The dust is settling on the first phase of the global oil market share war. Oil has been hovering around $50/barrel for nearly a week – a long-awaited relief to the industry which was wondering, exactly, where is rock bottom? The recent stabilization of oil prices has prompted some analysts to make the necessary adjustments to their respective models and estimate if the world will break out of the price slump within the fiscal year.

The recent “bottoming out” of prices in January were followed by WTI rebounding by 15% and Brent jumping 25%. These swings are within normal expectations, according to a note by Wells Fargo Securities on February 9, 2015, which explains the historical impact of maintenance season and typical industry patterns contributed to the jump. But don’t get used to the steadier prices just yet.

The Good News

The note says: “While anything is possible, we do not believe that oil prices need to establish a new low in the upcoming weeks/months to bring balance to the oil markets. The leading reason we do not believe oil needs to set new lows is that sub-$50/bbl oil clearly created conditions of significantly halting drilling activity, led to the deferral of well completions and is clearly below the price level that would allow major projects in the deepwater/oil sands/LNG to be sanctioned. We have previously called for oil prices to establish a cyclical bottom during Q1/Q2 2015 so this view remains consistent with our outlook.”

The Bad News

The climb won’t be as simple as the scenario above, says Wells Fargo. “Based on historical trading patterns we fully expect oil prices will head lower over the next several weeks,” the note says. “In addition to historical patterns, seasonal declines in physical oil demand from the refining sector as maintenance season gets underway should reduce physical demand for oil.”

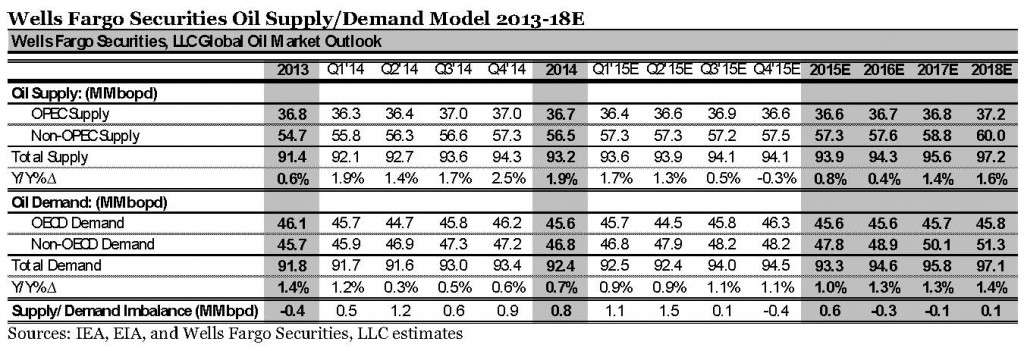

On the plus side, Wells Fargo forecasts the market slowing down in the second half of 2015 and a more normal supply and demand balance taking place. The crude oil inventories, however, are at record highs and may prolong the balance curve. The forecast says “While we see a balanced market evolving by Q4 2015, working down elevated inventories may suppress oil prices into 2016 unless OPEC steps up and implements cuts.”

Agency Adjustments

An output cut from OPEC does not appear to be in the immediate future, even though members like Algeria and Venezuela have publicly supported scaling back on volumes to boost prices. Saudi Arabia has been adamant in its strategy, declaring cuts will not occur and oil will never return to the $100 level again. Wells Fargo isn’t entirely convinced, saying “OPEC did implement production cuts following the 1986/1987, 1998/1999, 2001 and 2008/2009 oil price collapses so a production adjustment in H2 2015 or 2016 would not surprise us.”

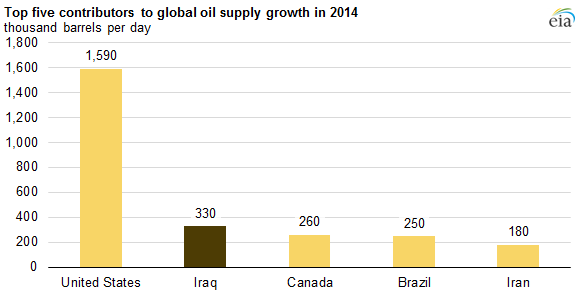

Consistent production rates are not as easy for other countries throughout Eastern Civilization. Iran’s volumes are currently being tempered due to sanctions and could further impact the global oil market once (or if) restrictions are lifted. Libya, the subject of a February 6 article by The Wall Street Journal, has seen its output dissipate to 325 MBOPD in January, down from 900 MBOPD in October. The OPEC member was producing as much as 1,600 MBOPD in 2011 before the Gadhafi regime was overthrown.

Arguably the focal study of oil prices and the economic effects lies in Russia, where falling prices and sanctions prompted Standard & Poor to drop the country’s credit rating to “junk” last week. Platts reported that the International Energy Agency will likely reduce Russia’s production estimates – a belief Wells Fargo has touted since October. “[However,] we do not believe this is a consensus view, thus the impact could be meaningful,” Wells Fargo says.

Mega-Projects at Risk?

Large scale projects, particularly liquefied natural gas (LNG) terminals, are being deferred or canceled in the new commodity environment. The lower margins stress execution on such sizable projects will have to be much more efficient – a problem that has especially plagued deepwater projects in Brazil and LNG export stations in Australia. Petrobras has been the target of an ongoing corruption scandal and 10 of Australia’s 12 LNG projects are either behind schedule or roughly 50% over the estimated budget.

E&Ps like Apache Corp. (ticker: APA) successfully left the LNG market by selling $2.75 billion of LNG projects late in 2014, citing the capital requirements. That same project, the Kitimat in British Columbia, is not viable with prices under $70/barrel, said Pavel Molchanov of Raymond James in a December note.

Wells Fargo says “Successfully developing the next round of mega projects will require major changes in how “Big Oil” executes these projects and that cost reductions alone are not enough.”

The oncoming projects, if they are indeed constructed, will still have no problem finding customers. The firm expects global demand to continue to grow through at least 2018. In the near term, Wells Fargo believes demand will outweigh supply by Q4’15, but the scales will tip in favor of supply by 2018 as shale development recovers and large-scale projects come online. The disparity will not be as great as 2014 however – Wells Fargo estimates we exited 2014 with 0.8 MMBOPD of excess supply.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.