|

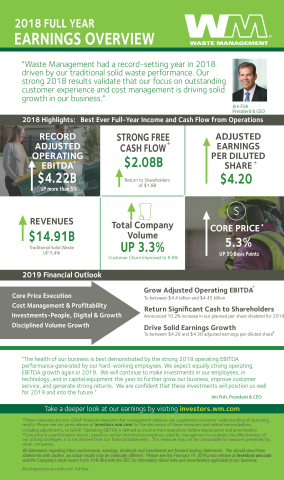

Waste Management Announces Fourth Quarter and Full-Year 2018 Earnings HOUSTON

The Company Generates Its Best Ever Full-Year Income and Cash Flow from

Operations

Waste Management, Inc. (NYSE: WM) today announced financial results for

its quarter ended December 31, 2018. Revenues for the fourth quarter of

2018 were $3.84 billion, compared with $3.65 billion for the same 2017

period. Net income for the quarter was $531 million, or $1.24 per

diluted share, compared with net income of $903 million, or $2.06 per

diluted share, for the fourth quarter of 2017.(a) On an

adjusted basis, earnings per diluted share were $1.13 for the fourth

quarter of 2018, compared with $0.85 for the fourth quarter of 2017.(b)

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190214005431/en/

2018 Full Year Earnings Overview (Graphic: Business Wire)

For the full year 2018, the Company reported revenues of $14.91 billion,

compared with $14.49 billion for 2017. Earnings per diluted share were

$4.45 for the full year 2018 compared with $4.41 for the full year 2017.

On an adjusted basis, earnings per diluted share were $4.20 for the full

year 2018 versus $3.22 for the full year 2017.(b)

Jim Fish, President and Chief Executive Officer of Waste Management,

commented, “2018 was a record-setting year for Waste Management, driven

by our traditional solid waste performance. We grew operating EBITDA by

more than 5%, which led to an increase in net cash provided by

operations of more than 12% to $3.57 billion.(c) This growth

translated into free cash flow of over $2 billion and the most cash

returned to our shareholders in over a decade.(b) Our strong

2018 results validate that our focus on outstanding customer experience

and cost management drives solid growth in our business.”

KEY HIGHLIGHTS FOR THE FOURTH QUARTER AND THE FULL YEAR 2018

Profitability

-

Operating EBITDA was $1.14 billion for the fourth quarter of 2018 and

$4.27 billion for the full year. Adjusted operating EBITDA was $1.09

billion for the fourth quarter of 2018 and $4.22 billion for the full

year. On a year-over-year basis, adjusted operating EBITDA grew $73

million, or 7.2%, in the fourth quarter and $210 million, or 5.2%, for

the year. Adjusted operating EBITDA margin improved 50 basis points in

the fourth quarter and 60 basis points for the full year.(b)

Revenue Growth

-

In the fourth quarter, revenue growth was driven by strong yield and

volume growth in the Company’s collection and disposal business, which

contributed $203 million of incremental revenue on a year-over-year

basis. Revenue from the Company’s recycling business increased $18

million in the fourth quarter of 2018. For the full year, yield and

volume growth in the Company’s collection and disposal business

contributed $693 million of incremental revenue. This was partially

offset by a decline in revenue from the Company’s recycling business,

which fell by $197 million year-over-year, due to lower market prices

for commodities net of contamination fees.

-

Core price was 5.6% in the fourth quarter of 2018, compared to 4.8% in

the fourth quarter of 2017. For the full year, core price was 5.3%,

compared to 4.8% in 2017.(d)

-

Internal revenue growth from yield for collection and disposal

operations was 2.3% for both the fourth quarter and the full year,

compared with 2.2% in the fourth quarter of 2017 and 2.0% for the full

year 2017.

-

Traditional solid waste internal revenue growth from volume was 3.1%

in the fourth quarter of 2018, or 2.4% on a workday-adjusted basis.

Total Company internal revenue growth from volume, which includes

recycling and other businesses, was 4.7% in the fourth quarter, or

4.0% on a workday adjusted basis. For the full year 2018, traditional

solid waste internal revenue growth from volume was 2.9% and total

Company volume was 3.3%.

Recycling

-

Operating EBITDA in the Company’s recycling line of business improved

modestly when comparing the fourth quarter of 2018 with the prior year

period as the Company executed on its contamination fee strategy. For

the full year, operating EBITDA in the Company’s recycling line of

business declined nearly $90 million when compared to the full year

2017.

Cost Management

-

The Company focused on managing SG&A to reduce costs as a percentage

of revenue to below 10% for the first time since 2005. As a percent of

revenue, SG&A expenses were 9.6% in the fourth quarter of 2018,

compared to 10.1% in the fourth quarter of 2017. For the full year, as

a percentage of revenue, SG&A expenses were 9.7%, compared to 10.1%

for the full year 2017.

Free Cash Flow & Capital Allocation

-

Net cash provided by operating activities was $912 million in the

fourth quarter compared to $792 million in the fourth quarter of 2017.

For the full year, net cash provided by operating activities was $3.57

billion, compared to $3.18 billion for the full year of 2017. The

increase in operating cash flow for the quarter and the year reflects

the benefits of strong operating income growth and lower cash taxes,

which were partially offset by the payment of approximately $65

million in bonuses to the Company’s hard-working front-line employees.

-

Capital expenditures were $454 million in the fourth quarter, compared

to $528 million in the fourth quarter of 2017. For the full year,

capital expenditures were $1.69 billion, compared to $1.51 billion for

the full year of 2017. The year-over-year increase was in line with

expectations as the Company invested a significant portion of its tax

savings in facility improvements, natural gas fueling infrastructure

and expanding its natural gas fleet.

