U.S. will be “NGL Storage Center for the World”

New technology in the drilling and completions segment may receive the lion’s share of the credit for the shale boom, but the evolution of the midstream industry has enabled the United States to fully capitalize on our newfound domestic production capacity.

In an Oil & Gas Journal webcast titled “U.S. Midstream Industry: At Another Crossroads,” the Journal welcomed two experts on the midstream sphere to discuss the evolution of the segment and what we can expect in the future. Daniel Lippe, Founder of Petral Consulting, and Lesa Adair, Chief Executive Officer of Muse Stencil, both weighed in on the pipelines and processing infrastructure that has been trying to keep pace with the feverish increase in production volumes.

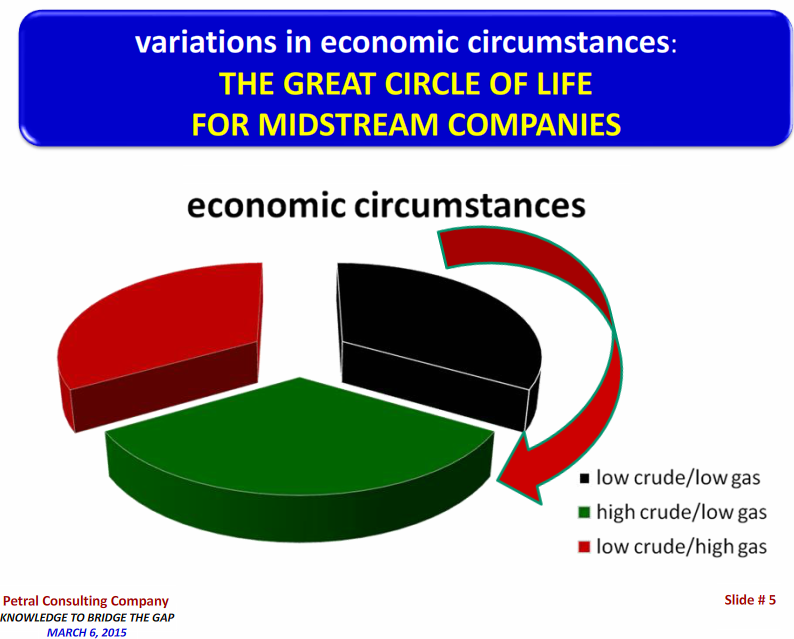

“We’re about to take a pause in what has been a breakneck pace of infrastructure due to the slower production growth,” Lippe said in regards to the current downturn. He explains we have typically lived in the “high crude – low gas” cycle in the midstream circle of life, but are at risk of moving into one of the other two cycles. The “low crude – high gas” scenario is typically the worst case scenario for midstream companies because of the lower margins. “Low crude prices are something you don’t want to have in the gas processing business,” Lippe said.

“We’re about to take a pause in what has been a breakneck pace of infrastructure due to the slower production growth,” Lippe said in regards to the current downturn. He explains we have typically lived in the “high crude – low gas” cycle in the midstream circle of life, but are at risk of moving into one of the other two cycles. The “low crude – high gas” scenario is typically the worst case scenario for midstream companies because of the lower margins. “Low crude prices are something you don’t want to have in the gas processing business,” Lippe said.

Chances are, the downswing in crude prices has affected independent companies in one of two ways; one, the highly levered companies are looking at ways to help their balance sheet, and two; companies with healthy balance sheets ready to take advantage of their highly levered peers.

“We had a lot of clients who were struggling to break into the industry in the past few years, but that has all changed with the lower commodity environment,” said Adair. “Threats like the price downturn can create opportunities, like reducing construction costs, retiring debt and jumping into plays by means of acquisition or joint ventures.”

Midstream has Evolved

The introduction of hydraulic fracturing introduced high volumes of various hydrocarbons, including different forms of gas. As the gas extraction began its ascent, particularly thanks to the Appalachia region, different forms of fractionalization and processing were needed to effectively separate the rich gas. Adair says: “In 2007, there was nothing going on in the Marcellus. Fast forward to 2012, 2013 and so on, there was an explosion of infrastructure than can now stand alone. A lot of capacity has been added and we expect to see more in order to optimize its netbacks.”

