What is blockchain?

Blockchain is the underlying technology to the now-prevalent cryptocurrencies, which began as a way to build a decentralized digital cash system.

Bitcoin, the first cryptocurrency, was established in 2008 by a person (or, perhaps, group of people) known as Satoshi Nakamoto; Bitcoin utilizes blockchain technology and introduced the concept to the world.

According to Don & Alex Tapscott, authors of Blockchain Revolution (2016), “The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.”

Hard to Hack

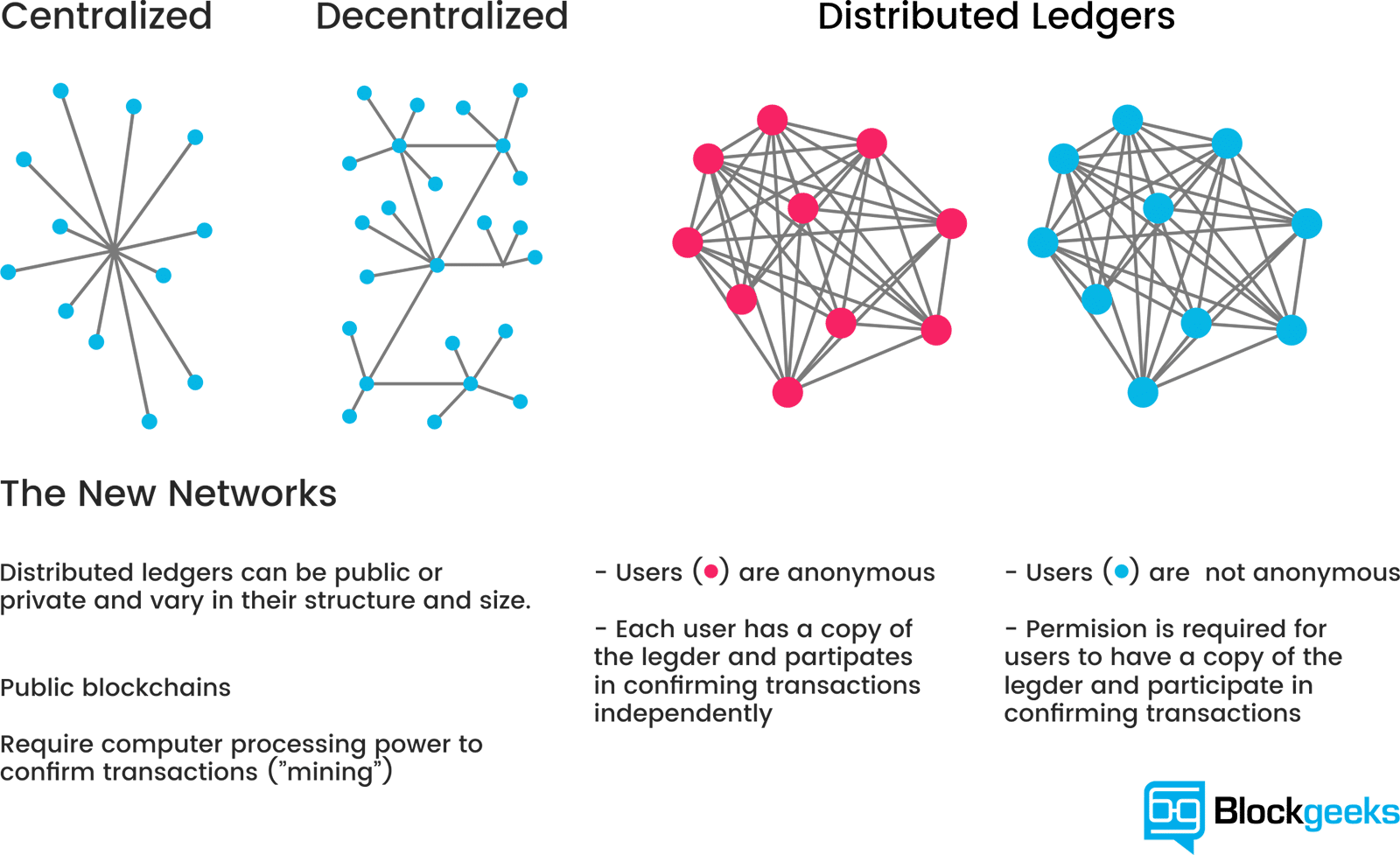

Picture a spreadsheet that is duplicated thousands of times across a network of computers, then imagine this network is designed as a single point of access for parties involved to regularly update the spreadsheet.