-

Free cash flow was $560 million, including $102 million in asset

sales, in the fourth quarter, compared to $344 million, including $80

million in asset sales, in the fourth quarter of 2017. For the full

year, free cash flow was $2.08 billion, including $208 million in

asset sales, compared to $1.77 billion, including $99 million in asset

sales, for the full year of 2017.(b)

-

The Company returned $451 million to shareholders in the fourth

quarter comprised of $197 million in dividends and $254 million in

share repurchases. For the full year, the Company returned $1.8

billion to shareholders comprised of $802 million in dividends and

$1.0 billion in share repurchases.

-

The Company spent $466 million on acquisitions of solid waste

businesses during 2018, $118 million of which was spent in the fourth

quarter.

Income Taxes

-

The Company’s effective tax rate for the fourth quarter of 2018 was

19.3%. On an adjusted basis, the tax rate was 21.5%. For the full

year, the Company’s effective tax rate was 19.0%. On an adjusted

basis, the tax rate was 22.1%.(b)

2019 OUTLOOK

The Company announced the following regarding its financial outlook for

2019:

Profitability

-

Adjusted operating EBITDA is expected to grow $185 to $235 million to

between $4.40 and $4.45 billion for the full year.(b)

-

Adjusted earnings per diluted share for 2019 is expected to be between

$4.28 and $4.38.(b)

Revenue Growth

-

Core price is expected to be greater than 4.0% for 2019. Internal

revenue growth from yield on the collection and disposal business is

expected to be greater than 2.0%.

-

Internal revenue growth from volume is expected to be around 2.0%.

Free Cash Flow & Capital Allocation

-

Free cash flow for 2019 is projected to be between $2.025 and $2.075

billion.(b)

-

Capital expenditures are expected to be in the range of $1.65 to $1.75

billion, with proceeds from asset sales projected to be $50 to $100

million.

-

The Board of Directors has indicated its intention to increase the

dividend by $0.19, or 10.2%, to $2.05 per share on an annual basis,

for an approximate annual cost of $870 million. The Board must

separately approve and declare each dividend.

-

The Board of Directors has authorized management to repurchase up to

$1.5 billion of the Company’s common stock. This authorization is not

limited to 2019 and does not expire.

Income Taxes

-

The Company expects its full year adjusted effective tax rate to be

approximately 24.0%.(b)

Fish concluded, “The health of our business is best demonstrated by the

strong 2018 operating EBITDA performance generated by our hard-working

employees. We expect equally strong operating EBITDA growth again in

2019. We will continue to make investments in our employees, in

technology, and in capital equipment this year to further grow our

business, improve customer service, and generate strong returns. We are

confident that these investments will position us well for 2019 and into

the future.”

|

|

|

|

|

|

(a)

|

|

For purposes of this press release, all references to “Net

income” refer to the financial statement line items “Net income

attributable to Waste Management, Inc.”

|

|

|

|

|

|

|

|

|

|

|

|

(b)

|

|

Adjusted earnings per diluted share, adjusted net income,

adjusted operating EBITDA, adjusted operating EBITDA margin,

adjusted tax rate, and free cash flow are non-GAAP measures.

Please see “Non-GAAP Financial Measures” below and the

reconciliations in the accompanying schedules for more information.

|

|

|

|

|

|

|

|

|

|

|

|

(c)

|

|

Management defines operating EBITDA as GAAP income from

operations before depreciation and amortization; this measure may

not be comparable to similarly-titled measures reported by other

companies.

|

|

|

|

|

|

|

|

|

|

|

|

(d)

|

|

Core price is a performance metric used by management to

evaluate the effectiveness of our pricing strategies; it is not

derived from our financial statements and may not be comparable to

measures presented by other companies. Core price is based on

certain historical assumptions, which may differ from actual

results, to allow for comparability between reporting periods and

to reveal trends in results over time.

|

|

|

|

|

|

|

|

The Company will host a conference call at 10:00 AM (Eastern) February

14, 2019 to discuss the fourth quarter and full year 2018 results.

Information contained within this press release will be referenced and

should be considered in conjunction with the call.

The conference call will be webcast live from the “Events &

Presentations” section of investors.wm.com. To access the conference

call by telephone, please dial (877) 710-6139 approximately 10 minutes

prior to the scheduled start of the call. If you are calling from

outside of the United States or Canada, please dial (706) 643-7398.

Please utilize conference ID number 6496795 when prompted by the

conference call operator.

A replay of the conference call will be available on the Company’s

website investors.wm.com

and by telephone from approximately 1:00 PM (Eastern)February 14, 2019

through 5:00 PM (Eastern) on February 28, 2019. To access the replay

telephonically, please dial (855) 859-2056, or from outside of the

United States or Canada, dial (404) 537-3406 and use the replay

conference ID number 6496795.

ABOUT WASTE MANAGEMENT

Waste Management, based in Houston, Texas, is the leading provider of

comprehensive waste management environmental services in North America.

Through its subsidiaries, the Company provides collection, transfer,

disposal services, and recycling and resource recovery. It is also a

leading developer, operator and owner of landfill gas-to-energy

facilities in the United States. The Company’s customers include

residential, commercial, industrial, and municipal customers throughout

North America. To learn more information about Waste Management, visit www.wm.com

or www.thinkgreen.com.

