WildHorse is Presenting Tuesday, August 21st at the EnerCom Conference

WildHorse Resource Development Corporation (NYSE: WRD) reported on operating and financial results for the three months ended June 30, 2018.

Some of the operational highlights from its second quarter 2018 included an Increased average daily production by 107% to 46.7 MBOEPD compared to 22.6 MBOEPD for the second quarter 2017, it also brought online 28 gross (26.2 net) Eagle Ford wells, and crude oil realizations were 100% of WTI as a result of low differentials and favorable Louisiana Light Sweet (“LLS”) pricing.

WildHorse also announced that the Irene/Inez/Lero Eagle Ford wells, located in Brazos County reached their average final peak IP-30(1) of 788 Boe/d (89% oil) on an average 6,404’ lateral.

Financial highlights from second quarter 2018 and other recent highlights include:

- Reported a Net Loss of $14.1 million for the second quarter 2018

- Reported a Net Loss available to common stockholders of $22.1 million or $0.22 per share for the second quarter 2018

- Reported Adjusted Net Income available to common stockholders of $39.1 million or $0.39 per share for the second quarter 2018

- Reported Adjusted EBITDAX of $161.5 million for the second quarter 2018

- Issued an additional $200 million of 6.875% Senior Notes due 2025 in April 2018

In his prepared remarks WildHorse President Anthony Bahr discussed the in-field sand mine operations and other upcoming projects. “In the second quarter, we also made significant progress on our sand mine, WRD has received all the necessary permits from the Texas Commission on Environmental Quality and additional staff members with extensive sand mine experience have been added to our operations team. We are also constructing the wet plant with three towers already up.

Given our progress, the wet plant should begin washing and stockpiling sand soon. Construction has also started on the dry plant facility, drainage ponds are complete and the load-out facilities are currently under construction as well.

Our plan includes dedicated load-out silos for WRD sand requirements and separate dedicated load-out silos for potential third-party sales. With this design, WildHorse will have priority access; will never wait behind a third-party customer for sand.

WRD is also continuing to evaluate the potential for an in-field oil and produced water gathering system, as well as additional out-of-basin takeaway capacity. Our path forward on these projects should be finalized in the second half of this year. Currently, our crude realizations are approximately LLS pricing minus $4.50 per barrel, the accounting for end market supply and demand as well as the cost of transporting volumes to our various markets. I cannot emphasize enough the geographic benefits of our proximity to the Gulf Coast, which can get even better as we work on ways to further improve our netbacks.

In addition to the sand mine and midstream projects, we see additional ways to strengthen margins, including efficiencies on lease operating expenses. Our operations team recently reduced our chemicals usage and through optimization achieved the same result. In addition, we have executed procurement and labor contracts, which have also reduced our LOE. As a result of these efforts, LOE declined by 18% quarter-over-quarter to approximately $2.84 per Boe. The second quarter marked our first reporting period as an Eagle Ford pure-play. The timing of the North Louisiana divestiture could not have been better as LLS pricing remains robust and investors continue to gravitate towards oil producers.”

Excerpts from the Q2 Earnings Call are below:

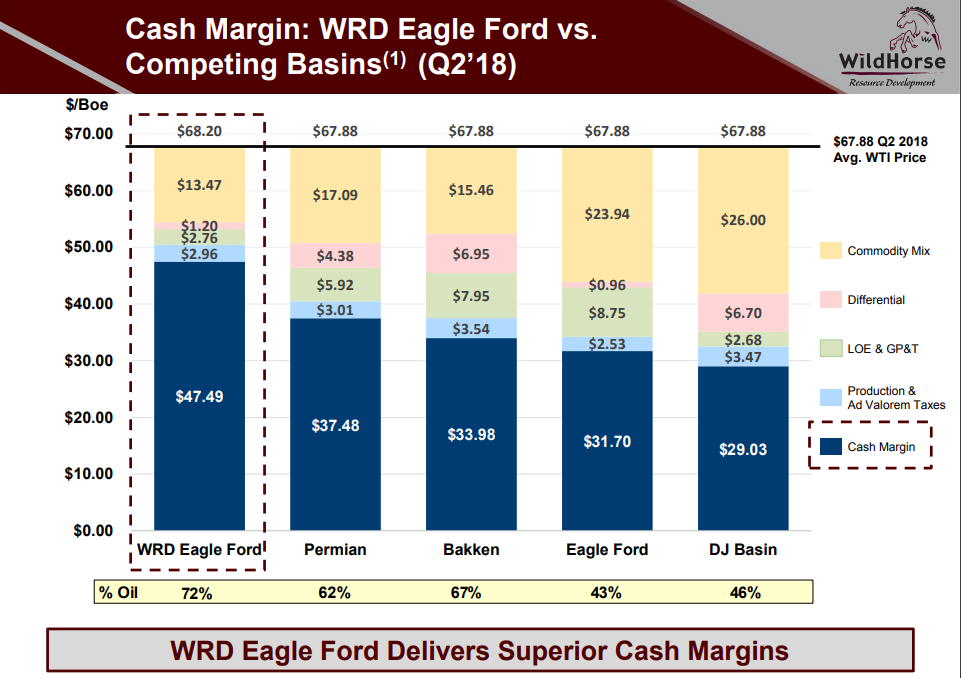

Q: You all obviously have one of the better cash margins in the E&P industry right now. So I’m just kind of curious when you are looking at this potential midstream solution, maybe if you all could talk about the different options that you’re looking at?

And then maybe also try to quantify, what the, per BOE savings could be of having an in-field midstream solution versus trucking barrels to the different pipelines?

Anthony Bahr, President and Member of the BOD: So there’s different phases to a potential midstream solution, obviously the first being the in-field gathering system, that helps obviously from a cost perspective. It also helps a little bit tangentially from field operations perspective. We expect to have some reductions in facilities costs for new wells, ongoing chemical and production costs related to our ability to move oil and water by pipe in the field and some of the efficiencies that come along with that. We’re probably not at the point yet we’re – because we haven’t finished negotiations on potential solutions about what the impact of margins on a absolute basis will be yet, except to convey that they will be better.

And then, as far from a base and takeaway perspective, the two obvious options are to either Houston or Corpus, and there are the existing pipelines that go to both of those locations now from our area. But all of those pipelines are intended to add capacity. So, additional capacity to either one or potentially both of those markets is an option.

Again, I don’t have good direction yet on the magnitude of the improvement in netback except to say that it will be better than our current position, which is good, and there is the potential for it to be very much better. We – we’ve mentioned in the commentary that the pipeline capacity out of the basin is currently full for all intents and purposes. And so, incremental barrels out of our portion of the Eagle Ford are all being trucked to their final destination, I guess is one way of saying it either to Houston, we do truck some barrels down to Cuero to get into Kinder Morgan’s land that’s about a 120 miles.

So, we’re not as far away from an ultimate market as the Permian is, but costs incrementally at the margin are going to continue to rise as we go forward into 2019, because of pressures from the transportation side of the business. But all-in, we’re really excited about a potential midstream option and the benefit that it’s going to bring back to the company in terms of margin bettering our already good margins.

The Oil and Gas Conference®

WildHorse Resource Development is presenting at EnerCom’s The Oil & Gas Conference® at the Denver Downtown Westin Hotel, Denver, Colo. Aug. 19-22, 2018. EnerCom expects to have more than 80 presenting oil and gas companies and more than 2000 financial professionals attending this year’s conference.

To learn more about the conference and presenter schedule please visit the conference website here.