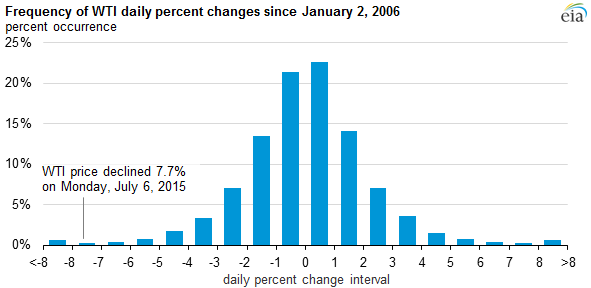

Historical oil price data shows one day price drops of 7.7% or higher are relatively rare

Last Monday saw the largest drop in oil prices for West Texas Intermediate (WTI) in four months, when the U.S. crude benchmark shed 7.7% of its value in a single day of trading. Concerns over the Greek debt crisis, weakness in the Chinese stock market and the potential for increased oil exports from Iran all contributed to pushing prices down.

Single-day price drops of that magnitude are relatively rare, according to information from the Energy Information Administration (EIA). Since January 2, 2006, the average daily percentage change for the front month WTI crude oil contract was close to zero, at 0.002%, and in that time daily price movements had a standard deviation of more than 2%, according to the EIA.

Assuming that daily oil prices are independent (i.e., one day’s movements do not influence another day’s movements) and are normally distributed, a decline the size of last Monday’s 7.7% fall only occurs, in theory, 0.05% of the time, meaning the odds of such a price drop are about one in two-thousand, according to the EIA’s data.

WTI implied volatility, an expectation of future price movements calculated from the prices of futures and options contracts, averaged 36.5% from July 1 to July 7, higher than both the June average and the comparable year-ago period. Continued uncertainties in international markets, along with a surprise build in oil inventories which sent prices down another 1% last Wednesday, have continued to drive volatility in oil prices.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.