FORWARD-LOOKING STATEMENTS

The Company, from time to time, provides estimates of financial and

other data, comments on expectations relating to future periods and

makes statements of opinion, view or belief about current and future

events. This press release contains a number of such forward-looking

statements, including but not limited to all statements under the

heading “2019 OUTLOOK” and all statements about future business

performance, growth, investments and returns. You should view these

statements with caution. They are based on the facts and circumstances

known to the Company as of the date the statements are made. These

forward-looking statements are subject to risks and uncertainties that

could cause actual results to be materially different from those set

forth in such forward-looking statements, including but not limited to,

increased competition; pricing actions; failure to implement our

optimization, growth, and cost savings initiatives and overall business

strategy; failure to identify acquisition targets and negotiate

attractive terms; failure to consummate or integrate such acquisitions;

failure to obtain the results anticipated from acquisitions;

environmental and other regulations; commodity price fluctuations;

international trade restrictions and tariffs; disposal alternatives and

waste diversion; declining waste volumes; failure to develop and protect

new technology; significant environmental or other incidents resulting

in liabilities and brand damage; weakness in economic conditions;

failure to obtain and maintain necessary permits; technology failures or

cybersecurity incidents; labor disruptions; impairment charges; and

negative outcomes of litigation or governmental proceedings. Please also

see the Company’s filings with the SEC, including Part I, Item 1A of the

Company’s most recently filed Annual Report on Form 10-K, for additional

information regarding these and other risks and uncertainties applicable

to our business. The Company assumes no obligation to update any

forward-looking statement, including financial estimates and forecasts,

whether as a result of future events, circumstances or developments or

otherwise.

NON-GAAP FINANCIAL MEASURES

To supplement its financial information, the Company, in some instances,

has presented adjusted earnings per diluted share, adjusted net income,

adjusted operating EBITDA, adjusted operating EBITDA margin, adjusted

tax rate and free cash flow, and has also provided projections of

adjusted earnings per diluted share, adjusted operating EBITDA, adjusted

tax rate, and free cash flow; these are non-GAAP financial measures, as

defined in Regulation G of the Securities Exchange Act of 1934, as

amended.

The Company reports its financial results in compliance with GAAP but

believes that also discussing non-GAAP measures provides investors with

(i) additional, meaningful comparisons of current results to prior

periods’ results by excluding items that the Company does not believe

reflect its fundamental business performance and are not representative

or indicative of its results of operations and (ii) financial measures

the Company uses in the management of its business.

The Company’s projected full year 2019 adjusted earnings per diluted

share, adjusted operating EBITDA and adjusted tax rate are anticipated

to exclude the effects of events or circumstances in 2019 that are not

representative or indicative of the Company’s results of operations.

Such excluded items are not currently determinable, but may be

significant, such as asset impairments and one-time items, charges,

gains or losses from divestitures or litigation, or other items. Due to

the uncertainty of the likelihood, amount and timing of any such items,

the Company does not have information available to provide a

quantitative reconciliation of adjusted projected full-year earnings per

diluted share, operating EBITDA or tax rate to the comparable GAAP

measures.

The Company discusses free cash flow because the Company believes that

it is indicative of its ability to pay its quarterly dividends,

repurchase common stock, fund acquisitions and other investments and, in

the absence of refinancings, to repay its debt obligations. Free cash

flow is not intended to replace “Net cash provided by operating

activities,” which is the most comparable GAAP measure. The Company

believes free cash flow gives investors useful insight into how the

Company views its liquidity, but the use of free cash flow as a

liquidity measure has material limitations because it excludes certain

expenditures that are required or that the Company has committed to,

such as declared dividend payments and debt service requirements. The

Company defines free cash flow as net cash provided by operating

activities, less capital expenditures, plus proceeds from divestitures

of businesses and other assets (net of cash divested); this definition

may not be comparable to similarly-titled measures reported by other

companies.

The quantitative reconciliations of non-GAAP measures used herein to the

most comparable GAAP measures are included in the accompanying

schedules, with the exception of projected earnings per diluted share,

operating EBITDA and tax rate. Non-GAAP measures should not be

considered a substitute for financial measures presented in accordance

with GAAP.

|

|

|

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In Millions, Except per Share Amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Years Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2018

|

|

|

2017

|

|

Operating revenues

|

|

|

$

|

3,842

|

|

|

|

$

|

3,652

|

|

|

|

$

|

14,914

|

|

|

|

$

|

14,485

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

|

|

|

|

2,379

|

|

|

|

|

2,263

|

|

|

|

|

9,249

|

|

|

|

|

9,021

|

|

|

Selling, general and administrative

|

|

|

|

370

|

|

|

|

|

369

|

|

|

|

|

1,453

|

|

|

|

|

1,468

|

|

|

Depreciation and amortization

|

|

|

|

370

|

|

|

|

|

342

|

|

|

|

|

1,477

|

|

|

|

|

1,376

|

|

|

Restructuring

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

4

|

|

|

|

|

—

|

|

|

Gain from divestitures, asset impairments and unusual items, net

|

|

|

|

(44

|

)

|

|

|

|

(26

|

)

|

|

|

|

(58

|

)

|

|

|

|

(16

|

)

|

|

|

|

|

|

3,075

|

|

|

|

|

2,948

|

|

|

|

|

12,125

|

|

|

|

|

11,849

|

|

|

Income from operations

|

|

|

|

767

|

|

|

|

|

704

|

|

|

|

|

2,789

|

|

|

|

|

2,636

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

|

(97

|

)

|

|

|

|

(91

|

)

|

|

|

|

(374

|

)

|

|

|

|

(363

|

)

|

|

Equity in net losses of unconsolidated entities

|

|

|

|

(12

|

)

|

|

|

|

(15

|

)

|

|

|

|

(41

|

)

|

|

|

|

(68

|

)

|

|

Other, net

|

|

|

|

1

|

|

|

|

|

(14

|

)

|

|

|

|

2

|

|

|

|

|

(14

|

)

|

|

|

|

|

|

(108

|

)

|

|

|

|

(120

|

)

|

|

|

|

(413

|

)

|

|

|

|

(445

|

)

|

|

Income before income taxes

|

|

|

|

659

|

|

|

|

|

584

|

|

|

|

|

2,376

|

|

|

|

|

2,191

|

|

|

Income tax expense (benefit)

|

|

|

|

128

|

|

|

|

|

(319

|

)

|

|

|

|

453

|

|

|

|

|

242

|

|

|

Consolidated net income

|

|

|

|

531

|

|

|

|

|

903

|

|

|

|

|

1,923

|

|

|

|

|

1,949

|

|

|

Less: Net loss attributable to noncontrolling interests

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

(2

|

)

|

|

|

|

—

|

|

|

Net income attributable to Waste Management, Inc.

