC (EDFTR).

The $126 million transaction made PSC the sole owner and operator of the venture, according to the Alpha press release, and “allows Alpha to expand and control a highly economic natural gas development program composed of over 25,000 net acres and associated infrastructure in the Marcellus Shale.”

The release said that “EDFTR and PSC initially formed the PLR joint venture in May 2013 to exploit a large, concentrated Marcellus Shale gas resource in Greene County, Pennsylvania. The concentrated acreage position is considered to be in the “core of the core” of the Marcellus Shale, one of the most profitable natural gas plays in the United States, and located adjacent to some of the most productive wells in the basin to date. PLR’s large, contiguous acreage position will allow efficient development of the resource with long laterals, maximizing both well productivity and returns. Significant existing pipeline capacity located adjacent to or crossing PLR’s leased acreage also provides strong transportation optionality.

In its statement Brian Sullivan, Alpha’s Executive Vice President and Chief Commercial Officer, said they expected to drill the first pad within 30 days, with an estimated 4 wells completed by the first quarter of 2016. “PLR’s concentrated position when it entered into the joint venture in May 2013 was 12,000 net acres, which has since more than doubled. Additionally, two well pads have been constructed with a total of 14 permitted wells. Alpha said the current lease position gave access to 50 drilling locations.

PLR also controls rights to develop gas resources located at other depths, including the deeper Utica Shale, on the majority of the leased acreage and several adjoining properties, according to the Alpha statement.

Vantage Energy

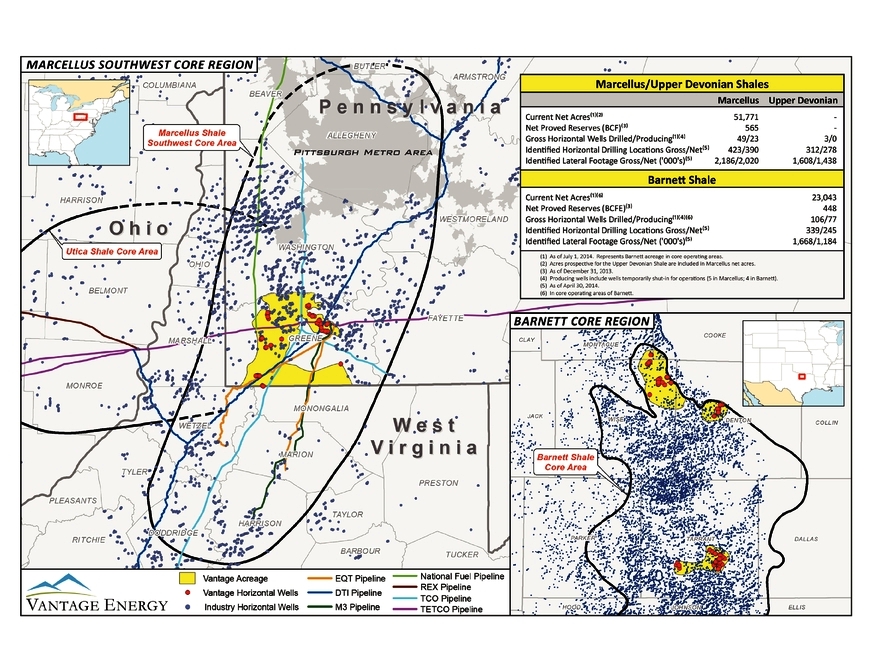

Vantage states on its website that its focus is on the Marcellus Shale, where it has “a concentrated acreage position in what we believe to be the core of the play in Greene County, Pennsylvania. Additionally, we have a sizable position in what we believe to be the core of the Barnett Shale.” Vantage says it made its initial entry into the Barnett Shale in 2007 and the Marcellus Shale in 2010.

On September of 2014, Vantage announced its IPO, in which it was offering 23,550,000 shares of its common stock, at an anticipated initial public offering price between $24.00 and $27.00 per share. However on Sept. 24 the company withdrew the offering, citing poor market conditions. A link to the July 7, 2014, S-1 Registration Statement is available here.

In June of 2015, Bloomberg reported that Vantage was considering a sale of the company, but said it could not cite its sources.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.