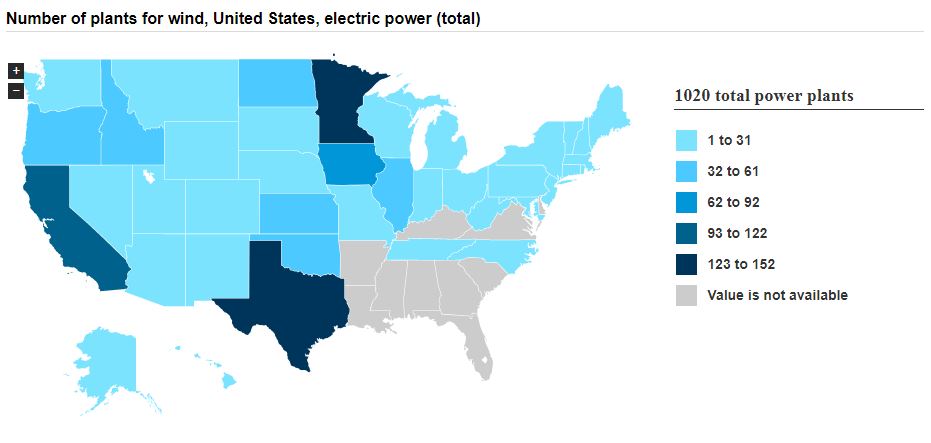

In Texas wind is big: it’s in the top two states for wind power plants

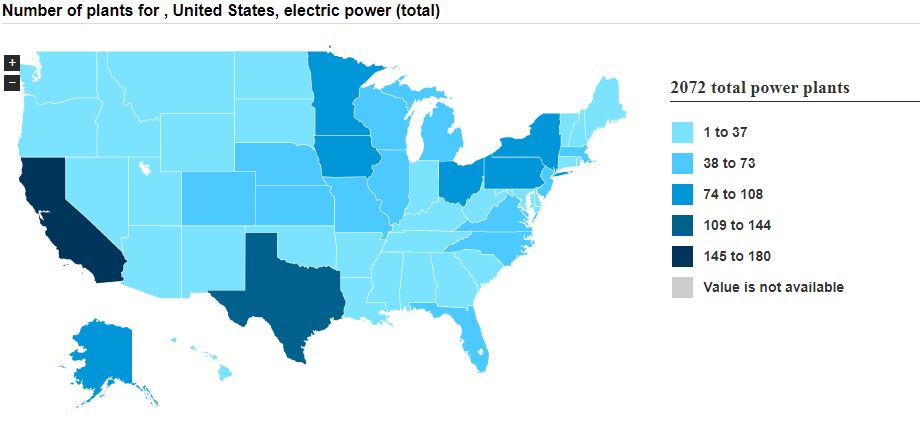

Electricity generation from wind in the United States has increased from about 6 billion kilowatthours (kWh) in 2000 to about 254 billion kWh in 2017, according to the EIA. That means wind power in the U.S. increased by a factor of 42 in 17 years. And it’s still growing.

In 2017, wind turbines in the United States were the source of nearly 6.3% of total U.S. utility-scale electricity generation, according EIA data.

There are currently 33,000 MW of new wind resources under consideration or development for Texas and leading that charge is Iberdrola. Ibreloa is a Spanish utility company that is planning to put $1 billion into new wind projects in Texas.

Iberdrola’s new Texas project will add 725 MW of wind power rivaling that of the Roscoe wind farm.

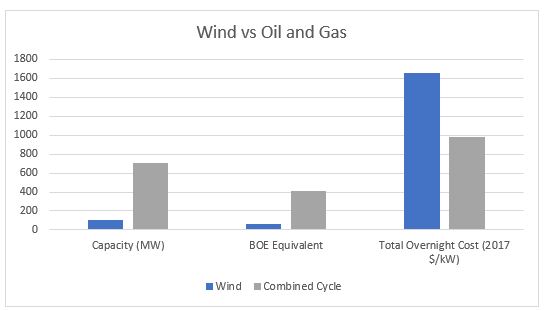

What does wind generation cost to build?

The costs for a single utility scale wind turbine range anywhere from $1.3 million to $2.2 million per MW of nameplate capacity installed. Most of the commercial-scale turbines installed today are 2 MW in size and cost roughly $3-$4 million installed.

The average size of an onshore wind farm has a capacity of 100MW with a lead time of 3 years, according to the EIA. The total overnight cost is $1,657/kW with fixed operation and maintenance costs of $47.47/kW/yr. Overnight cost refers to the cost of a construction project if no interest was incurred during construction, as if it were built ‘overnight’.

According to the American Wind Energy Association “The U.S. wind industry has recruited nearly $90 billion of private investment into new energy infrastructure over the past 5 years.”

Comparison to natural gas fired power plants

According to the EIA a combined cycle plant on average has a capacity of 702 MW and a lead time of three years as well. The total overnight cost for this plant is $982/kW and fixed O&M costs of $11.11/ kW/yr.

To put things into perspective 1MW equals approximately .59 BOE, and in 2016 the EIA reported that the average annual electricity consumption for a U.S. residential customer was 10.8MW. The EIA also reported that for July 2018, the average new-well oil production per rig in the U.S. was 677 barrels/day. Meaning that each rig could potentially yield enough energy to power to 41,610 homes annually.

It is important to keep in mind that the capacities of each power generation source are if the facility is at maximum usage. For example, a 1 MW power plant produces 1000 kilowatt-hours of power each hour it operates at full capacity, or 24,000 kilowatt-hours per day, or 8,670,000 kilowatt-hours per year.

Texas tops all states for wind power capacity, a look at the Roscoe wind farm

Roscoe wind farm (RWF) is the largest onshore wind farm in the world with an installed capacity of 781.5 MW.

- Located 45 miles south-west of Abilene, Texas

- Owned and operated by E.ON Climate and Renewables (EC&R) a German company

- Construction began in 2007 and became fully operational in 2009

- Provides 70-full time positions to the surrounding community

- 627 turbines between 350 feet and 415 feet tall, manufactured by Mitsubishi, Siemens AG, and General Electric

- Capable of supplying power to 265,000 homes

- Situated on 100,000 acres leased from dryland cotton farmers

The total investment for Roscoe was nearly $1 billion spread across four phases of turbine installments. Meaning that the entire project cost broke out at $1.6 million per turbine.

Why not have wind and oil together?

One might think that since oil and gas development and wind have relatively small surface footprints for the main equipment, that this would allow for the two to coincide in the same areas. However, this isn’t the case for a few different reasons.

Wind farms generally require 3 acres of land per turbine and a location that can be dedicated to the long-term development of tens to hundreds of turbines. Most of this surface use stems from the supporting infrastructure, such as:

- turbine spacing

- buffer zones

- other surface uses such as roads, substations, operations and maintenance facilities, and laydown yards

- overhead and underground transmission, collection and distribution lines.

Besides surface use issues there are problems regarding mineral rights. As many in the land business know, issues arise from the separation of the surface estate and mineral estate, where often the surface owners do not own the mineral rights under their property.

A coordinated agreement between the wind project developers, mineral estate lessees, and surface landowner must be reached to achieve the desired combination of win and oil production within the same area.