|

|

|

$

|

531

|

|

|

|

$

|

903

|

|

|

|

$

|

1,925

|

|

|

|

$

|

1,949

|

|

|

Basic earnings per common share

|

|

|

$

|

1.25

|

|

|

|

$

|

2.08

|

|

|

|

$

|

4.49

|

|

|

|

$

|

4.44

|

|

|

Diluted earnings per common share

|

|

|

$

|

1.24

|

|

|

|

$

|

2.06

|

|

|

|

$

|

4.45

|

|

|

|

$

|

4.41

|

|

|

Weighted average basic common shares outstanding

|

|

|

|

425.3

|

|

|

|

|

434.4

|

|

|

|

|

429.1

|

|

|

|

|

438.8

|

|

|

Weighted average diluted common shares outstanding

|

|

|

|

428.5

|

|

|

|

|

437.7

|

|

|

|

|

432.2

|

|

|

|

|

441.9

|

|

|

Cash dividends declared per common share

|

|

|

$

|

0.465

|

|

|

|

$

|

0.425

|

|

|

|

$

|

1.86

|

|

|

|

$

|

1.70

|

|

|

|

|

|

|

|

|

|

|

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

61

|

|

|

$

|

22

|

|

Receivables, net

|

|

|

|

2,275

|

|

|

|

2,374

|

|

Other

|

|

|

|

309

|

|

|

|

298

|

|

Total current assets

|

|

|

|

2,645

|

|

|

|

2,694

|

|

Property and equipment, net

|

|

|

|

11,942

|

|

|

|

11,559

|

|

Goodwill

|

|

|

|

6,430

|

|

|

|

6,247

|

|

Other intangible assets, net

|

|

|

|

572

|

|

|

|

547

|

|

Other

|

|

|

|

1,061

|

|

|

|

782

|

|

Total assets

|

|

|

$

|

22,650

|

|

|

$

|

21,829

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Accounts payable, accrued liabilities and deferred revenues

|

|

|

$

|

2,676

|

|

|

$

|

2,523

|

|

Current portion of long-term debt

|

|

|

|

432

|

|

|

|

739

|

|

Total current liabilities

|

|

|

|

3,108

|

|

|

|

3,262

|

|

Long-term debt, less current portion

|

|

|

|

9,594

|

|

|

|

8,752

|

|

Other

|

|

|

|

3,672

|

|

|

|

3,773

|

|

Total liabilities

|

|

|

|

16,374

|

|

|

|

15,787

|

|

Equity:

|

|

|

|

|

|

|

|

Waste Management, Inc. stockholders’ equity

|

|

|

|

6,275

|

|

|

|

6,019

|

|

Noncontrolling interests

|

|

|

|

1

|

|

|

|

23

|

|

Total equity

|

|

|

|

6,276

|

|

|

|

6,042

|

|

Total liabilities and equity

|

|

|

$

|

22,650

|

|

|

$

|

21,829

|

|

|

|

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended

|

|

|

|

|

|

December 31,

|

|

|

|

|

|

2018

|

|

|

|

2017

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Consolidated net income

|

|

|

|

$

|

1,923

|

|

|

|

|

$

|

1,949

|

|

|

Adjustments to reconcile consolidated net income to net cash

provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

|

|

1,477

|

|

|

|

|

|

1,376

|

|

|

Other

|

|

|

|

|

199

|

|

|

|

|

|

53

|

|

|

Change in operating assets and liabilities, net of effects of

acquisitions and divestitures

|

|

|

|

|

(29

|

)

|

|

|

|

|

(198

|

)

|

|

Net cash provided by operating activities

|

|

|

|

|

3,570

|

|

|

|

|

|

3,180

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Acquisitions of businesses, net of cash acquired

|

|

|

|

|

(460

|

)

|

|

|

|

|

(198

|

)

|

|

Capital expenditures

|

|

|

|

|

(1,694

|

)

|

|

|

|

|

(1,509

|

)

|

|

Proceeds from divestitures of businesses and other assets (net of

cash divested)

|

|

|

|

|

208

|

|

|

|

|

|

99

|

|

|

Other, net

|

|

|

|

|

(223

|

)

|

|

|

|

|

(12

|

)

|

|

Net cash used in investing activities

|

|

|

|

|

(2,169

|

)

|

|

|

|

|

(1,620

|

)

