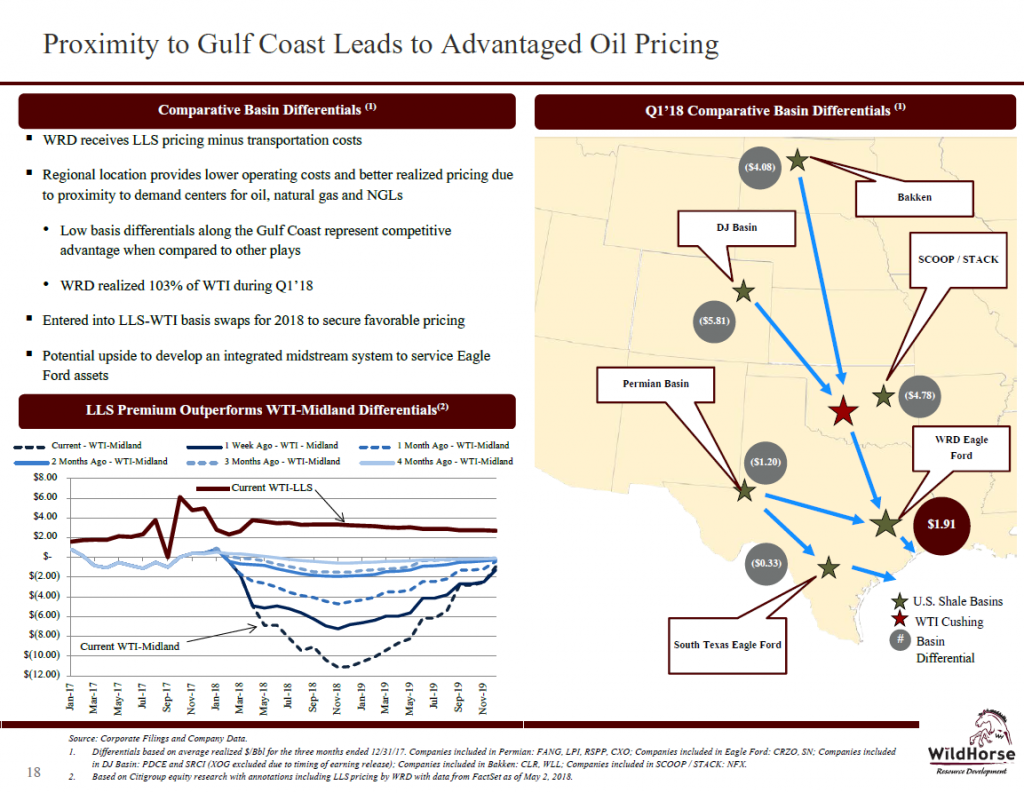

WildHorse Resource Development Corporation (ticker: WRD) reported a net loss available to common stockholders of $123.2 million in Q1 2018, or $(1.24) per share. Net production was 52.4 MBOEPD for the quarter, consisting of 60% oil, 31% natural gas and 9% NGLs. The company said it realized 103% of WTI during Q1 2018.

