Walmart Leads Retail Week. Crude Claws Back. Dollar Dips, Gold Bullish

Bill Baruch, president and founder of Blue Line Futures, previews E-mini S&P, Gold, Crude, and Treasury markets and today’s economic report calendar. Follow his reports Monday-Friday on MoneyShow.com and short Midday Markets video.

Bill Baruch’s Midday Market Minute for August 16 here.

China and U.S. are set to resume trade talks and the markets react

Bill Baruch’s FX Rundown short video for the evening of August 15 here.

E-mini S&P (September)

Wednesday’s close: Settled at 2821.25, down 19.75.

Fundamentals: Wednesday’s weakness opened the door to a buying opportunity for those who were patiently cautious. Our narrative all week long has been cautiously optimistic; get out of the forest to see the trees, this market is in a strong uptrend. However, we emphasized Wednesday the high probability of a washout. Today the S&P and NQ are up, let’s call it, 0.5%.

China announced last night that it will send low-level delegates to the U.S to meet with parallel representatives at the end of this month. The U.S and China trade spat has provided a lot of pain across commodities and foreign equity markets, but we have even referred to it as a tailwind to U.S equity markets.

However, we have also said that the official start of a trade war would be the implementation of the third wave of tariffs worth $200 billion on Chinese goods. Until this happens, uncertainty surrounding trade keeps the Federal Reserve from tightening policy at a faster pace, a bullish factor for equities. This third wave would likely be announced sometime in September. China is getting ahead of this by reopening talks.

Shifting gears to earnings, they are the lifeblood of stocks. On Sunday’s Tradable Events this Week we pointed to how the Retail sector will be extremely important this week in helping to keep the focus domestic. Just about everything except Apple, Consumer Goods, Healthcare and of course Utilities lost ground Wednesday.

The SPDR S&P Retail ETF (XRT) lost 2.7% despite a strong read on July Retail Sales. Home Depot (HD) held green on great earnings finishing up 0.46%. This morning Walmart (WMT) is leading the way with a blowout quarter and is up 10%. The XRT has snapped back 1% premarket. This is Retail’s chance to demonstrate leadership in its most important week of each quarter.

Technicals: Wednesday brought some great buy opportunities for those who were patient, especially on that high-volume spike down that stayed afloat at the 2803 low. We talked about this as well as resistance at the 2820 area in the Midday Market Minute; emphasizing Wednesday was a day to put on your trading cap. Wednesday’s close above 2817.50-2821 neutralized the weakness and last night’s move back above 2826.25 has reinvigorated our immediate-term Bullish Bias. Still, we maintain major three-star resistance at ...

Today’s economic calendar

Weekly U.S. jobless claims: 212,000, a decrease of 2,000 from the previous week's revised figure.

Philly Fed Manufacturing: growth slowed in the region in August.

July New Residential Building Permits: 1,311,000. Housing Starts: 1,168,000. Housing Completions: 1,188,000.

Crude Oil (October)

Wednesday’s close: Settled at 64.46, down 0.87.

Fundamentals: Crude Oil lost 2.8% Wednesday and finished 4.8% from Tuesday’s swing high. Yes, Crude Oil is slipping and failing but it can get up. Wednesday’s EIA report was bearish and headlined by Crude inventories gaining 6.805 mb. This was nearly double the already bearish estimate from the API survey and the EIA confirmed a large build of 1.643 mb at Cushing.

Lastly, production was unchanged in the lower 48 states but was added in Alaska. Despite refinery capacity at 98%, a massive weekly increase in imports of 1.34 mbpd bloated inventories.

Positive news on the U.S and China trade front last night worked to support price action across commodities into this morning. We maintain that Crude Oil is trending higher and Wednesday’s sharp drop was also a byproduct of the global risk-off sentiment. All in all, if Crude battles at these levels and can finish the week on a strong note it would be a tremendous signal of its resilience and longer-term bullish trend.

Technicals: Crude traded to a new swing low of 63.89 last night but has clawed back steadily into this morning trading as much as a dollar from the overnight low. Let’s be honest, the bears are in the driver’s seat and especially so with price action below ...

Gold (December)

Wednesday’s close: Settled at 1185 down 15.7.

Fundamentals: Wednesday, overnight and in fact this entire week has been the washout that the metals complex needed so bad. Lower price action, and that at a high-velocity is exactly what a market needs to rinse and refresh.

There has been a tremendous amount of pain to the downside and that high-velocity move lower is longs calling it quits. Gold continued to slip late last night to a low of 1167.1 but has bounced as much as $20 this morning in the first signs of a potential bottom we have had in a long time.