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

New borrowings

|

|

|

|

|

359

|

|

|

|

|

|

1,479

|

|

|

Debt repayments

|

|

|

|

|

(499

|

)

|

|

|

|

|

(1,907

|

)

|

|

Net commercial paper borrowings

|

|

|

|

|

453

|

|

|

|

|

|

513

|

|

|

Common stock repurchase program

|

|

|

|

|

(1,004

|

)

|

|

|

|

|

(750

|

)

|

|

Cash dividends

|

|

|

|

|

(802

|

)

|

|

|

|

|

(750

|

)

|

|

Exercise of common stock options

|

|

|

|

|

52

|

|

|

|

|

|

95

|

|

|

Tax payments associated with equity-based compensation transactions

|

|

|

|

|

(29

|

)

|

|

|

|

|

(47

|

)

|

|

Other, net

|

|

|

|

|

(38

|

)

|

|

|

|

|

6

|

|

|

Net cash used in financing activities

|

|

|

|

|

(1,508

|

)

|

|

|

|

|

(1,361

|

)

|

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash and cash equivalents

|

|

|

|

|

(3

|

)

|

|

|

|

|

—

|

|

|

Increase (decrease) in cash, cash equivalents and restricted cash

and cash equivalents

|

|

|

|

|

(110

|

)

|

|

|

|

|

199

|

|

|

Cash, cash equivalents and restricted cash and cash equivalents at

beginning of period

|

|

|

|

|

293

|

|

|

|

|

|

94

|

|

|

Cash, cash equivalents and restricted cash and cash equivalents at

end of period

|

|

|

|

$

|

183

|

|

|

|

|

$

|

293

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior year information has been revised to reflect the adoption of

Accounting Standards Update (ASU) 2016-15 and ASU 2016-18 and conform to

our current year presentation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET

(In Millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Revenues by Line of Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Years Ended

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2018

|

|

|

2017

|

|

Commercial

|

|

|

|

|

|

|

$

|

1,024

|

|

|

|

$

|

950

|

|

|

|

$

|

3,972

|

|

|

|

$

|

3,714

|

|

|

Residential

|

|

|

|

|

|

|

|

644

|

|

|

|

|

640

|

|

|

|

|

2,529

|

|

|

|

|

2,528

|

|

|

Industrial

|

|

|

|

|

|

|

|

705

|

|

|

|

|

653

|

|

|

|

|

2,773

|

|

|

|

|

2,583

|

|

|

Other

|

|

|

|

|

|

|

|

117

|

|

|

|

|

109

|

|

|

|

|

450

|

|

|

|

|

439

|

|

|

Total collection

|

|

|

|

|

|

|

|

2,490

|

|

|

|

|

2,352

|

|

|

|

|

9,724

|

|

|

|

|

9,264

|

|

|

Landfill

|

|

|

|

|

|

|

|

914

|

|

|

|

|

883

|

|

|

|

|

3,560

|

|

|

|

|

3,370

|

|

|

Transfer

|

|

|

|

|

|

|

|

454

|

|

|

|

|

399

|

|

|

|

|

1,711

|

|

|

|

|

1,591

|

|

|

Recycling

|

|

|

|

|

|

|

|

339

|

|

|

|

|

310

|

|

|

|

|

1,293

|

|

|

|

|

1,432

|

|

|

Other

|

|

|

|

|

|

|

|

440

|

|

|

|

|

433

|

|

|

|

|

1,736

|

|

|

|

|

1,713

|

|

|

Intercompany (a)

|

|

|

|

|

|

|

|

(795

|

)

|

|

|

|

(725

|

)

|

|

|

|

(3,110

|

)

|

|

|

|

(2,885

|

)

|

|

Total

|

|

|

|

|

|

|

$

|

3,842

|

|

|

|

$

|

3,652

|

|

|

|

$

|

14,914

|

|

|

|

$

|

14,485

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal Revenue Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period-to-Period Change for the

Three Months Ended

December

31, 2018 vs. 2017

|

|

|

Period-to-Period Change for the

Year Ended

December

31, 2018 vs. 2017

|

|

|

|

|

|

As a % of

|

|

|

|

As a % of

|

|

|

|

|

As a % of

|

|

|

|

As a % of

|

|

|

|

|

|

Related

|

|

|

|

Total

|

|

|

|

|

Related

|

|

|

|

Total

|

|

|

|

Amount

|

|

Business(b)

|

|

Amount

|

|

Company(c)

|

|

|

Amount

|

|

Business(b)

|

|

Amount

|

|

Company(c)

|

|

Collection and disposal

|

|

$

|

73

|

|

|

2.3

|

%

|

|

|

|

|

|

|

$

|

291

|

|

|

2.3

|

%

|

|

|

|

|

|

Recycling commodities

|

|

|

(21

|

)

|

|

(6.7

|

)

|

|

|

|

|

|

|

|

(273

|

)

|

|

(19.1

|

)

|

|

|

|

|

|

Fuel surcharges and mandated fees

|

|

|

24

|

|

|

17.3

|

|

|

|

|

|

|

|

|

111

|

|

|

21.3

|

|

|

|

|

|

|

Total average yield (d)

|

|

|

|

|

|

$

|

76

|

|

|

2.1

|

%

|

|

|

|

|

|

|

$

|

129

|

|

|

0.9

|

%

|

|

Volume

|

|

|

|

|

|

|

169

|

|

|

4.7

|

|

|

|

|

|

|

|

|

478

|

|

|

3.3

|

|

|

Internal revenue growth

|

|

|

|

|

|

|

245

|

|

|

6.8

|

|

|

|

|

|

|

|

|

607

|

|

|

4.2

|

|

|

Acquisitions

|

|

|

|

|

|

|

57

|

|

|

1.5

|

|

|

|

|

|

|

|

|

199

|

|

|

1.4

|

|

|

Divestitures

|

|

|

|

|

|

|

(43

|

)

|

|

(1.2

|

)

|

|

|

|

|

|

|

|

(133

|

)

|

|

(0.9

|

)

|

|

Foreign currency translation and other

|

|

|

|

|

|

|

(69

|

)

|

|

(1.9

|

)

|

|

|

|

|

|

|

|

(244

|

)

|

|

(1.7

|

)

|

|

Total

|

|

|

|

|

|

$

|

190

|

|

|

5.2

|

%

|

|

|

|

|

|

|

$

|

429

|

|

|

3.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period-to-Period Change for the