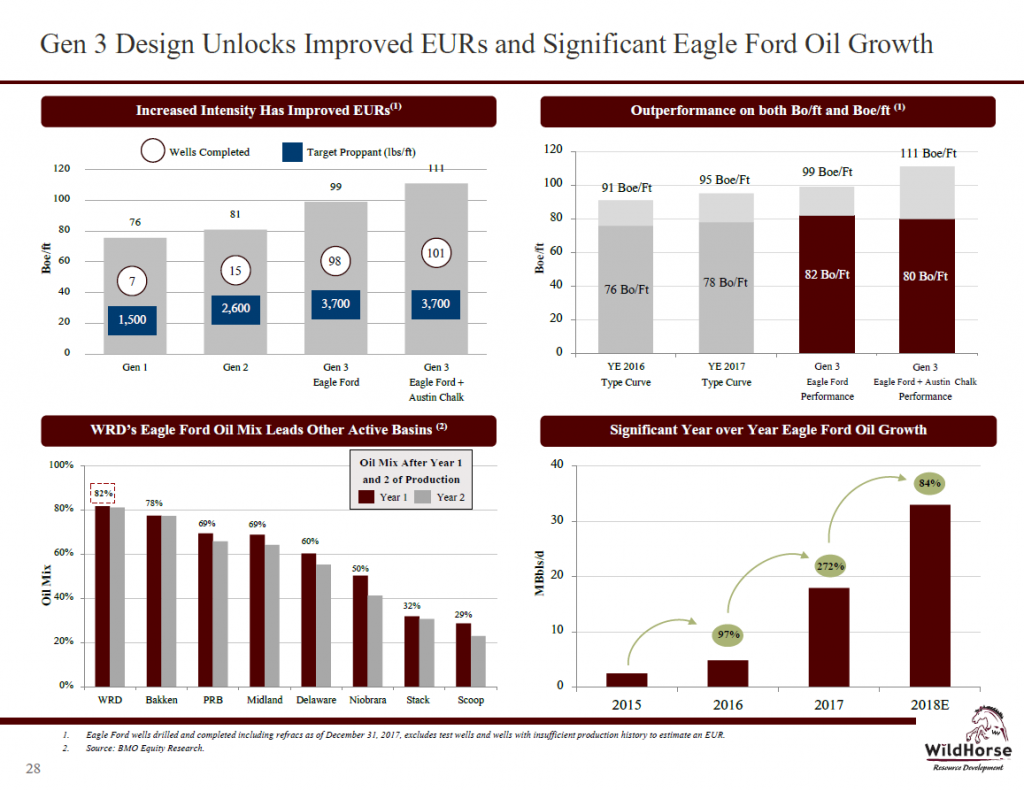

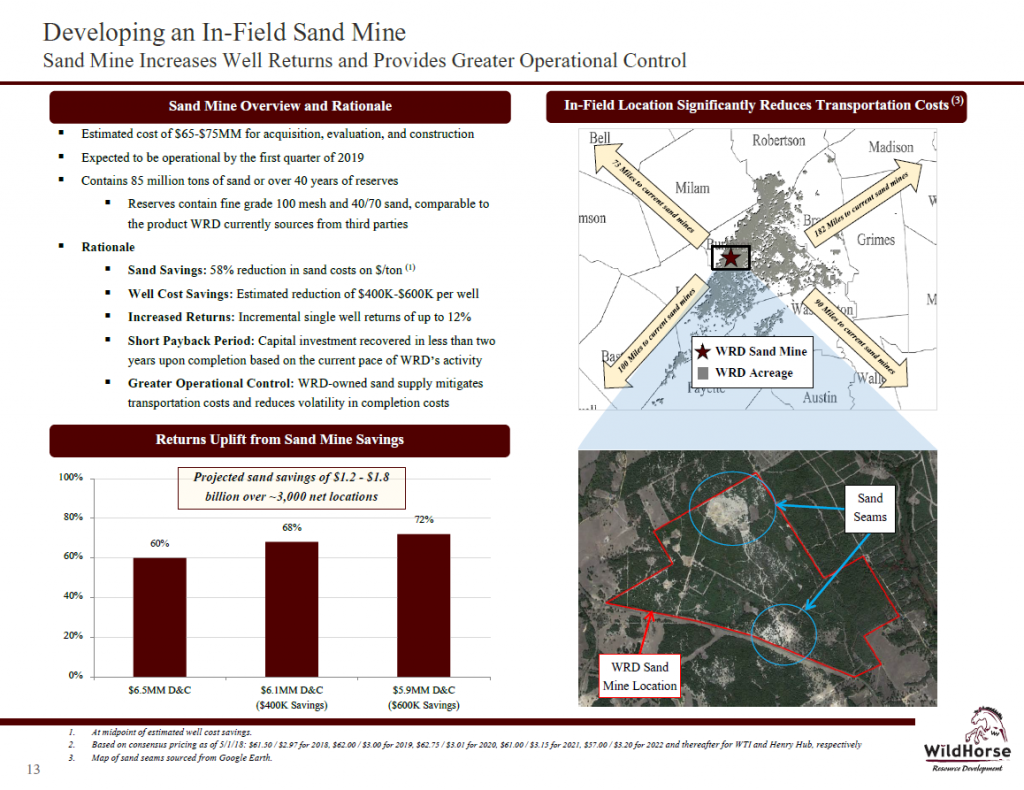

“In 2018, we are further optimizing our completion design in preparation for full field development and are building economies of scale with our in-field sand mine,” Chairman and CEO Jay Graham said. “In addition, we are further investing in technology with upcoming diverter and stage spacing tests, permanent fiber optics installation, and microseismic analysis.”

Austin Chalk, Eagle Ford

WRD brought online a total of 23 gross (22 net) wells, including 19 gross (18.4 net) Eagle Ford wells and 4 gross (3.6 net) Austin Chalk wells, along with six Eagle Ford refracs in Q1 2018.