Information held on a blockchain exists as a shared — and continually reconciled — database. This has obvious benefits: the blockchain database isn’t stored in any single location, this means the record it keeps acts as a single source of truth for all parties involved. No centralized version of this information exists for a hacker to corrupt. Hosted by millions of computers simultaneously, its data is accessible to anyone on the network.

Previously, for example, colleagues were able to share Word documents only by email; blockchain is much like working in the same document at the same time online. Both parties have access to the same document at the same time, and the single version of that document is always visible to both of them. Both parties see the same thing and share the same set of facts.

Whenever a block of transactions is to be agreed, every participating node attempts to ‘mine’ the block (a mathematical algorithmic process that requires extensive CPU capacity).

The network self-audits and reconciles every transaction that happens. Each group of these transactions is referred to as a “block.” Important properties resulting from this are:

- Transparency – data is embedded within the network

- It cannot be corrupted from the outside; altering any unit of information on the blockchain would mean overriding the entire network.

- By storing identical blocks of information across its network, the blockchain cannot be controlled by any single entity and it has no single point of failure.

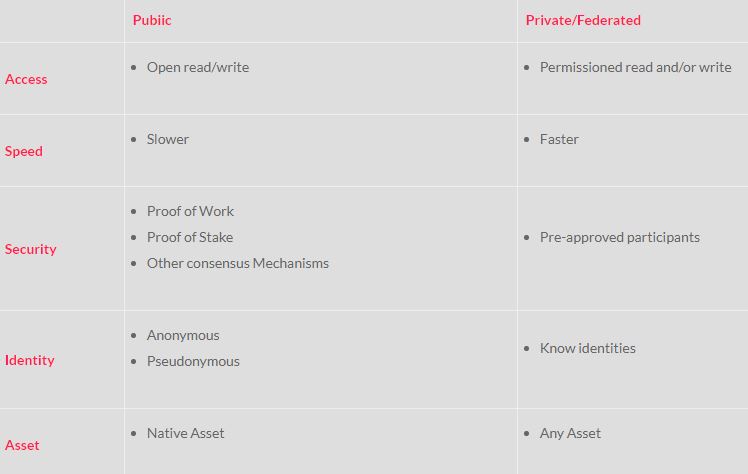

Public vs Private Blockchain

- Both are decentralized peer-to-peer networks, where each participant maintains a replica of a shared append-only ledger of digitally signed transactions.

- Both maintain the replicas in sync through a protocol referred to as consensus.

- Both provide certain guarantees on the immutability of the ledger, even when some participants are faulty or malicious.

The sole distinction between public and private blockchain is related to who is allowed to participate in the network, execute the consensus protocol, and maintain the distributed ledger. A public blockchain network is completely open and anyone can join and participate in the network. The network typically has an incentivizing mechanism to encourage more participants to join the network.

A private blockchain network requires an invitation and must be validated by either the network starter or by a set of rules put in place by the network starter. Businesses who set up a private blockchain, will generally set up a permissioned network. This places restrictions on who is allowed to participate in the network, and only in certain transactions. Participants need to obtain an invitation or permission to join.

Implementation

There are a few different ways to implement blockchain technology or distributed ledger technology. Most relevant to the energy industry would be a “Vertical Solution”. Recently there has been a huge shift in this segment, especially within financial services. These solutions are industry-specific, and they are based on private blockchain or ledger infrastructures. A caveat here is that some of these are not full blockchains. Rather, they are distributed ledgers, which are a subset of blockchain capabilities.

Impact on energy businesses

Blockchain’s many applications provide valuable opportunities for the energy industry and companies are taking notice. BP plc (NYSE: BP) and Royal Dutch Shell plc. (NYSE: RDS.A) are experimenting with various use cases. Last fall, two oil giants entered into a consortium to develop a blockchain based platform for energy commodities trading that is scheduled to launch by the end of 2018.

Applications under consideration across the energy sector include:

- Smart Contracts: Distributed ledgers enable the coding of simple contracts that will execute when specified conditions are met.

- Energy Trading: “Using blockchain allows for a reliable and efficient platform for executing and recording energy trades,” Mark Koeppen, principal, Deloitte Consulting, said.

- Land Title Records: Keeping land title records using this technology provides efficient updates and data management for joint ownership and interest validations.