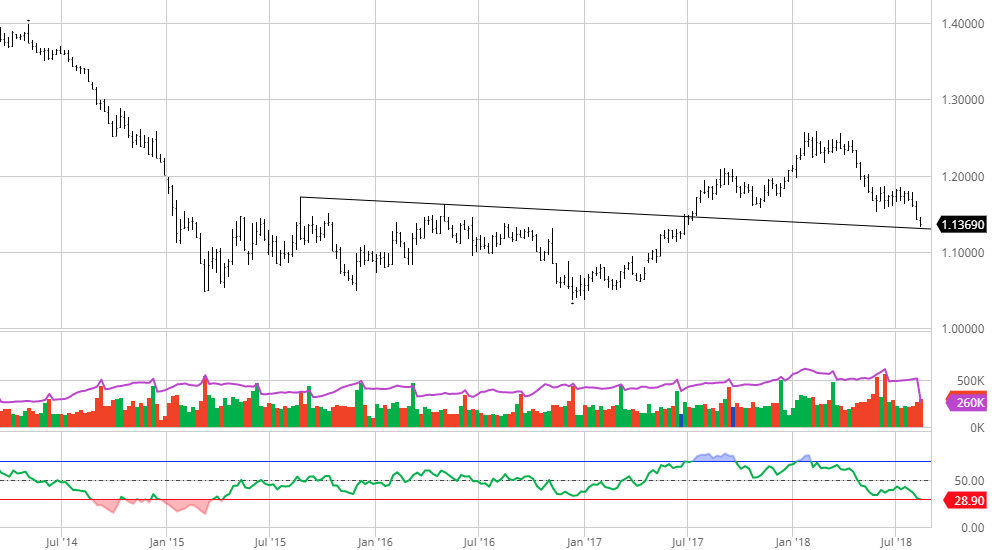

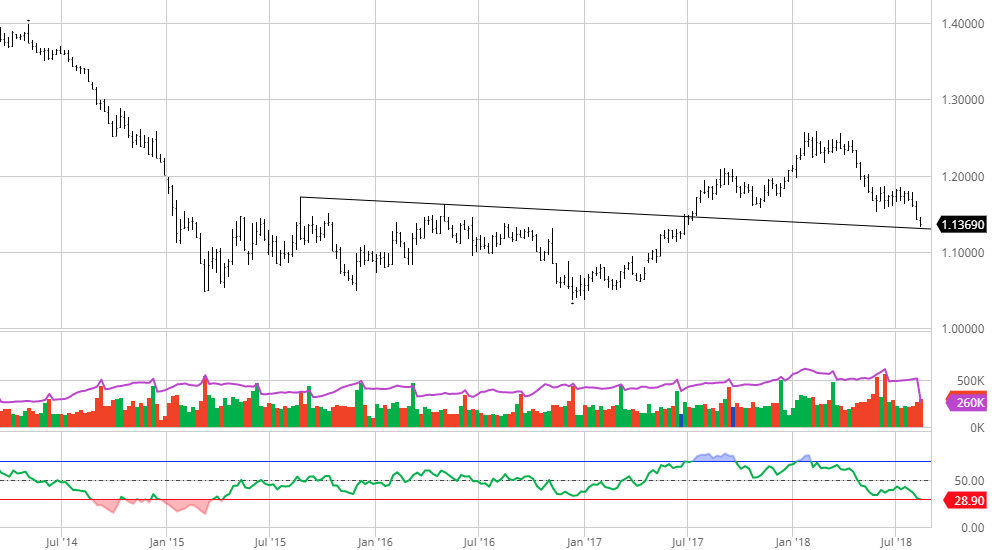

Wednesday, the U.S dollar (USD) ripped against the Chinese yuan (CNY) to the highest level since early January 2017. This five-week span at the end of 2016 and early 2017 was highest level since 2008. It has retreated more than 0.5% this morning on news that China will send low-level delegates to the U.S to discuss trade. This is heightened reflection on how Gold is not a safe haven and instead trading like a base metal. To put this currency move into perspective, the Dollar Index (DXY) was at 103 at that time in January 2017. Today, the Dollar Index is at 96.50.

The euro (EUR) is testing tremendous long term-support at 1.1340 and sentiment in the euro according to options is the most bearish since April 2017, right when the euro began its rip-your-face off rally. Is this the low in Gold? We do not know that. But what feel confident that there is a capitulation taking place with short positions at a record level.

Technicals: We are back to being Bullish Gold and as we told those at the trade desk Wednesday, this sort of flush is the time to buy. Of course, we recommend managing risk and there are a number of ways we do this with clients at the trade desk, call us at 312-278-0500. Today, we must see Gold maintain a close above major three-star support at ...

Please sign up for a free trial at Blue Line Futures to view our entire technical outlook and proprietary bias and levels.