In the Austin Chalk, the Brollier AC #1H has reached its final peak 24-hr rate of 3,416 BOEPD and an IP-30 of 3,030 BOEPD or 18.2 MMcfe/d (62% natural gas, 30% NGLs and 8% oil) on a 5,684’ lateral.

In the Eagle Ford, the Irene, Inez and Lero wells have averaged a peak 24-hr rate of 941 BOEPD at 90% oil and an IP-30 rate of 778 BOEPD (90% oil) on a 6,404’ lateral. WildHorse said that these wells represent the most northeastern Gen 3 wells drilled to date. WildHorse increased its average daily Eagle Ford production by 251% to 40.4 MBOEPD for Q1 2018, compared to 11.5 MBOEPD for Q1 2017.

Spending

D&C capital expenditures totaled $216.7 million in the first quarter of 2018, and sand mine expenditures totaled $9.3 million (comprised primarily of property acquisition costs).

Exploration expense was $1.7 million for the quarter, with LOE at $16.4 million ($3.48 per Boe) and gathering, processing and transportation costs at $1.4 million ($0.29 per Boe).

Conference call Q&A excerpts

Q: You’re going from six rigs to maybe four rigs in the second half of the year. Is part of the thinking, “get the sand mine up and running” before potentially adding a rig or two as you get into 2019, or are you comfortable with that four-rig program?

President Anthony Bahr: Well, we’re not changing our guidance right now.

Our plan for 2018 has us slowly decreasing rigs. We had one rig running in North Louisiana that departed with the sale and we have dropped one rig in the Eagle Ford. So, we’re currently at five rigs, which is right on plan. And at the present time, we’re maintaining our guidance right now to average 4.8 rigs for the year.

But directionally, you’re not far off. Yes, we want to get the sand mine up and running to begin to really achieve those savings at the well level investment and then we’ll integrate that in with the rest of our planning process and see when it’s appropriate to increase activity.

Q: You all are doing more pad drilling this year than you had, I think, last year. Are you all seeing the cost benefits on wells, on pads versus maybe standalone HBP-type drilling and maybe somewhat quantify that or has that just offset inflation?

COO and EVP Steve Saad Habachy: The short answer is yes, we are seeing the benefit as we’re transitioning into multi-, three- and four-well pads.

It really stems from a couple things… times being reduced, obviously, now you’re drilling three or four wells versus one or two. So you’re moving less days, which translates into incremental drilling time.

And the same thing on the completion side, less… days associated with your completion crews. You can park that crew and frac three or four wells versus one or two. So all that’s translating into more operational execution time versus kind of NPT time.

So, we’re definitely seeing the benefit, in conjunction with other things we’re doing from a technical perspective to continue driving our cycle times down.

Q: You put in some LLS basis hedge for oil, $3 premium and about $3 million all the way out to 2020.

So I’m kind of curious as to the split between 2018, 2019 and 2020. And related to that is really your view on how the LLS premium will hold up once the debottlenecking happens for the Permian, I guess you’re talking about mid-2019. How do you envision this unfolding?

CFO and EVP Andrew J. Cozby: So, our WTI and LLS oil basis hedges are for fiscal year 2018 only. So, we’ve got about 17,000 barrels a day hedged for the remainder of the year, which is in that 50% range of our expected production. That’s at $3.03. We think that strikes the balance we achieved.

The proximity to the Gulf Coast is going put us in a comparatively advantaged position anyway. And so, we continue to, with our hedging program, is designed to protect the balance sheet and ensure that we’re going to develop actively across multiple years because the objective is with this significant footprint is to continue to develop a quarter of our acreage, 94,000 net acres, where we’ve got legacy Gen 1 wells, but not our Gen 3 wells on, and continue developing that successfully.

Bahr: Just to elaborate a little bit on the future for LLS. As everyone on the call knows, the ability to export crude out of the U.S. and in particular, the Gulf Coast, has really made the Gulf Coast oil markets a very dynamic place, and being able to forecast six months or even a year or two years into the future.

What’s going to happen on that with any level of certainty, I think, is difficult, which is why I want to try to maintain the maximum amount of flexibility that we can.

And as Drew said, comparatively, we’re going to be advantaged to everybody else anyway due to our proximity. So, we don’t want to pin ourselves down too much long term with regards to differentials because of the uncertainty about what’s going to happen.

But regardless of what happens, I think we’re going to be in a good spot.