- Supply Chain Auditing: Transparency comes with blockchains ability to show all parties on the ledger the exact transaction details that occur at any time with an extreme level of security.

- Royalty and Contract Settlement: Distributed ledger and blockchain technology have the potential to greatly minimize and ultimately eliminate resource and royalty-based contract disputes.

Industry insights into blockchain

Oil and Gas 360® wanted to learn more about blockchain technology, so we contacted James Graham, President and CEO of GuildOne Inc. (GuildOne), who recently executed the world’s first oil royalty contract settlement and payment transaction on R3’s Corda blockchain platform.

An exclusive conversation with GuildOne President and CEO James Graham

OAG 360: What are some of the misconceptions – or the most common misconceptions you’ve run into when trying to explain blockchain and what it can do for people and business?

GuildOne President and CEO James Graham: The first misconception that most people have is the nature of the overlap of blockchain technologies with bitcoin and other cryptocurrencies. They put it all into one big mysterious pile. They don’t differentiate between the two but see bitcoin and the crypto markets as having massive materiality in the blockchain world.

GuildOne CEO James Graham is a featured presenter at EnerCom’s The Oil & Gas Conference Aug. 20-22, 2018 in Denver, Colorado.

These are important things to consider together – and it’s very hard to separate them – as bitcoin is the first use case. But that’s the first misconception, that we need to settle stuff in cryptocurrency on our ledger. We don’t. We actually do everything by fiat [money, or conventional currencies], we have what some would call a stable coin – a digitized state of the asset with the value pegged to fiat currency. Users have on ledger “tokenized” positions which settle to cash when they exit the ledger position. So, that’s the first misconception: that we need crypto, and that bitcoin is a critical part of blockchain, rather it is the first demonstrated use case.

The second misconception is that blockchain is not ready for prime time. A lot of people say that it doesn’t scale. That is essentially last year’s thinking as there are significant proof-of-concept live solutions available now with a variety of value propositions.

The third misconception is that you’re going to flip a switch and suddenly everybody will be in this new world. I suppose for some uses and operations this would be true, but the reality is that it’s a really evolutionary thing, at least for our customers and our projects. In our case, most customers go contract by contract, and over time they conduct more transactions on the ledger.

This leads to an even bigger question, which is: “How do we transition these systems?” A lot of people believe it’s an all or nothing sort of transition, that’s not how it is. It’s much more likely to be an iterative, evolutionary transition for most applications.

OAG 360: How does someone deploy or even create a platform using blockchain? Is there a simple way to describe the deployment into it?

GuildOne President and CEO James Graham: That’s a bit of an open question in that every day we see new meaningful entries with large players like the Microsoft Azure platform, the Google Cloud platform, the Amazon Web Service platform. Every day we see new features, functionality, and announcements around deploying as a solution stack, around offering platform capabilities to simplify access to – and path to market for – the leading blockchain technologies.

The reality is IT departments clearly are not ready. If we were waiting for our customers’ IT departments to deploy our builds, we’d still be waiting. Of course, we were able to roll out some important and successful initiatives in February by working with key platform and technology partners R3 and Amazon Web Services playing key roles.

There is a lot of platform risk. There are currently four major platforms that I would consider in the distributed ledger/blockchain world. They are the Bitcoin blockchain, Ethereum, Hyperledger and R3’s Corda. A lot of people would argue for XRP and Iota and Eos and about 1,300 other names that would flood in, but those aren’t as clearly proven. Platform risk – staying on top of the developments, and ensuring you have a good fit for your use case – can make deployment tricky and cause development teams some heartburn.

OAG 360: From an oil and gas company perspective, how do you select a platform when there’s so much choice out there?

Honestly, in order to make the right choice, you need a high-level of sophistication regarding the platform and its capabilities. There is a sense that there’s still a lot of failing-forward experiments going on. I think platform risk is probably the most important consideration from an adoption perspective, at least for the people that are in charge of the computer assets inside a given enterprise.

Things are evolving every day. Every day we see more and more activity with people building out nodes, executing transactions or implementing smart contracts. And we see—every day—more and more new developments.

What I’ve personally experienced is that a lot of that stuff is more “road map” than reality at this point. But the amount of effort that’s being expended right now and the number of people trying to pull this stuff together is profound.

