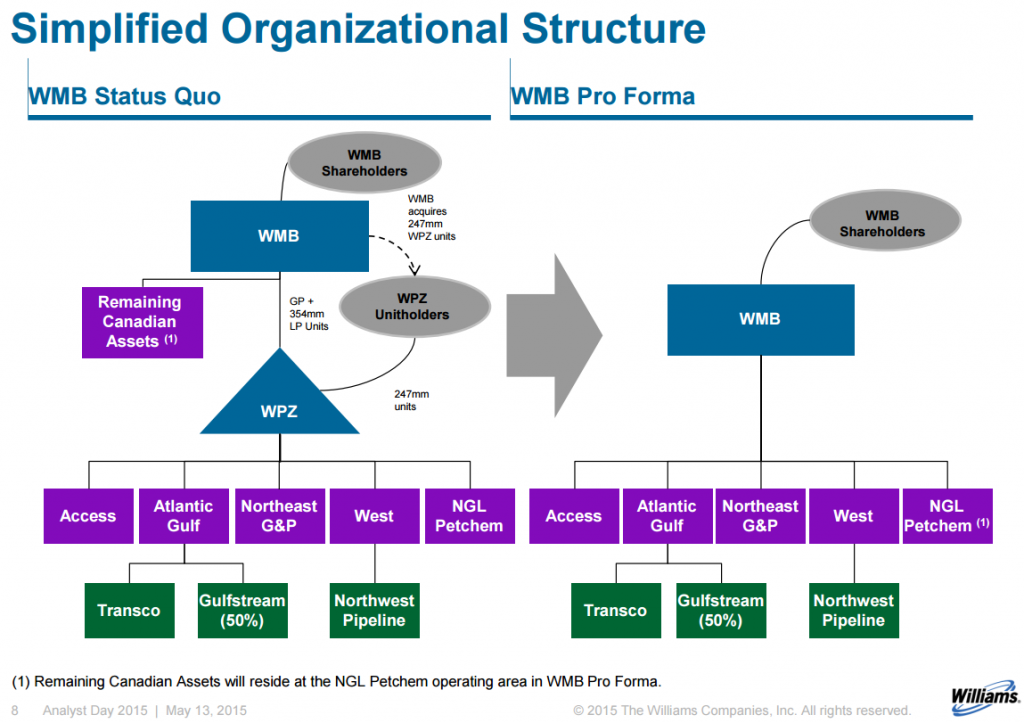

In a move designed to simplify the corporate structure, streamline governance and position itself for investment-grade ratings, Williams (ticker: WMB) is merging with its limited partnership subsidiary in an all stock-for-unit transaction. The merger is valued at $13.8 billion and is expected to close in the fall of 2015.

Williams owns 60% of its subsidiary, Williams Partners (ticker: WPZ), and is one the largest oil and gas infrastructure providers in North America. WPZ’s pipeline footprint spans more than 33,000 miles and touches approximately 30% of U.S. natural gas.

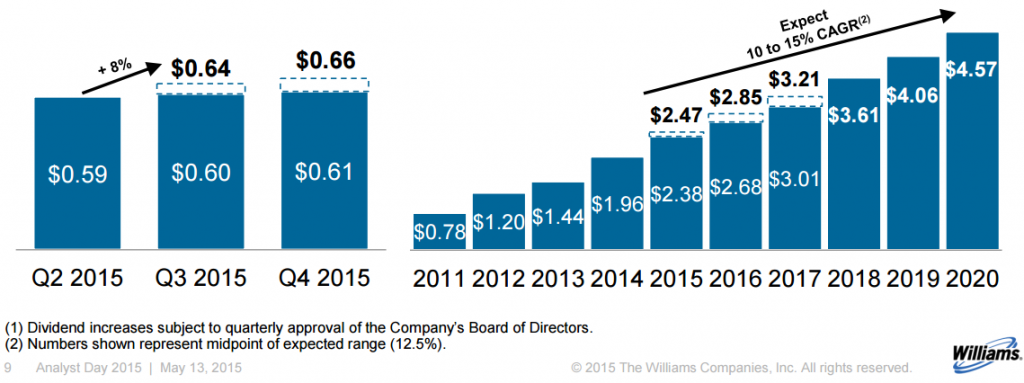

WPZ unitholders are in line to receive 1.115 WMB shares per unit, representing a 12.6% premium to its 20-day average closing price. WPZ’s transferred units will represent 27% of the combined entity. WPZ stock ended 22% higher after the announcement on May 13, 2015. The Williams conglomerate plans on increasing its dividend to $2.64/share on an annualized basis in Q3’15 and expects annual dividend growth of 10% to 15% through 2020.

“We anticipate significant market valuation upside and lower cost of capital for new fee-based growth projects along with incremental growth through strategically aligned M&A activities,” said Alan Armstrong, President and Chief Executive Officer of Williams. “Our roster of large-scale, fully contracted infrastructure projects will drive extraordinary adjusted EBITDA growth from an expected $5.4 billion in 2016 to $6.8 billion in 2018.”

MLP Atmosphere

Simplifying and uniting company structures have been a common plan of action once a company has arguably outgrown its MLP structure. Kinder Morgan (ticker: KMI) initiated the largest subsidiary consolidation last year, merging its three subsidiaries into its general partner in a deal valued at $70 billion. Energy Transfer Partners (ticker: ETP) followed suit in January 2015 with the $18 billion merger of Regency Energy Partners (ticker: RGP), which was owned by the same general partner. Williams and Kinder Morgan both announced dividend increases along with planned dividend growth of at least 10% annually through 2020 in conjunction with the announcements.

MLPs, popular among investors for their dividend and growth structure, have become a rarity in the new commodity environment. Only two energy MLPs have either filed or commenced their initial public offering (IPOs) in 2015 to date. By comparison, 12 energy MLPs commenced their IPOs in both 2014 and 2013.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.