Vermilion Energy Inc. (ticker: VET) has entered into an arrangement to acquire all of the issued and outstanding common shares of a private southeast Saskatchewan producer for total cash consideration of $90.8 million. The purchase price will be funded from Vermilion’s existing credit facilities, the company said in a press release.

The deal is expected to close on or about Feb. 15, 2018.

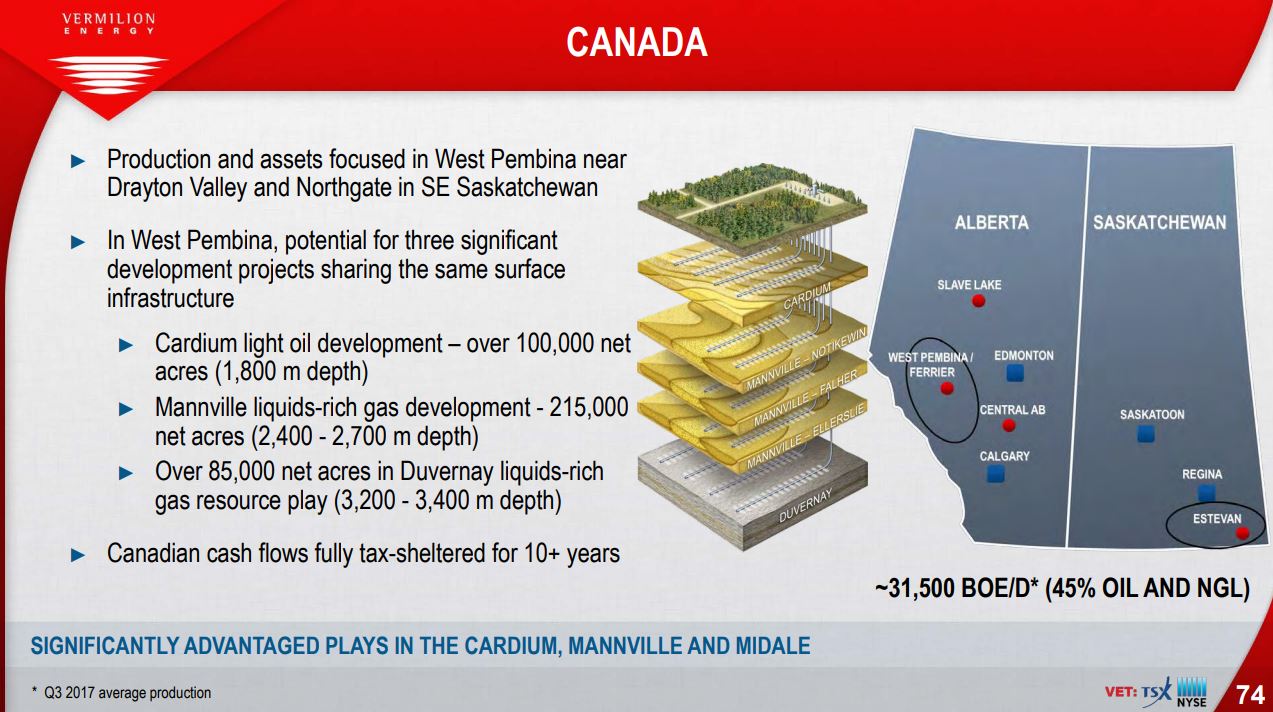

Vermilion said the acquisition is comprised of high netback, low base decline, light oil producing fields in the Sinclair and Fertile areas, straddling the Saskatchewan/Manitoba border, approximately 55 km northeast of Vermilion’s existing operations in southeast Saskatchewan.

The assets include approximately 42,600 net acres of land (approximately 100% WI), three oil batteries and associated pipelines, along with the necessary water infrastructure to facilitate the existing seven waterflood projects and initiate up to eight additional waterflood projects.

The assets produced approximately 1,150 bbl/d of 40° API oil during Q4 2017, sourced from the Bakken/Three Forks formation. All of the current production and infrastructure will be 100% owned and operated by Vermilion.

Total proved plus probable (2P) reserves that attributed to the assets on Dec. 31, 2017 include 6.7(1) MMboe (100% crude oil) – based on an independent evaluation by GLJ Petroleum Consultants Ltd. The assets demonstrate a low base decline rate of approximately 15% at present and are expected to have even lower decline rates over time.

Based on the provided figures, each acre was purchased for about $2,131. The company paid $78,956 per flowing BOPD, based on the Q4 2017 production numbers provided. Additionally, Vermilion paid $13.55 per BOE of 2P reserves.

Areas under waterflood have decline rates of less than 10% with certain areas of flat or increasing production. Approximately 45% of the production comes from active waterflood projects, leaving significant opportunity to expand the waterflood.

As a result of the acquisition, and based on a mid-Feb. closing date, Vermilion is revising its 2018 production guidance to between 75,000 and 77,500 BOEPD (from 74,500 to 76,500 BOEPD, previously). The company is also increasing its 2018 capital budget to $325 million (from $315 million, previously) to reflect additional capital activity on these assets planned for the second half of the year.

| (1) | Estimated total proved and proved plus probable reserves attributable to the Assets as evaluated by GLJ Petroleum Consultants Ltd. in a report dated January 12, 2018 with an effective date of December 31, 2017, in accordance with National Instrument 51-101 – Standards for Disclosure for Oil and Gas Activities of the Canadian Securities Administrators, using the GLJ (2018-01) price forecast (the “GLJ Report”) |

EnerCom Dallas conference presenter details

Vermilion Energy will be presenting at the EnerCom Dallas investment conference, Feb. 21-22 at the Tower Club in downtown Dallas. Institutional investors, portfolio managers, financial analysts, CIOs and other investment community professionals who invest in the energy space should register now.