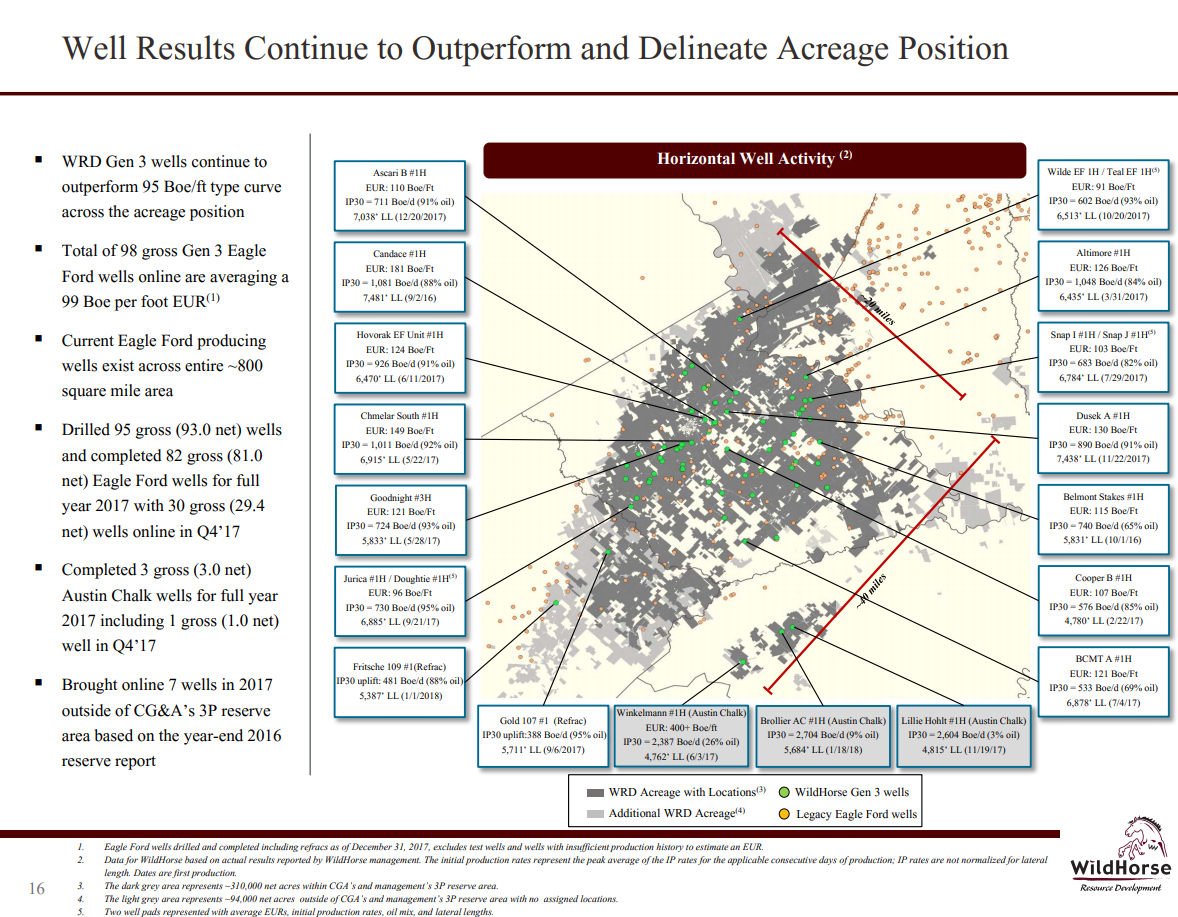

Almost 100 Gen 3 Eagle Ford wells were online by yearend of 2017

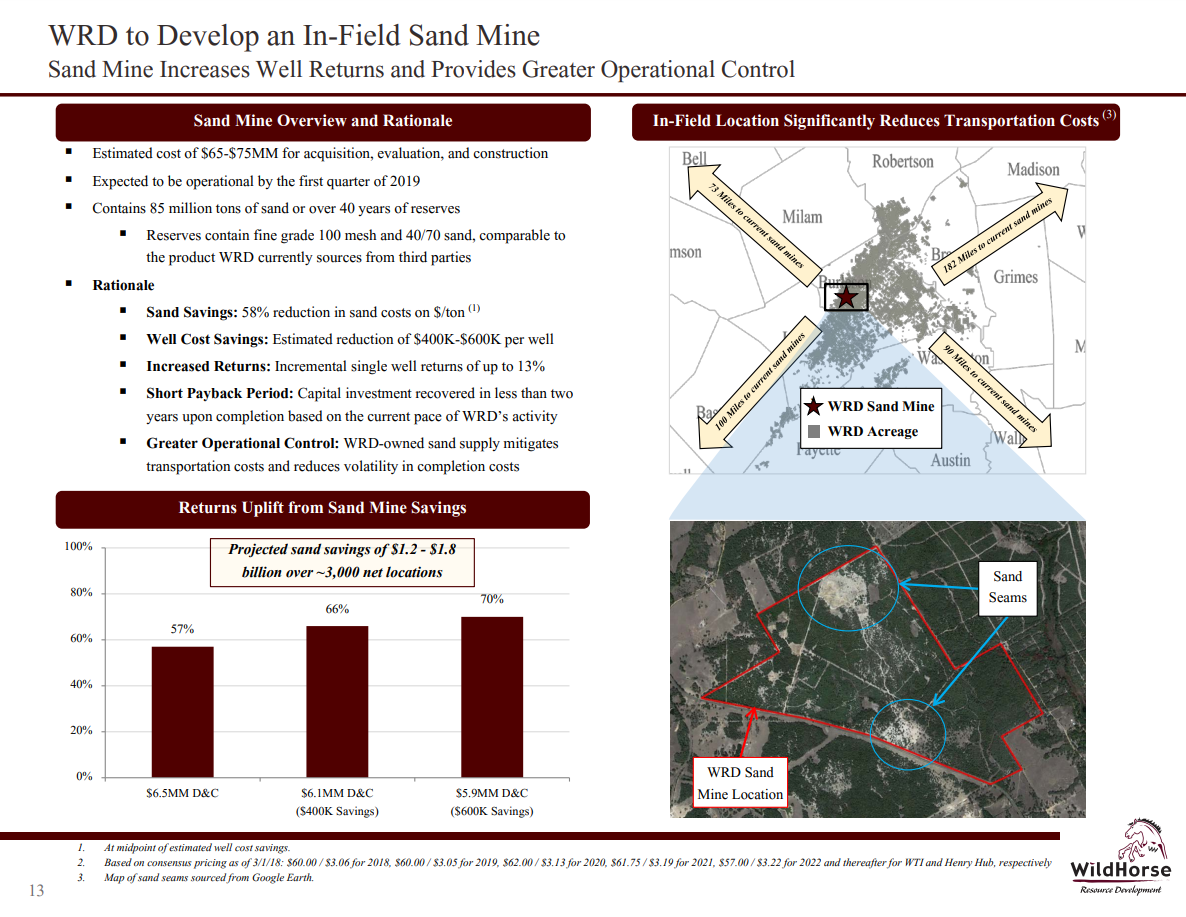

2018 Eagle Ford: WRD plans own in-basin sand mine, could reduce well costs $400,000-$600,000 per well

WildHorse Resource Development Corporation (ticker: WRD) reported a net income of $14.1 million for Q4 2017. For 2017, the company reported a net income of $49.9 million. Net income available to common stockholders was $5.6 million, or $0.06 per share for Q4 2017 and $31.1 million, or $0.32 per share, for the full year of 2017.