Three Months Ended

December 31, 2018 vs. 2017

|

|

|

Period-to-Period Change for the

Year Ended December

31, 2018 vs. 2017

|

|

|

|

|

|

As a % of Related Business(b)

|

|

|

As a % of Related Business(b)

|

|

|

|

|

|

Yield

|

|

Volume(e)

|

|

|

Yield

|

|

Volume

|

|

Commercial

|

|

|

|

2.3

|

%

|

|

4.0

|

%

|

|

|

2.9

|

%

|

|

3.2

|

%

|

|

Industrial

|

|

|

|

4.7

|

|

|

0.9

|

|

|

|

4.4

|

|

|

2.8

|

|

|

Residential

|

|

|

|

2.0

|

|

|

0.6

|

|

|

|

1.9

|

|

|

0.1

|

|

|

Total collection

|

|

|

|

2.8

|

|

|

2.5

|

|

|

|

2.9

|

|

|

2.2

|

|

|

MSW

|

|

|

|

2.4

|

|

|

1.4

|

|

|

|

2.2

|

|

|

1.9

|

|

|

Transfer

|

|

|

|

2.2

|

|

|

10.8

|

|

|

|

1.9

|

|

|

6.9

|

|

|

Total collection and disposal

|

|

|

|

2.3

|

|

|

3.5

|

|

|

|

2.3

|

|

|

3.2

|

|

|

_____________________________________________

|

|

(a)

|

|

Intercompany revenues between lines of business are eliminated in

the Condensed Consolidated Financial Statements included herein.

|

|

(b)

|

|

Calculated by dividing the increase or decrease for the current year

period by the prior year period’s related business revenue adjusted

to exclude the impacts of divestitures for the current year period.

|

|

(c)

|

|

Calculated by dividing the increase or decrease for the current year

period by the prior year period’s total Company revenue adjusted to

exclude the impacts of divestitures for the current year period.

|

|

(d)

|

|

The amounts reported herein represent the changes in our revenue

attributable to average yield for the total Company.

|

|

(e)

|

|

Workday adjusted volume impact.

|

|

|

|

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET

(In Millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow Analysis (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Years Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

2018

|

|

2017

|

|

Net cash provided by operating activities (b)

|

|

|

$

|

912

|

|

|

$

|

792

|

|

|

|

$

|

3,570

|

|

|

$

|

3,180

|

|

|

Capital expenditures

|

|

|

|

(454

|

)

|

|

|

(528

|

)

|

|

|

|

(1,694

|

)

|

|

|

(1,509

|

)

|

|

Proceeds from divestitures of businesses

|

|

|

|

|

|

|

|

|

|

|

|

and other assets (net of cash divested)

|

|

|

|

102

|

|

|

|

80

|

|

|

|

|

208

|

|

|

|

99

|

|

|

Free cash flow

|

|

|

$

|

560

|

|

|

$

|

344

|

|

|

|

$

|

2,084

|

|

|

$

|

1,770

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Years Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

2018

|

|

2017

|

|

Supplemental Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internalization of waste, based on disposal costs

|

|

|

|

66.2

|

%

|

|

|

65.6

|

%

|

|

|

|

66.0

|

%

|

|

|

65.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Landfill amortizable tons (in millions)

|

|

|

|

29.6

|

|

|

|

28.8

|

|

|

|

|

115.6

|

|

|

|

111.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition Summary (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross annualized revenue acquired

|

|

|

|

73

|

|

|

|

16

|

|

|

|

|

288

|

|

|

|

74

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total consideration

|

|

|

|

121

|

|

|

|

116

|

|

|

|

|

471

|

|

|

|

205

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions consummated during the period,

|

|

|

|

|

|

|

|

|

|

|

|

net of cash acquired

|

|

|

|

111

|

|

|

|

110

|

|

|

|

|

455

|

|

|

|

196

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions including contingent consideration

|

|

|

|

|

|

|

|

|

|

|

|

and other items from prior periods, net of cash acquired

|

|

|

|

118

|

|

|

|

120

|

|

|

|

|

466

|

|

|

|

200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization, Accretion and Other Expenses for

|

|

|

|

|

|

|

|

|

|

|

|

Landfills Included in Operating Groups:

|

|

|

Three Months Ended

|

|

|

Years Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

2018

|

|

2017

|

|

Landfill amortization expense

|

|

|

|

|

|

|

|

|

|

|

|

Cost basis of landfill assets

|

|

|

$

|

112.7

|

|

|

$

|

106.4

|

|

|

|

$

|

438.5

|

|

|

$

|

405.0

|

|

|

Asset retirement costs

|

|

|

|

20.6

|

|

|

|

8.1

|

|

|

|

|

100.5

|

|

|

|

88.1

|

|

|

Total landfill amortization expense

|

|

|

|

133.3

|

|

|

|

114.5

|

|

|

|

|

539.0

|

|

|

|

493.1

|

|

|

Accretion and other related expense

|

|

|

|

20.5

|

|

|

|

20.4

|

|

|

|

|

80.8

|

|

|

|

79.2

|

|

|

Landfill amortization, accretion and other related expense

|

|

|

$

|

153.8

|

|

|

$

|

134.9

|

|

|

|

$

|

619.8

|

|

|

$

|

572.3

|

|

|

|

|

|

|

(a)

|

|

The summary of free cash flow has been prepared to highlight and

facilitate understanding of the principal cash flow elements. Free

cash flow is not a measure of financial performance under generally

accepted accounting principles and is not intended to replace the

consolidated statement of cash flows that was prepared in accordance

with generally accepted accounting principles.

|

|

(b)

|

|

Prior year information has been revised to reflect the adoption of

ASU 2016-18 and conform to our current year presentation.

|

|

(c)

|

|

Represents amounts associated with business acquisitions consummated

during the applicable period except where noted.

|

|

|

|

WASTE MANAGEMENT, INC.