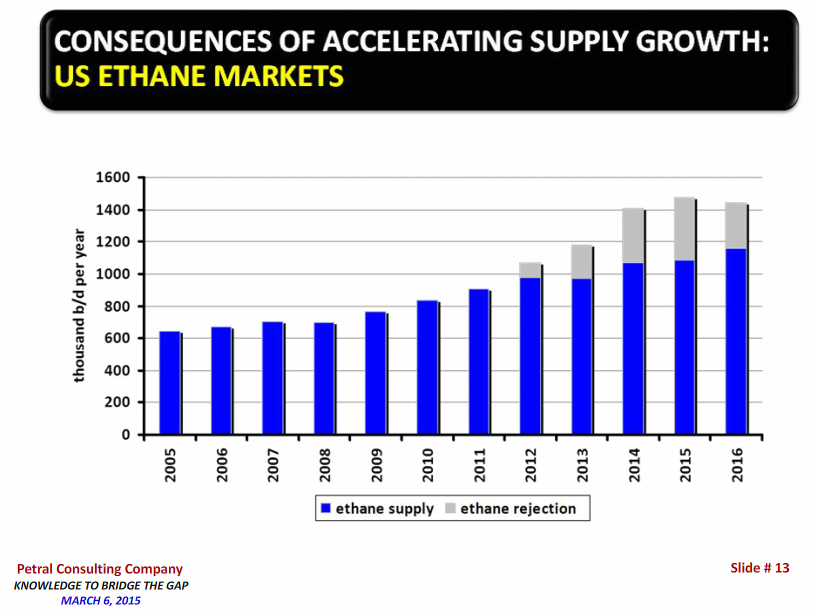

The U.S. was recovering so much gas that the amount of ethane became somewhat troublesome – operators began rejecting the hydrocarbon in 2012. Some producers such as Range Resources (ticker: RRC) have turned a potential problem into an asset by creating its own ethane market, can move 75,000 barrels of ethane per day to three different hubs. “I think we have the best ethane portfolio that I’m aware of,” said Jeff Ventura, Chief Executive Officer of RRC, at a conference last year. “Once all three pipelines are running, net (revenue) to us is a 25% cost uplift as opposed to selling as BTU.”

The U.S. was recovering so much gas that the amount of ethane became somewhat troublesome – operators began rejecting the hydrocarbon in 2012. Some producers such as Range Resources (ticker: RRC) have turned a potential problem into an asset by creating its own ethane market, can move 75,000 barrels of ethane per day to three different hubs. “I think we have the best ethane portfolio that I’m aware of,” said Jeff Ventura, Chief Executive Officer of RRC, at a conference last year. “Once all three pipelines are running, net (revenue) to us is a 25% cost uplift as opposed to selling as BTU.”

The need for ethane capacity led to the largest building boom in U.S. chemical history, says Lippe. Enterprise Products Partners (ticker: EPD) expects to complete its ethane export facility in 2016 and had already secured 85% of its volumes for long-term commitments in August 2014. In the short-term, the United States is emerging as the most influential supplier for Northwest Europe in wake of the complications with Russia.

Global Supplier

The oncoming LNG infrastructure will impact the global market on different levels, says Lippe. The variations between nations are extensive and many will use certain spot prices as a bargaining chip. Supply and demand in Asia and Europe has a direct effect on Mont Belvieu prices, but Lippe says “everything competes with everything” in the U.S. Gulf. Adair adds that the expansion of the Panama Canal will only further integrate United States products into the global market.

The supply growth in the United States has essentially squeezed out the NGL market in Africa, and operations in Northwest Europe may be next. The game of garnering a market share will become intense once U.S. export terminals come online, and Asia is going to be the target. “Everybody in the world is competing for those markets,” said Lippe.

More Changes Needed

Lippe was adamant with his belief that the United States needs to reconfigure its infrastructure layout, and believes this downturn is not like most surpluses. “Most times, the surplus is worked off in eight to 12 months, but this time is different,” he said, adding that he sees less expansion in the market through 2017 as opposed to the previous three years.

Even though infrastructure build-out may slow in the short-term, Lippe points out that we need more storage capacity – a popular subject considering U.S. crude storage is the highest on record. “Every salt cavern storage facility has probably been as full as you can get in the midcontinent. The Northeast doesn’t have nearly enough to accommodate everything. If you run out of storage capacity, you have to move them to by rail to the gulf coast and prices will drop even more.”

All things considered, the surplus is still a luxury as opposed to a problem. The United States’ rebranding into a producer rather than a consumer will continue, regardless of the commodity downturn. “We are going to be the storage center for the world, considering our capacity for exports,” he said.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.