In Q4 2017, the company delivered an average daily production rate of 45.9 MBOEPD and for the full year of 2017, WildHorse produced 30.7 MBOEPD – this exceeded the mid-point of the company’s annual guidance by over 1.7 MBOEPD.

Q4/2017 – wells, reserves and highlights

The company brought online 37 gross (35.7 net) horizontal wells in Q4 2017, including 30 gross (29.4 net) wells in the Eagle Ford, one gross/net Austin Chalk well and six gross (5.3 net) wells in North Louisiana. Additionally, the company brought online 10 gross wells on the Anadarko/KKR acquired acreage and two additional Eagle Ford step out wells. In the Eagle Ford, the company posted an average drill time of 13.8 days from spud to rig release, on all of its Eagle Ford rigs in Q4.

Overall for 2017, WildHorse brought online 93 gross (90.7 net) horizontal wells, including 82 gross (81.0 net) Eagle Ford wells, three gross/net Austin Chalk wells and eight gross (6.7 net) wells in North Louisiana.

A total of 98 Gen 3 Eagle Ford wells were online as of year-end 2017, the company reported.

- The company increased proved reserves by 198% to 454.3 MMBOE at year-end 2017, from 152.5 MMBOE at year-end 2016

- Increased PV-10 of proved reserves by 372% to $3.539 billion at year-end 2017 from $750 million at year-end 2016

- F&D costs, excluding acquisitions and price revisions, averaged $3.36 per BOE

- Closed $594 million Anadarko/KKR acquisition of approximately 111,000 net acres in the Eagle Ford

- Closed financing of $435 million in stock (Series A Perpetual Convertible Preferred Stock)

- Issued $500 million of senior unsecured notes due 2025 at 6.875%

“We are very proud of our achievements in 2017. In the matter of a year, we have more than doubled our production, reserves and PV-10 valuation… In addition, our location count has grown significantly, our Austin Chalk wells continue to outperform expectations and our Eagle Ford type curve has been raised for the fourth time since our Eagle Ford drilling program began in 2014,” said Chairman and CEO Jay Graham.

2018: WRD plans to have own in-basin sand mine, could reduce well costs $400,000-$600,000 per well

“Our planned in-field sand mine will set WRD on a course which takes advantage of our size and scale in the basin and could reduce well costs from $400,000 to $600,000 per well. We look forward to executing our 2018 plan and delineating even more of our acreage position,” added Graham.

2018

Q1 2018

WildHorse closed the acquisition of 17,453 net acres and 110 net locations in Lee County, TX for approximately $18.6 million.

The company also divested its North Louisiana assets to a third party for consideration of $217 million in cash and up to $35 million based on the number of wells spud on the North Louisiana assets over the next four years. The sale is expected to close on or about March 30, 2018 with an effective date of January 1, 2018.