RECONCILIATION OF CERTAIN NON-GAAP MEASURES

(In

Millions, Except Per Share Amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, 2018

|

|

|

|

|

Income from

Operations

|

|

Pre-tax

Income

|

|

Tax Expense

|

|

Net

Income (a)

|

|

Per Share

Amount

|

|

As reported amounts

|

|

|

$

|

767

|

|

|

$

|

659

|

|

|

$

|

128

|

|

|

$

|

531

|

|

|

$

|

1.24

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain from divestitures, asset impairments and unusual items, net

|

|

|

|

(44

|

)

|

|

|

(44

|

)

|

|

|

(13

|

)

|

|

|

(31

|

)

|

|

|

|

Tax benefits related to adjustment to deferred taxes

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17

|

|

|

|

(17

|

)

|

|

|

|

|

|

|

|

(44

|

)

|

|

|

(44

|

)

|

|

|

4

|

|

|

|

(48

|

)

|

|

|

(0.11

|

)

|

|

As adjusted amounts

|

|

|

$

|

723

|

|

|

$

|

615

|

|

|

$

|

132

|

|

(b)

|

$

|

483

|

|

|

$

|

1.13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, 2017

|

|

|

|

|

Income from

Operations

|

|

Pre-tax

Income

|

|

Tax Expense

|

|

Net

Income (a)

|

|

Per Share

Amount

|

|

As reported amounts

|

|

|

$

|

704

|

|

|

$

|

584

|

|

|

$

|

(319

|

)

|

|

$

|

903

|

|

|

$

|

2.06

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact of Tax Cuts and Jobs Act

|

|

|

|

-

|

|

|

|

-

|

|

|

|

529

|

|

|

|

(529

|

)

|

|

|

|

Gain from divestitures, asset impairments and unusual items, net

|

|

|

|

(26

|

)

|

|

|

(14

|

)

|

|

|

(10

|

)

|

|

|

(4

|

)

|

|

|

|

Loss on extinguishment of debt

|

|

|

|

-

|

|

|

|

6

|

|

|

|

2

|

|

|

|

4

|

|

|

|

|

|

|

|

|

(26

|

)

|

|

|

(8

|

)

|

|

|

521

|

|

|

|

(529

|

)

|

|

|

(1.21

|

)

|

|

As adjusted amounts

|

|

|

$

|

678

|

|

|

$

|

576

|

|

|

$

|

202

|

|

|

$

|

374

|

|

|

$

|

0.85

|

|

|

|

|

|

|

(a)

|

|

For purposes of this press release table, all references to "Net

income" refer to the financial statement line item "Net income

attributable to Waste Management, Inc."

|

|

(b)

|

|

The Company calculates its effective tax rate based on actual

dollars. When the effective tax rate is calculated by dividing the

Tax Expense amount in the table above by the Pre-tax Income amount,

differences occur due to rounding, as these items have been rounded

in millions. The fourth quarter 2018 adjusted effective tax rate was

21.5%.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WASTE MANAGEMENT, INC.

RECONCILIATION OF CERTAIN NON-GAAP MEASURES

(In

Millions, Except Per Share Amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2018

|

|

|

|

|

Income from

Operations

|

|

Pre-tax

Income

|

|

Tax Expense

|

|

Net

Income (a)

|

|

Per Share

Amount

|

|

As reported amounts

|

|

|

$

|

2,789

|

|

|

$

|

2,376

|

|

|

$

|

453

|

|

|

$

|

1,925

|

|

|

$

|

4.45

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain from divestitures, asset impairments and unusual items, net

|

|

|

|

(55

|

)

|

|

|

(55

|

)

|

|

|

(17

|

)

|

|

|

(38

|

)

|

|

|

|

Tax benefits related to income tax audit settlements

|

|

|

|

-

|

|

|

|

-

|

|

|

|

33

|

|

|

|

(33

|

)

|

|

|

|

Benefit primarily related to favorable adjustments from changes in

state tax law and impact of Tax Cuts and Jobs Act

|

|

|

|

-

|

|

|

|

-

|

|

|

|

27

|

|

|

|

(27

|

)

|

|

|

|

Tax benefits related to adjustment to deferred taxes

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17

|

|

|

|

(17

|

)

|

|

|

|

Charges related to multiemployer pension plans

|

|

|

|

3

|

|

|

|

3

|

|

|

|

1

|

|

|

|

2

|

|

|

|

|

Restructuring

|

|

|

|

2

|

|

|

|

2

|

|

|

|

1

|

|

|

|

1

|

|

|

|

|

|

|

|

|

(50

|

)

|

|

|

(50

|

)

|

|

|

62

|

|

|

|

(112

|

)

|

|

|

(0.25

|

)

|

|

As adjusted amounts

|

|

|

$

|

2,739

|

|

|

$

|

2,326

|

|

|

$

|

515

|

|

(b)

|

$

|

1,813

|

|

|

$

|

4.20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2017

|

|

|

|

|

Income from

Operations

|

|

Pre-tax

Income

|

|

Tax Expense

|

|

Net

Income (a)

|

|

Per Share

Amount

|

|

As reported amounts

|

|

|

$

|

2,636

|

|

|

$

|

2,191

|

|

|

$

|

242

|

|

|

$

|

1,949

|

|

|

$

|

4.41

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact of Tax Cuts and Jobs Act