I personally believe that the “behind the firewall” concept, i.e. that a given oil and gas enterprise will do a lot of internal work with blockchain, is a bit flawed – for a couple of reasons. First, on the ledger, we do a lot of encryption and computing depending on what platform you’re using. Those resources are quite heavy. Most oil and gas companies have pretty rigid security policies. Generally, these are big, wide-area networks that already have secure protocols and data sharing protocols in place, in which case, why would they expend a lot of compute cycles to reconcile disputes inside a company behind a firewall or between parties one desk away?

Second, it’s not really a one-company, internal process. I think this ties to your first question about misconceptions. There’s a lot of talk about enterprise blockchain behind the firewall for single company needs. I don’t understand the value of blockchain in that scenario because –particularly in the work that we do in oil and gas—the value of the system is cases where there are counterparties at the table and they are transacting in a fashion that drives – or at least sustains – dispute.

OAG 360: Is the focus on clarity?

GuildOne President and CEO James Graham: Well, I think the key factor is that in oil and gas there’s a lot of disputes, from royalty disputes through contract disputes ultimately even volume disputes. Material disputes with high business impacts are between contractual partners, not internal disagreeing business units.

On the other hand, disputes with counterparties happen every day. I think that’s where the big happy paths for blockchain in oil and gas are. It’s that we don’t really trust our partners data or view of the contract. When you look at the custody transfer of the hydrocarbons all the way up to the settlement of the royalty contracts, there are disputes throughout, and there are multiple contract types throughout, with multiple terms, and we only share information at a very high, or aggregated level.

The big win for oil and gas is that blockchain allows us to have a common interpretation of the contract and share the same relevant facts. The terms of the contract are on the ledger and they’re shareable by all counterparties. So, we’re no longer fighting about the interpretation of the contract or the facts that are driving the value exchange and settlement. We effectively remove downstream disputes. Traditionally, counter-parties had major issues with trust, but a distributed ledger removes distrust as a concern.

I think another big win is clearly for the regulators, for the federal, state, province, and sector regulators. Who will be able to better understand industry activity and streamline reporting processes – and costs – by access to the same toolset. By giving them access to the tools and systems that the companies use to codify entitlements consensualize data.

I think the other big lift here is that oil and gas companies spend a lot of resources – not only trying to make their counter-parties happy when it comes to settling these contract entitlements — but also supporting all of the other stakeholders in Canada and the U.S., all the freeholders and the less sophisticated players who have entitlement against the volume flows.

We’re starting to see that companies can report their volumes in one place. We can then use those volumes to calculate everyone’s entitlement, including First Nations and farmers or other private freeholders. In that respect, blockchain democratizing the tools and systems to ensure that all parties receive their entitlements. The big win is a major reduction in the rework of contracts and reconciliation of volume that both parties currently perform when disputes impede business transactions – sadly all too often.

OAG 360:Do you see any major hindrances from adoption, besides the IT side? Especially in the U.S.?

GuildOne President and CEO James Graham: I think the software needs to mature. You have data at the heart of these systems and we work hard to obtain consensus on the data. But what does the end point look like for a given user or role? Until we have a user interfaces that make this comprehensible for all users and integrated into their day to day, we’re still somewhat behind the curtain for them. Currently, there is no wallet – for lack of a better term – that is simple enough that a farmer or land owner in the field can use it.

On the other side of the equation, how do traditional “big iron” systems that are currently deployed by oil and gas companies tie into this new distributed data platform we’re using? How do we make it practical for all of those user types, from farmers to First Nations to the majors?

OAG 360: So that’s where you see the future of blockchain moving towards?

GuildOne President and CEO James Graham: I definitely think we’re moving towards a scenario under which individuals and organizations have wallets, if you will–you could call them ledger positions—with tokenized assets that accrue and transact value based on their codified entitlements. Those interfaces are very primitive at this point in time. But, there’s so much reason to do it that it becomes inevitable – and the interfaces improve rapidly

The big question becomes “how do you make the transition?” You can’t just flip a switch and support all of these roles, but the lack of trust in all of these systems means we have to find a way to do it. Anybody who transacts on the current systems knows that almost nobody trusts the operator fully. So when you see that much contention, you see an opportunity to put a system in that will drive that trust and consensus.

The Oil and Gas Conference®

GuildOne is presenting at EnerCom’s The Oil and Gas Conference at the Denver Downtown Westin Hotel, Denver, Colo. Aug. 19-23, 2018. EnerCom expects to have more than 80 presenting oil and gas companies and more than 2000 financial professionals attending this year’s conference.

To learn more about the conference and presenter schedule, please visit the conference website here.