Development, guidance

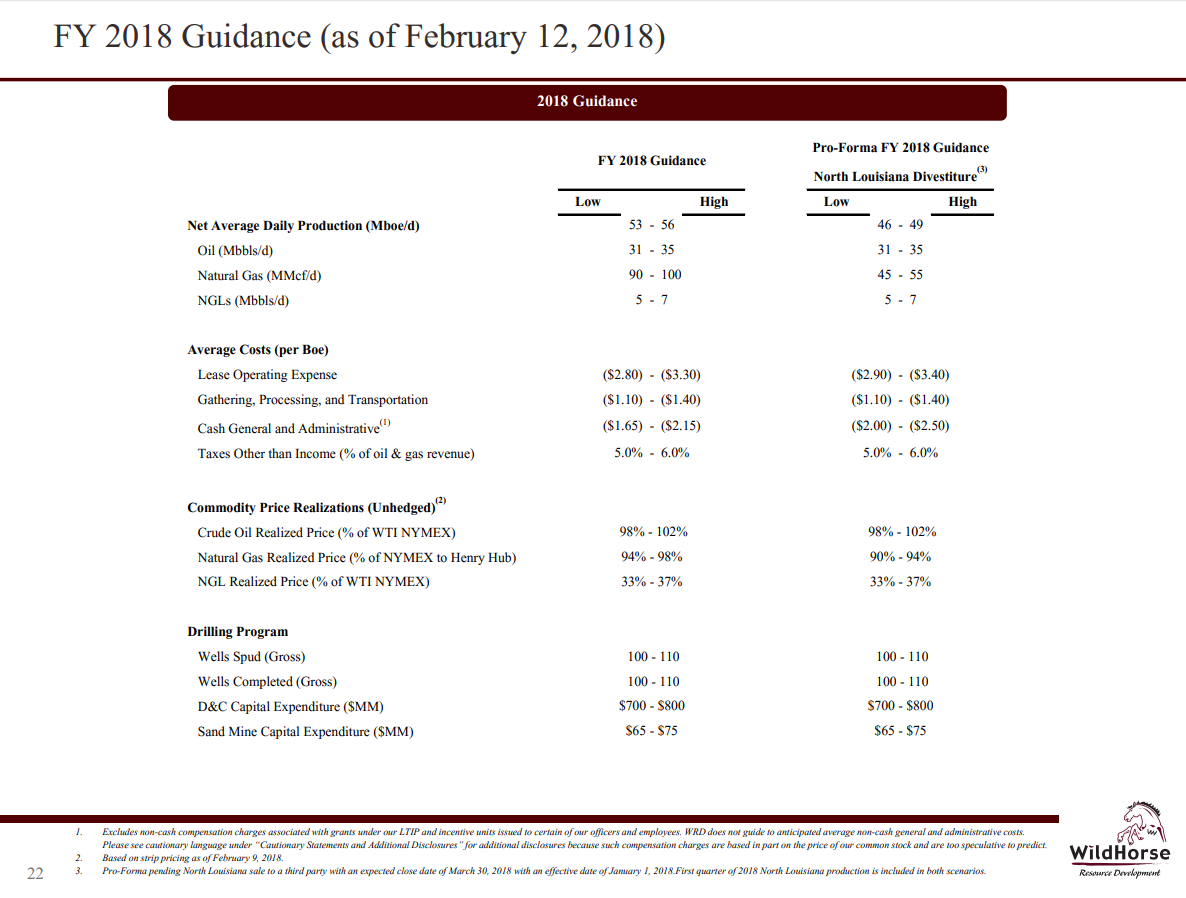

WildHorse projects 2018 average daily production between 53-56 MBOEPD, consisting of 31-35 MBbls/d of oil, 90-100 MMcf/d of natural gas and 5-7 Mbbls/d of NGLs. At the mid-point of guidance, this represents a total production growth rate of 78% over 2017’s average daily production.

The company estimates a fiscal year 2018 D&C CapEx budget of approximately $700-$800 million. Drilling and completion activity will be weighted toward the first half of 2018 as WRD transitions from 7.0 rigs at the beginning of the year to 4.0 rigs at mid-year for an average of 4.8 rigs in the Eagle Ford and Austin Chalk during 2018. In addition, WRD expects to transition from 4.0 completion crews in the first half of the year to 3.0 completion crews in the second half of 2018.

The budget also allocates between $65-$75 million of non-D&C capital expenditure for the acquisition, evaluation and construction of WRD’s recently announced sand mine, which is expected to produce savings of $400,000-$600,000 per well upon completion by the first quarter of 2019.

WRD expects its capital budget to be funded by cash on hand, the anticipated proceeds of the North Louisiana divestiture and borrowings under its revolving credit facility.

For the full year 2018, WRD expects to spud 100 to 110 gross wells and to bring online 100 to 110 gross wells which include 90-100 Eagle Ford wells and eight Austin Chalk wells. For wells brought online in 2018, WRD estimates an average working interest of approximately 93% in the Eagle Ford and 96% in the Austin Chalk.