Wells Fargo sees market balance in 2016

A recent note from Wells Fargo Equity Research highlights the continued unresponsiveness of production in the face of low oil prices, but the analysts say they expect the market to rebalance in 2016. “Given OPEC’s continued focus on market share and the lack of production response thus far to lower drilling/spending from non-OPEC, the global oil market is likely to remain sloppy for a bit longer,” read the note. The question is how long is “a bit longer”?

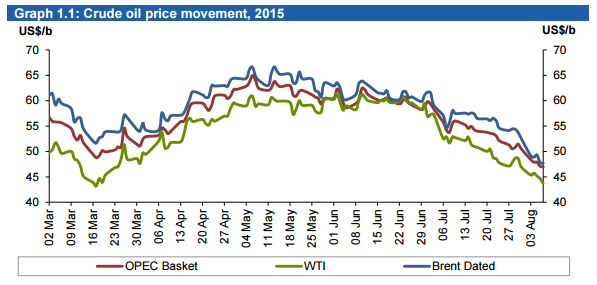

In its most recent Oil Monthly Report, OPEC reported that it produced 31.51 MMBOPD in July, an increase of 101 MBOPD, despite a continued glut in crude oil.

The good news, says Wells Fargo, is that global demand is responding to lower prices, with the bank predicting demand to grow by 1.6 MMBOPD and 1.5 MMBOPD in 2015 and 2016, respectively. While oversupply continues to outpace demand growth, the imbalance should disappear through 2016. “Highlighting this view, the IEA expects 2016 demand growth and static non-OPEC growth to result in the call on OPEC supplies increasing by 1.4 MMBOPD next year. This would create a balanced market in 2016.”

OPEC’s Secretary General Abdalla Salem El-Badri shares Wells Fargo’s view as well. “Despite continuing uncertainties, there are possible signs of achieving a more balanced situation in the oil market and to stabilize by 2016,” El-Badri said in a joint statement with Russian Energy Ministry Aleksandr Novak.

Will shale momentum sink Saudi?

The OPEC decision to continue producing instead of supporting prices was spearheaded by the group’s largest producer, Saudi Arabia, in a move many believed was to push U.S. shale production out of the market. The Kingdom’s decision not to support prices may have backfired, however, leaving Saudi Arabia “beached,” according to the Telegraph’s Ambrose Evans-Pritchard.

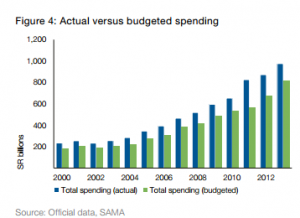

Roughly 90% of Saudi Arbia’s budget depends on oil revenues, and with shale production continuing to increase per well despite lower rig counts, Saudi Arabia is having to burn through its sovereign wealth fund. And Saudi Arabia may have to continue relying on its sovereign wealth fund, even if prices come up further, says Evans-Pritchard.

Saudi Arabia subsidizes a number of energy related services, and charges citizens no tax on income, interest or stock dividends. The International Monetary Fund estimates that the budget deficit will reach 20% of Saudi Arabia’s GDP, or roughly $140 billion, this year as the Kingdom continues to replace lost oil revenue with money from its sovereign wealth fund.

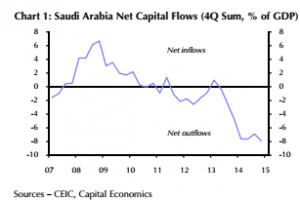

Khalid Alsweilem, a former official at the Saudi central bank and now at Harvard University, said the fiscal deficit must be covered almost dollar-for-dollar by drawing down reserves. “We are much more vulnerable,” said Alsweilem, commenting on the fact that Kuwait, Qatar and Abu Dhabi all have three times greater reserves per capita than Saudi Arabia. “That is why we are the fourth rated sovereign in the Gulf at AA-. We cannot afford to lose our cushion over the next two years.”

Saudi’s financial reserves peaked at $737 billion in August of 2014. They sat at $672 billion in May 2015, but at current oil prices they are falling by at least $12 billion per month.

OPEC’s permanent headwind

Continued low prices may put some of the more highly-levered U.S. producers out of business, but the wells and infrastructure will remain for stronger companies to pick up. “Once oil climbs back to $60 or even $55 – since the threshold [for shale production’s breakeven] keeps falling – they will crank up production almost instantly,” said Evans-Pritchard. “OPEC now faces a permanent headwind. Each rise in price will be capped by a surge in U.S. output.”

“In hindsight, it was a strategic error to hold prices so high, for so long,” said Evans-Pritchard. Maintaining $100 per barrel of oil allowed shale producers to develop technology they could use even as prices began to sink. If prices remain on their current course, the Saudi sovereign fund could be down to $200 billion by the end of 2018, a fact that will likely send capital out of the country at increasing speeds says Evans-Pritchard.

Rampant social spending, on top of financing its involvement in Yemen may drain OPEC’s largest producer long before it kills shale development in the U.S. “The Saudis are now trapped,” said Evans-Pritchard. Any increase in price will bring along with it more shale production, and with its sovereign fund being drained at an incredible rate, a stable market in 2016 may not be enough to support Saudi Arabia.