Western Gas Partners Expands Delaware Basin Position

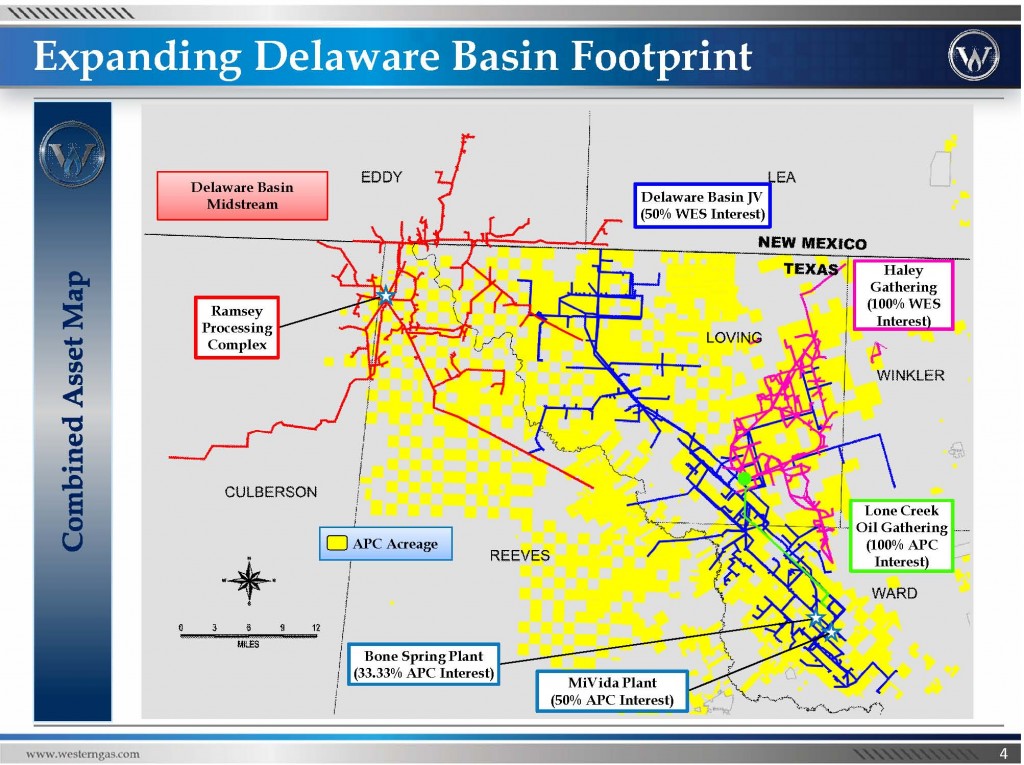

Houston based Western Gas Partners (ticker: WES) yesterday announced the acquisition of Anadarko’s (ticker: APC) 50% interest in the Delaware  Basin JV (DBJV) gathering system. Williams Companies (ticker: WMB) owns the other 50% of the pipeline and will continue to operate the pipeline. The DBJV assets are located in close proximity to the Delaware Midstream Assets WES purchased in November from Nuevo Midstream for $1.5 billion.

Basin JV (DBJV) gathering system. Williams Companies (ticker: WMB) owns the other 50% of the pipeline and will continue to operate the pipeline. The DBJV assets are located in close proximity to the Delaware Midstream Assets WES purchased in November from Nuevo Midstream for $1.5 billion.

WES was formed by Anadarko to operate as a master limited partnership (MLP) in the midstream industry. Due to the relationship of the two entities, WES did not pay any consideration at closing, but has agreed to make a future payment on March 31, 2020 based on an average 2018 and 2019 EBITDA multiple of 8.0x; this price is estimated to be $283 million. The assets are expected to add $15 to $25 million to Western’s 2015 EBITDA.

During a conference call discussing the new acquisition, Donald Sinclair, President and Chief Executive Officer of Western, explained, “The assets are 100% fee based and like many of our other assets will operate under cost of service gathering agreement which targets an 18% regular return over the life of the contract.” A note from Sunil Sibal at Global Hunter Securities estimates the net present value of the purchase price is $176 million.

Mr. Sinclair said the goal will be to continue to integrate the company’s midstream assets in West Texas. “Our objective is to have all of our Delaware Basin assets operate as one complex, which will allow us to create more commercial opportunities [and] provide better services to our producers.”

2015 guidance

Western also announced its 2015 guidance along with the news of the DBJV acquisition. The company expects its 2015 adjusted EBITDA to be between $725 and $775 million. WES anticipates spending 48% of its 2015 capital in the Delaware Basin. “We expect approximately 27% of our total capital to be allocated to the assets we purchased last November,” said Sinclair.

Sinclair said during the conference call that WES will maintain its long-term distribution coverage goals. The company plans to deliver 15% growth in 2015, which will require it to run a distribution coverage ratio at around 1.0x. Western’s debt-to-market cap of 25% is well below the average of 47% of the 57 midstream-based MLP companies on EnerCom’s MLP Scorecard.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.

Analyst Commentary

Sunil Sibal, Global Hunter Securities 03.04.2015

WES maintained 2015 distribution growth guidance of no less than 15% initially provided in late October in a much higher commodity price environment, while its GP, WGP, expects distribution growth no less than 30%. WES's adjusted EBITDA guidance of $725MM-$775MM was in line with our expectations after accounting for the associated lower capital spending in 2015. Importantly, the terms of the DBJV acquisition demonstrate the value of the parent's strong support for the partnership. This support should help WES to continue to grow cash flows and distributions at an industry leading rate in 2015 despite a slowdown in activity in the Delaware Basin, where the partnership completed a major acquisition in October. We maintain our Buy rating and $83 price target.