|

|

|

|

-

|

|

|

|

-

|

|

|

|

529

|

|

|

|

(529

|

)

|

|

|

|

Tax benefits related to equity-based compensation

|

|

|

|

-

|

|

|

|

-

|

|

|

|

32

|

|

|

|

(32

|

)

|

|

|

|

Gain from divestitures, asset impairments and unusual items, net (c)

|

|

|

|

(17

|

)

|

|

|

20

|

|

|

|

(6

|

)

|

|

|

26

|

|

|

|

|

Charges related to multiemployer pension plans

|

|

|

|

11

|

|

|

|

11

|

|

|

|

4

|

|

|

|

7

|

|

|

|

|

Loss on early extinguishment of debt

|

|

|

|

-

|

|

|

|

6

|

|

|

|

2

|

|

|

|

4

|

|

|

|

|

|

|

|

|

(6

|

)

|

|

|

37

|

|

|

|

561

|

|

|

|

(524

|

)

|

|

|

(1.19

|

)

|

|

As adjusted amounts

|

|

|

$

|

2,630

|

|

|

$

|

2,228

|

|

|

$

|

803

|

|

|

$

|

1,425

|

|

|

$

|

3.22

|

|

|

|

|

|

|

(a)

|

|

For purposes of this press release table, all references to "Net

income" refer to the financial statement line item "Net income

attributable to Waste Management, Inc."

|

|

(b)

|

|

The Company calculates its effective tax rate based on actual

dollars. When the effective tax rate is calculated by dividing the

Tax Expense amount in the table above by the Pre-tax Income amount,

differences occur due to rounding, as these items have been rounded

in millions. The full year 2018 adjusted effective tax rate was

22.1%.

|

|

(c)

|

|

Adjustments in 2017 included impairment charges associated with

assets in the "Gain from divestitures, asset impairments and unusual

items" and "Other, net" financial captions. Additionally,

adjustments in 2017 include impairment charges associated with

certain of our investments in unconsolidated entities that are

included in the "Equity in net loss of unconsolidated entities"

financial caption.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WASTE MANAGEMENT, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF CERTAIN NON-GAAP MEASURES

|

|

(In Millions)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

December 31, 2018

|

|

|

|

December 31, 2017

|

|

Adjusted Operating EBITDA and Adjusted Operating EBITDA Margin

|

|

|

Amount

|

|

|

As a % of

Revenues

|

|

|

|

Amount

|

|

|

As a % of

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues, as reported

|

|

|

$

|

3,842

|

|

|

|

|

|

|

|

$

|

3,652

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations, as reported

|

|

|

$

|

767

|

|

|

|

|

|

|

|

$

|

704

|

|

|

|

|

|

Depreciation and amortization, as reported

|

|

|

|

370

|

|

|

|

|

|

|

|

|

342

|

|

|

|

|

|

Operating EBITDA, as reported

|

|

|

$

|

1,137

|

|

|

|

|

29.6

|

%

|

|

|

|

$

|

1,046

|

|

|

|

28.6

|

%

|

|

Adjustment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain from divestitures, asset impairments and unusual items, net

|

|

|

|

(44

|

)

|

|

|

|

|

|

|

|

(26

|

)

|

|

|

|

|

Adjusted operating EBITDA (a)

|

|

|

$

|

1,093

|

|

|

|

|

28.4

|

%

|

|

|

|

$

|

1,020

|

|

|

|

27.9

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended

|

|

|

|

|

December 31, 2018

|

|

|

|

December 31, 2017

|

|

Adjusted Operating EBITDA and Adjusted Operating EBITDA Margin

|

|

|

Amount

|

|

|

As a % of

Revenues

|

|

|

|

Amount

|

|

|

As a % of

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues, as reported

|

|

|

$

|

14,914

|

|

|

|

|

|

|

|

$

|

14,485

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations, as reported

|

|

|

$

|

2,789

|

|

|

|

|

|

|

|

$

|

2,636

|

|

|

|

|

|

Depreciation and amortization, as reported

|

|

|

|

1,477

|

|

|

|

|

|

|

|

|

1,376

|

|

|

|

|

|

Operating EBITDA, as reported

|

|

|

$

|

4,266

|

|

|

|

|

28.6

|

%

|

|

|

|

$

|

4,012

|

|

|

|

27.7

|

%

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain from divestitures, asset impairments and unusual items, net

|

|

|

|

(55

|

)

|

|

|

|

|

|

|

|

(17

|

)

|

|

|

|

|

Charges related to multiemployer pension plans

|

|

|

|

3

|

|

|

|

|

|

|

|

|

11

|

|

|

|

|

|

Restructuring

|

|

|

|

2

|

|

|

|

|

|

|

|

|

-

|

|

|

|

|

|

Adjusted operating EBITDA (b)

|

|

|

$

|

4,216

|

|

|

|

|

28.3

|

%

|

|

|

|

$

|

4,006

|

|

|

|

27.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019 Projected Free Cash Flow Reconciliation (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scenario 1

|

|

|

Scenario 2

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

|

$

|

3,625

|

|

|

|

$

|

3,725

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

|

(1,650

|

)

|

|

|

|

(1,750

|

)

|

|

|

|

|

|

|

|

|

Proceeds from divestitures of businesses and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

other assets (net of cash divested)

|

|

|

|

50

|

|

|

|

|

100

|

|

|

|

|

|

|

|

|

|

Free cash flow

|

|

|

$

|

2,025

|

|

|

|

$

|

2,075

|

|

|

|

|

|

|

|

|

|